Making Tax Digital (MTD) software helps you meet HMRC’s requirements for digital tax reporting.

It replaces manual tax returns with digital records and direct submissions.

If you’re VAT-registered or earning over £50,000 through self-employment or property, you’ll need software that works with HMRC’s systems from April 2026. And from April 2027, you’ll need MTD software if you’re earning over £30,000.

MTD software stores your records, calculates your VAT or income tax, and sends updates to HMRC throughout the year. Some options work with spreadsheets using bridging tools. Others offer full bookkeeping features.

The right MTD software for you and your businesses depends entirely on your needs: how you keep records, and what obligations you manage. Many tools are free, some are paid. Most of the MTD-compatible software offer the basics:

- digital record-keeping

- submission to HRMC

- ongoing compliance.

To work with MTD software, you’ll need to link your software to your Government Gateway account before you can send returns.

HMRC maintains a list of approved MTD-compatible software, which helps when comparing options. Here are our top 5 picks for MTD software:

| Software | Summary | Who is it for |

|---|---|---|

| Xero | Our recommendation for creative businesses; MTD-compliant and user-friendly. | Creative businesses, agencies, and small-to-medium teams |

| QuickBooks | Well-known software with solid features for VAT and income tax. | Sole traders, small businesses, and growing teams |

| FreeAgent | Simple and ideal for freelancers, contractors, and small business owners. | Freelancers, contractors, and those using NatWest/Mettle |

| MyTaxDigital | Minimalist bridging tool for spreadsheet-based VAT submissions. | Sole traders and small businesses using Excel or CSV |

| QuickFile | Free-to-use with both bookkeeping and MTD submission tools. | Cost-conscious businesses, microbusinesses, and DIY users |

1. Xero: our recommendation for MTD-compatible software

Price:

- Simple – £7/month

- Ignite – £16/month

- Grow – £37/month

- Comprehensive – £50/month

- Ultimate – £65/month

Xero is one of the most popular MTD software solutions in the UK.

It’s trusted by thousands of small businesses and accountants for handling VAT and income tax submissions.

We’re not going to hide the obvious: as a Xero-certified accountancy agency for creative businesses, we’ve seen firsthand how well it suits freelancers, studios, and agencies that need clear, simple tools to stay compliant.

Xero connects directly to HMRC, handles digital record-keeping, and supports both VAT and upcoming Income Tax Self Assessment (ITSA) requirements. Its dashboard makes day-to-day bookkeeping easier, and has strong integrations with banks and third-party apps.

Pros ✅

- Fully MTD-compliant for VAT and preparing for ITSA

- User-friendly interface suitable for non-accountants

- Strong ecosystem of add-ons and app integrations

Cons ⛔

- Monthly subscription starts higher than some alternatives

- Can feel overwhelming for very simple needs or sole traders

- Some advanced features are locked behind higher-tier plans

If you need help with setting up MTD with Xero, feel free to book your FREE call with us.

2. QuickBooks: HMRC-recognised digital software

Price:

- Sole Trader (Self‑Employed) – £10/month

- Simple Start – £16/month

- Essentials – £38/month

- Plus – £56/month

- Advanced – £123/month

QuickBooks is another MTD software that supports both VAT submissions and upcoming Income Tax Self Assessment requirements.

It primarily focuses on small businesses and sole traders who want a straightforward way to stay compliant with HMRC.

The platform has tools for invoicing, expense tracking, and real-time tax estimates. It connects directly to HMRC and handles digital record-keeping without the need for bridging software. The interface is simple, with guided steps that help users stay on top of their obligations.

A mobile app is also available if you’re managing your finances on-the-go.

Pros ✅

- Supports MTD for VAT and preparing for ITSA

- Easy-to-use interface with guided setup

- Mobile app with full accounting features

Cons ⛔

- Some bank feeds may require manual refreshes

- Entry-level plans have feature limits

- Occasional reports of customer support delays

3. FreeAgent: accounting software for freelancers, contracts & SMEs

Price:

- Landlord – £10/month

- Sole Trader – £19/month

- Partnership or LLP – £27/month

- Limited Company – £33/month

- Accountant or bookkeeper – Free practice

FreeAgent is a strong MTD software option for freelancers, contractors, and small business owners.

