Key Takeaways

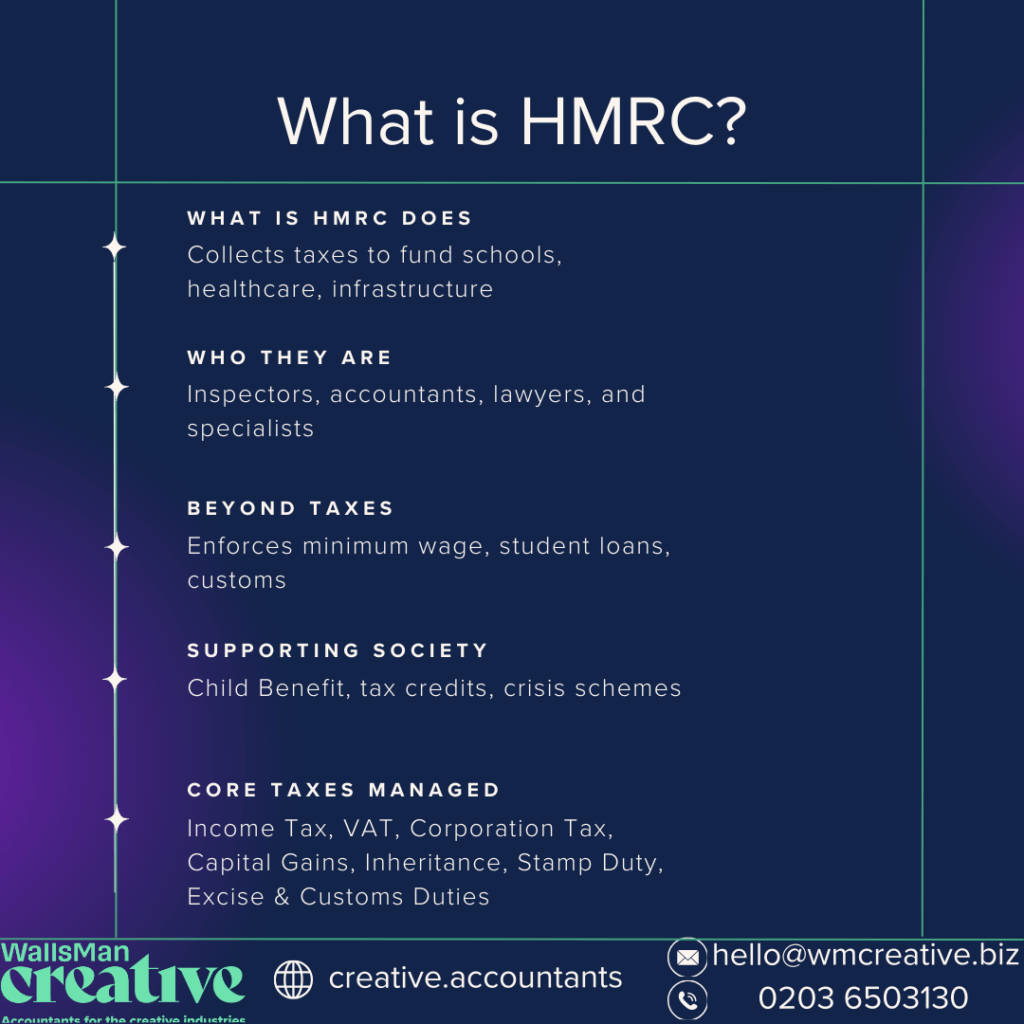

- What Is HMRC? – HMRC (His Majesty’s Revenue and Customs) is the UK’s tax authority, collecting and managing taxes while funding schools, healthcare, and infrastructure.

- It is staffed by a diverse workforce of inspectors, accountants, lawyers, and specialists.

- HMRC goes beyond taxes, enforcing the minimum wage, handling student loan repayments, and managing customs.

- It also provides financial support, such as Child Benefit, tax credits, and crisis schemes like furlough.

- Core taxes managed include Income Tax, VAT, Corporation Tax, Capital Gains Tax, Inheritance Tax, Stamp Duty, Excise Duties, and Customs Duties.

- Not every HMRC letter means trouble: many are reminders, updates, or confirmations.

Wonder how HMRC defines itself? Well, search no more, because they gave us a video that you can check out right here:

Table of contents

- 1. What is HMRC?

- 2. Who make up HM Revenue and Customs?

