Making Tax Digital (MTD) is a new way to report income to HMRC, it isn’t just for big companies – it affects a wide mix of people and businesses.

You’ll need to register for Making Tax Digital if you fall into any of these groups:

- VAT-registered businesses, even if you’re voluntarily registered

- Sole traders and landlords with gross earnings over £50,000 (from April 2026)

- Accountants and agents who manage tax returns on behalf of clients

If you’re unsure, a good rule of thumb: If you file VAT or income tax and use spreadsheets or old-school methods, MTD is your next step.

Still voluntary?

Even if you’re under the income threshold, signing up early can help you stay organised and avoid a rush later.

Creative Takeaways

- VAT-registered businesses are already auto-enrolled in MTD.

- Sole traders and landlords earning £50k+ must join from April 2026, £30k+ from April 2027.

- Agents (accountants/bookkeepers) must set up an Agent Services Account and get client authorisations.

- Registration requires a Government Gateway ID, tax details, and MTD-compatible software.

- After registering, all returns must be submitted digitally through approved software.

Table of contents

1. What you’ll need for MTD before you start

Before you start the sign-up process, make sure you’ve got everything lined up. Learn the Making Tax Digital jargon. HMRC won’t let you complete registration without these:

For businesses or individuals:

- Government Gateway user ID and password

- Business or personal tax details (like VAT number or National Insurance number)

- Email address linked to your tax account

- MTD-compatible software to submit returns (you’ll need this ready to connect)

For agents:

- Agent Services Account

- Authorisation from each client

- Client tax details for VAT or income tax

- Access to MTD software that supports agent submissions

Don’t start the registration unless you’ve got your software sorted! HMRC requires the software connection to complete setup.

2. How to register for MTD for VAT

If you’re VAT-registered, you’re already part of Making Tax Digital.

HMRC has automatically enrolled all VAT-registered businesses into MTD – unless you’ve been formally exempted.

So even if you haven’t done anything yet, you’re likely already included. What you still need to do is make sure you’ve:

- Set up MTD-compatible software

- Connected it to HMRC

- Started submitting VAT returns through that software

To check if you’re enrolled, log in to your HMRC VAT account. If you see messages about MTD or can’t file the old way, you’re in the system.

If not, here’s how to register:

Step-by-step: Registering for MTD for VAT manually

- Sign in to HMRC’s VAT service using your Government Gateway ID

- Follow the MTD sign-up prompts (or use the direct link from HMRC)

- Provide your VAT number, business name, and email

- Confirm your software provider – some platforms walk you through this part

- Wait for confirmation (usually within 72 hours by email)

Once you’re confirmed, start submitting your returns directly through your software – not via the old HMRC portal.

3. How to register for MTD for Income Tax (ITSA)

Making Tax Digital for Income Tax is the next big rollout from HMRC – and it’s not fully live yet. But the change is coming fast, so it’s best to prepare!

From April 2026, you’ll need to follow MTD rules if you’re:

- A sole trader or landlord

- Earning over £50,000 per year in total income (from self-employment or property)

If your income is between £30,000 and £50,000, you’ll be brought in from April 2027.

MTD for ITSA is a big shift – replacing the old annual Self Assessment with quarterly digital submissions.