It’s fully compatible with MTD for VAT and is preparing for MTD ITSA. The platform is simple to use and well-suited to people who don’t have an accounting background.

FreeAgent’s features are:

- invoicing

- expense tracking

- bank reconciliation

- tax forecasting

It links directly to HMRC for VAT submissions, and many users benefit from built-in prompts and reminders that keep things on track. (Some NatWest, RBS, and Mettle business account holders can access FreeAgent for free.)

Pros ✅

- Clear, user-friendly layout for non-accountants

- MTD for VAT compliant, with ITSA features in development

- Often free for NatWest, RBS, Ulster bank, and Mettle customers

Cons ⛔

- Not as flexible or customisable as larger platforms

- Limited features for businesses with complex needs

- Support response times can vary during busy periods

4. MyTaxDigital: simple MTD compatible software

Price:

- Free

MyTaxDigital is a no-frills MTD software built for businesses and individuals who want a simple, HMRC-recognised way to submit VAT returns. It’s especially useful for those who prefer to keep records in spreadsheets and need bridging software to stay compliant.

The platform focuses on core functionality: uploading VAT return data from Excel or CSV files and submitting it directly to HMRC. It doesn’t include accounting features like invoicing or bank feeds, which makes it better suited to users who already have a bookkeeping system in place.

Pros ✅

- Free to use for MTD VAT submissions

- Compatible with Excel, CSV, and other spreadsheet formats

- Quick setup and straightforward interface

Cons ⛔

- No full bookkeeping or accounting tools

- Limited support for ITSA or non-VAT taxes

- No mobile app or advanced features like reporting or forecasting

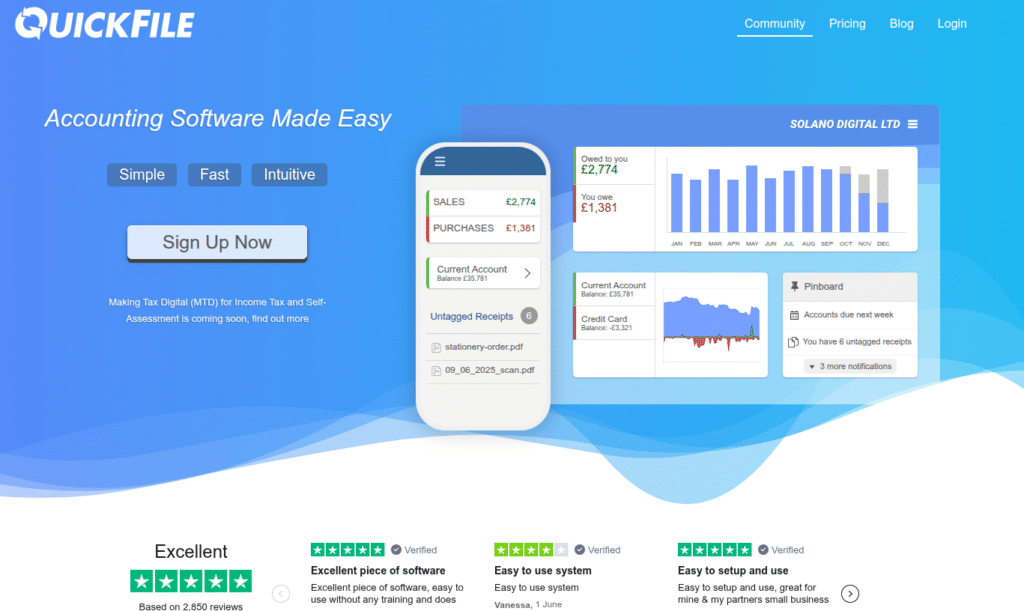

5. QuickFile: digital records, invoices & bank feeds

Price:

- Account size up to Medium (≤1,000 entries) – £0/month (free)

- Account size Large/XL (>1,000 entries) – £5/month (Power User subscription; billed £60/year)

- Automated bank feeds – £1.25/month (billed £15 + VAT/year)

- Additional fie storage – £9.99/per GB (per year)

QuickFile is a flexible MTD software option that works well for small businesses, freelancers, and sole traders.