- 3. What HMRC does beyond taxes

- 4. How HMRC supports society

- 5. Why HMRC matters to you as a sole trader or business

- 6. HMRC’s core tax duties & how to get in touch

- 7. Clearing up confusion around HMRC letters and warnings

- 8. Use HMRC online services with an accountant

1. What is HMRC?

His Majesty’s Revenue & Customs – HMRC for short – is the UK’s tax authority.

It’s the government department that makes sure tax rules apply fairly across the country, and that the money collected goes back into public services like healthcare, schools, and infrastructure.

HMRC isn’t only about collecting income tax or chasing your VAT. This organisation makes sure the system runs smoothly so that families, businesses, and communities all get the support they truly need. You can think of it as the financial backbone of the UK.

2. Who make up HM Revenue and Customs?

Behind the name HMRC is a huge team of people.

It’s not just tax inspectors and number-crunchers. You’ve got accountants, lawyers, policy experts, project managers, and thousands more specialists, who all work towards the financial stability of the UK.

Don’t think that HMRC is a faceless machine! It’s made up of people just like you, and they’re all working to keep the system fair, up-and-running, while helping businesses stay compliant with all the rules in place. On top of that, they even make sure individuals receive the support they’re entitled to.

3. What HMRC does beyond taxes

Most people know HMRC for tax:

- income tax

- VAT

- corporation tax

- PAYE

and many more…

But that’s only part of the story. HMRC also looks after areas you might not expect.

It checks that employers pay at least the National Minimum Wage. It collects student loan repayments when graduates start earning. And it helps UK businesses trade more easily overseas by managing customs and import rules.

So even if you’re not filing a tax return yet, chances are HMRC already has a role in your day-to-day life.

4. How HMRC supports society

HMRC isn’t just about taking money IN – it’s also about paying money OUT where it’s needed.

Every year, millions of families receive Child Benefit and tax credits that help with the cost of raising children.

Some taxes are designed to change behaviour, not just raise revenue. The Plastic Packaging Tax and the Landfill Tax are both collected by HMRC to encourage recycling and reduce waste.

And when a crisis hits, HMRC steps in. During the COVID-19 pandemic, it supported more than 11 million workers by helping employers cover wages through furlough schemes.

| The real-world challenges of HMRC While HMRC plays a vital role in keeping the UK’s finances on track, it isn’t without its challenges. Like many large organisations, it operates with limited resources and varying levels of training across its staff. That means your experience can sometimes depend on who you deal with, and even seasoned accountants can find the process frustrating. It’s worth keeping this in mind: HMRC is made up of individuals and systems, some more effective than others. Being aware of this can make it easier to remain patient and highlight the importance of professional guidance for complex matters. |

5. Why HMRC matters to you as a sole trader or business

Even if you’ve never thought much about taxes, HMRC will cross your path sooner or later.

If you’re a student, it collects your loan repayments. If you’re employed, it makes sure your PAYE tax is taken correctly. If you run a business, HMRC is where you deal with VAT, corporation tax, and payroll.

And if you’re a parent, HMRC is the one paying out Child Benefit. In one way or another, it touches nearly every household in the UK.

That’s why it pays to understand the basics of what HMRC does. It makes the letters and forms feel a lot less intimidating when they eventually land on your doorstep.

6. HMRC’s core tax duties & how to get in touch

At its core, HMRC is the guardian of the UK’s tax system.

Its job is to make sure taxes are collected fairly, and that money flows back into schools, hospitals, infrastructure, and the benefits system.

Here are the main taxes HMRC oversees:

Income Tax

Paid on income such as wages, pensions, rental income, and some savings and investments. The amount you pay depends on your tax band and personal allowance. Most people pay it automatically through PAYE or via Self Assessment.

How to get in touch:

Phone (UK): 0300 200 3300 – Outside UK: +44 135 535 9022 – Official Income Tax web page

National Insurance contributions

These contributions help fund the State Pension, statutory maternity pay, sickness benefits, and other state support. How much you pay depends on your employment status and earnings. Employees, employers, and the self-employed all pay different classes of National Insurance.

How to get in touch:

Phone (UK): 0300 200 3500 – Outside UK: +44 191 203 7010 – Official National Insurance web page

VAT (Value Added Tax)

A consumption tax charged on most goods and services sold in the UK. Businesses must register for VAT once their turnover exceeds the VAT threshold. Registered businesses collect VAT from customers and pay it to HMRC.