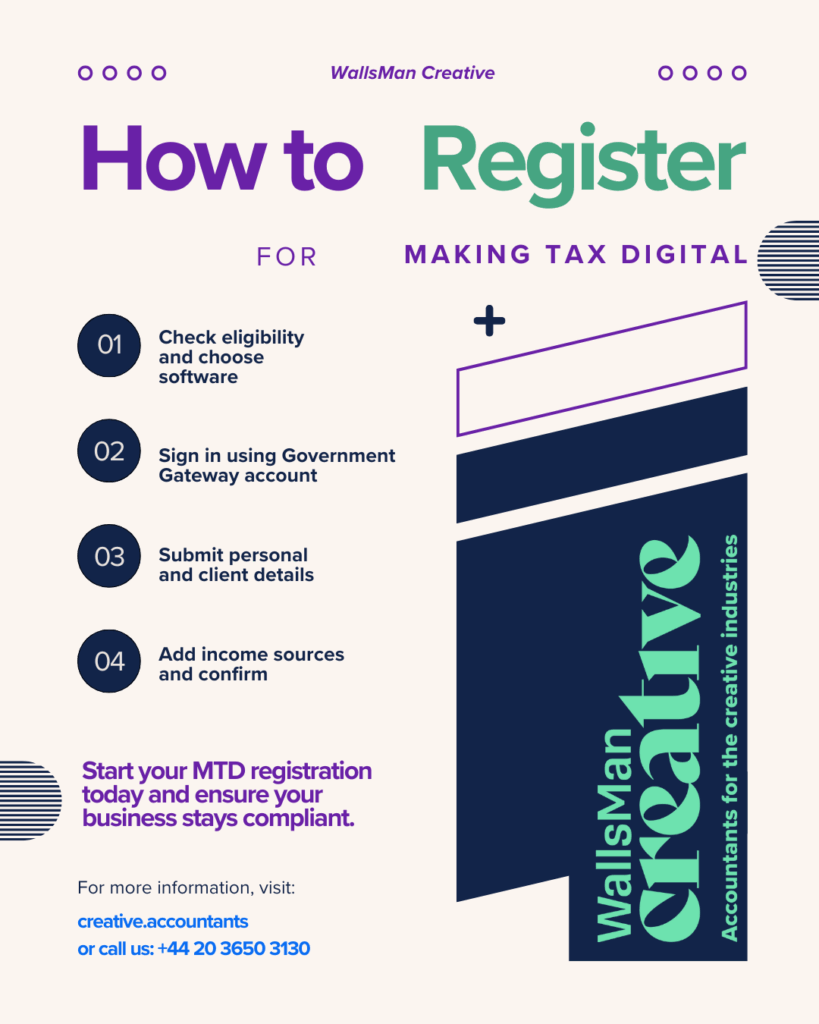

How to register for MTD for ITSA (early or once eligible):

- Check your eligibility – are you over the income threshold?

- Get MTD-compatible income tax software

- Use that software to sign up for MTD

- Submit your first quarterly update once enrolled

Unlike VAT, there’s no auto-enrolment for ITSA – you (or your software provider) need to opt in.

4. How to register for MTD as an Agent

If you handle tax for clients – as an accountant, bookkeeper, or tax adviser – you’ll need to register as an MTD agent before you can act on their behalf.

This isn’t just about filing returns. You’ll need proper access set up through HMRC’s system, and your clients must authorise you to act for them.

Step-by-step: Getting set up as an MTD agent

- Create an Agent Services Account

- Link your existing client list using your old Government Gateway ID

- Get authorisation from each MTD client

- Use MTD-compatible software that lets you manage multiple clients and file on their behalf

Once you’re set up, you’ll be able to register clients for MTD, manage returns, and monitor deadlines. And you’ll do all this from your agent dashboard.

5. After you register: what’s next + choosing your MTD software

Once you’ve completed registration, HMRC will usually send a confirmation email within 72 hours. After that, you’ll no longer be able to use the old HMRC portal – all returns must be submitted through your chosen software.

What happens next?

- You’ll start submitting returns digitally via software

- For VAT, your next return must be MTD-compliant

- For ITSA, you’ll begin quarterly submissions once your start date kicks in

There’s no single HMRC app that handles everything for you regarding MTD – you’ll need third-party software that’s officially MTD-compatible. We have a dedicated article about the best MTD software.

Look for features like:

- Automatic deadline reminders

- Live HMRC integration

- Agent dashboards (if relevant)

- Mobile access for on-the-go filing

6. WallsMan Creative helps with MTD

Registering for Making Tax Digital doesn’t have to be a headache.

If you’re not sure which path to take – or just want someone else to handle the setup – we’ve got you.

At WallsMan Creative, we help UK creatives, freelancers, and small studios stay on the right side of HMRC. From VAT sign-ups to ITSA planning, we know how to make the transition smooth (and jargon-free).

Ready to get MTD sorted? Let’s talk.