It has both bookkeeping features and support for MTD for VAT – with optional tools to handle Self Assessment needs.

It’s also quite well-known for its generous free tier and low-cost upgrades.

The software combines digital record-keeping, invoicing, and bank feeds with built-in MTD submission tools.

For users who prefer working with spreadsheets, QuickFile also has a bridging functionality. It’s a good fit for users who want more than just a basic VAT filing tool but don’t need a full accounting suite.

Pros ✅

- Free for small accounts, with low-cost upgrades

- MTD-compliant with both bookkeeping and bridging options

- Includes tools for invoicing, expenses, and reporting

Cons ⛔

- Interface can feel dated or less intuitive for new users

- Some features require manual setup or technical knowledge

- Support is forum-based unless on a paid support plan

Compare MTD software: all-in-one table

Here’s an all-in-one comparison table for the best MTD software:

| Software | Best For | Price | Key Features |

|---|---|---|---|

| Xero | Creative businesses, agencies, small teams | £7–£59/month | Full bookkeeping, MTD for VAT & ITSA, bank feeds, app integrations |

| QuickBooks | Sole traders, small and growing businesses | £10–£115/month | Invoicing, expenses, MTD for VAT & ITSA, mobile app |

| FreeAgent | Freelancers, contractors, NatWest/Mettle users | £10–£33/month (often free via bank) | Simple interface, VAT-ready, ITSA in progress, invoicing, tax forecasts |

| MyTaxDigital | Spreadsheet users filing VAT | Free | Bridging tool for VAT returns via Excel/CSV |

| QuickFile | Microbusinesses, DIY users, budget-conscious | Free–£5/month (+£15/year for feeds) | Bookkeeping + VAT submissions, bridging, invoicing, MTD for VAT & ITSA |

How to authorise software for Making Tax Digital

Before you start doing MTD for income tax or MTD for VAT, you need to authorise your software with HMRC. The process is similar across all software, and should only take a few minutes.

Let’s see how you can do that!

First, make sure your HMRC account is set up for Making Tax Digital. If you haven’t already done this, you can register through the HMRC website using your Government Gateway credentials.

Once you’re signed up for MTD, open your chosen software and look for the option to connect or authorise with HMRC. The software will redirect you to HMRC’s secure login page.

Log in with your Government Gateway ID and follow the on-screen prompts to give permission for the software to access your account.

After you grant access, you’ll be redirected back to your software, which should now show that it’s connected and ready to submit returns.

Most software will remember this connection, but you might need to reauthorise it every 18 months or if your HMRC login details change.

If you’re not sure about the process, don’t worry! Accountants can help you in the process, and you’ll be set up in no time.

Most software providers include built-in tools to handle this.

FAQ about MTD software

Xero, QuickBooks, and FreeAgent are the best options, depending on your business size and needs. They are all HMRC-recognised and support MTD for VAT, with ITSA support in development.

You need to keep digital records and use compatible software to send your VAT or income tax returns directly to HMRC. Start by registering for MTD and linking your software to your Government Gateway account.

Yes, but only with bridging software that connects your spreadsheet to HMRC. Tools like MyTaxDigital or QuickFile support this setup.

Accountants often use Xero, QuickBooks, or FreeAgent, depending on their client base. These platforms offer features that make managing multiple accounts easier.

How to choose the right MTD software

We can give you honest advice: start by thinking about what you actually need!

If you just want to file VAT returns from a spreadsheet, a free bridging tool like MyTaxDigital might be enough. If you’re looking for a full bookkeeping solution with MTD built in, software like Xero will give you more flexibility.

Check out the best bridging software for MTD on our site:

Cost, ease of use, and whether you already have an accountant are also worth factoring in. Some tools are free, while others offer more features for a monthly fee.

At WallsMan Creative, we’ve been working with creative businesses for over 10 years. We know how to match the right tools to the way you work – and we’re here to help you stay fully MTD-compliant without overcomplicating things.

If you’d like to talk through your options or need help getting started, just get in touch.