How to get in touch:

Phone (UK): 0300 200 3700 – Outside UK: +44 2920 501 261 – Official VAT web page

Corporation Tax

Paid by limited companies on their taxable profits. This includes income from trading, investments, and selling assets. Companies must calculate and report this through a Company Tax Return.

How to get in touch:

Phone (UK): 0300 200 3410 – Outside UK: +44 151 268 0571 – Official Corporation Tax web page

Capital Gains Tax

Charged on the profit made when you sell or dispose of assets such as property, shares, or valuable items. It applies only to the gain, not the total sale value. Certain allowances and reliefs can reduce how much you pay.

How to get in touch:

Phone (UK): 0300 200 3300 – Outside UK: +44 135 535 9022 – Official Capital Gains Tax web page

Inheritance Tax

Charged on estates worth more than the tax-free threshold when someone dies. It can also apply to some gifts made before death. Careful estate planning can help reduce or eliminate the tax due.

How to get in touch:

Phone (UK): 0300 123 1072 – Outside UK: +44 300 123 1072 – Official Inheritance Tax web page

Stamp Duty Land Tax

A tax paid when buying property or land in England and Northern Ireland. The amount depends on the property value and whether you’re a first-time buyer, homeowner, or investor. Different rates apply to additional properties.

How to get in touch:

Phone (UK): 0300 200 3510 – Outside UK: +44 1726 209 042 – Official Stamp Duty Land Tax web page

Excise Duties

Taxes added to specific products such as alcohol, tobacco, and fuel. These duties are usually included in the retail price. Rates vary depending on the type and quantity of the product.

How to get in touch:

Phone (UK): 0300 200 3700 – Outside UK: +44 2920 501 261 – Official Excise Duties web page

Customs Duties

Charged on certain goods imported into or exported from the UK. The amount depends on the type of goods and their value. Businesses involved in international trade must account for these charges when moving goods across borders.

How to get in touch:

Phone (UK): 0300 322 9434 – Official Customs Duties web page

Insurance Premium Tax

Added to most general insurance policies, including car, home, and travel insurance. It works similarly to VAT and is included in the premium you pay. Different rates apply depending on the type of cover.

How to get in touch:

Phone (UK): 0300 200 3700 – Official Insurance Premium Tax web page

Air Passenger Duty

A tax added to the price of most flights departing from UK airports. The amount depends on the flight distance and travel class. It is usually included in the ticket price when you book.

How to get in touch:

Phone (UK): 0300 200 3700 – Official Air Passenger Duty web page

These taxes account for most of the UK government’s revenue. If you’re employed, self-employed, running a business, or buying property, HMRC is the body that makes sure the rules apply consistently.

If you feel like you want to learn more about what is HMRC, and how it works with taxes, you could also ask an accountant… like WallsMan Creative! We’ve been doing business for more than 10 years now, and our expertise lies with the creative sectors: whether you’re a photographer, a writer, a design studio, or you have your own tech company, it doesn’t matter – we know the ins and outs of what you need to ace it in business!

7. Clearing up confusion around HMRC letters and warnings

One of the biggest worries people have about HMRC is when a letter arrives in the post.

It’s easy to panic, but not every HMRC notice means you’re in trouble! 😉

Common reasons HMRC writes to you include:

- A reminder about Self Assessment deadlines

- Updates on your tax code or PAYE

- Confirmation of Child Benefit or tax credit payments

- Notices about underpaid or overpaid tax

Recently, searches have spiked around the “HMRC warning on savings accounts.”

These warnings usually highlight potential scams or explain how interest on savings is taxed. If you get a message claiming to be from HMRC about your savings, always check it carefully. HMRC will never ask for your bank details or request payment over text or email.

You can read more about HMRC scam calls and HMRC phishing emails on our site.

8. Use HMRC online services with an accountant

To summarise, HMRC is more than just the taxman.

It collects the money that keeps the UK running, but it also pays out benefits, protects workers, supports families, and funds public service we all rely on. And if you already understand what is HMRC, maybe you can learn the basics about what is tax.

If you run a creative business in the UK and want clarity around your taxes, WallsMan Creative specialises in helping people like you deal confidently with HMRC. With the right support, managing your accounts becomes much simpler. Use HMRC online services with an accountant to its full potential!