Key Takeaways

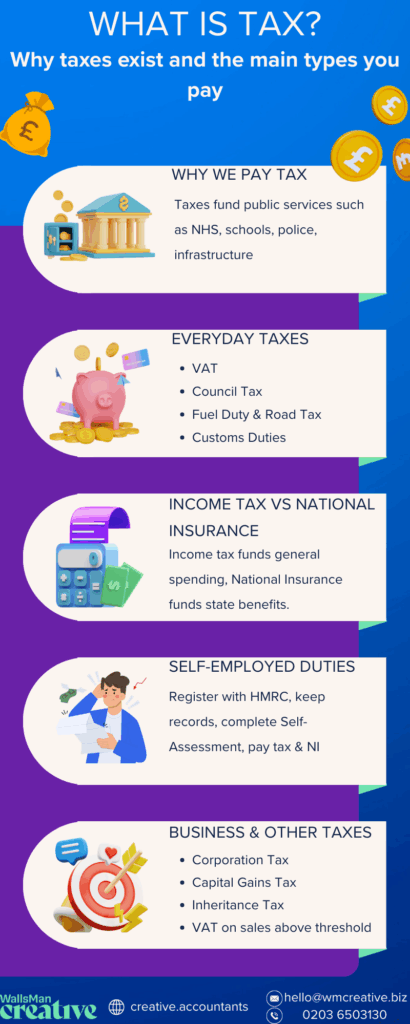

- Tax in the UK is money you pay to the government to fund public services and infrastructure, collected by HMRC.

- You pay tax when you earn, spend, or own something above certain allowances: this applies to income, purchases, and business profits.

- Income Tax and National Insurance are the main deductions on earnings, with NI contributing to future benefits like the State Pension.

- If you’re self-employed, you must register with HMRC, keep income and expense records, file an annual Self Assessment tax return and pay tax by HMRC’s deadlines.

- Businesses may also deal with Corporation Tax, VAT and employer PAYE responsibilities.

- There are several other taxes (like Capital Gains Tax and Stamp Duty), but most businesses won’t face them all at once.

A simple video explanation is brought to you by HMRC Tax Facts:

Table of contents

1. Why taxes exist?

Taxes aren’t just numbers on a payslip.

They’re how the UK pays for the essentials that keep life moving.

The money collected goes into things you rely on daily:

- the NHS

- schools and universities

- police and fire services

- roads

- public transport

- benefits for people who need extra support.

They also cover the big responsibilities of government, from defending the country to tackling poverty. To put it simply, tax is how we all chip in to keep the system running.

2. Everyday taxes you already pay

You probably pay tax more often than you realise.

Some of the most common ones are built into daily life:

Value Added Tax (VAT)

Added to the price of most goods and services at 20%. For example: if a chocolate bar costs £1 before tax, VAT adds 20p, so you pay £1.20 at the till.

Council Tax

A local tax that pays for services like rubbish collection, libraries, and street lighting. The amount depends on your property’s value band.

Fuel duty and vehicle tax

Built into petrol, diesel, and road tax for your car. These help maintain roads and fund transport.

The good thing about these taxes it that you don’t have to calculate or file these yourself. They’re already included in the prices you pay or collected automatically by local authorities.

3. Income Tax and National Insurance (NI)

Once you earn above a set allowance, part of your pay goes to the government.

Two main deductions appear on your payslip:

Income Tax

This is taken as a percentage of what you earn over your tax-free allowance. The money goes towards public services like healthcare, education, and policing.

You can calculate your take home pay after Income Tax and other deductions with our Take Home Pay Calculator.

National Insurance (NI)

This isn’t the same as Income Tax. NI builds up your entitlement to benefits such as the State Pension and certain allowances later in life.

Use our National Insurance calculator to break down how much NI you’ll pay on your salary (or how much your employer pays).

If you’re employed, your employer deducts both automatically through PAYE (Pay As You Earn). You’ll see the amounts clearly listed each month.

4. How to pay taxes if you’re self-employed (in 4 steps)

When you work for yourself, tax isn’t handled automatically.

You’re responsible for telling HMRC what you earn and paying the right amount. You have to handle all these things:

- Register as self-employed with HMRC.

- Keep digital records of your income and expenses throughout the year.

- Submit your Self Assessment tax return once a year. As Making Tax Digital for Income Tax expands, you’ll need to send updates quarterly through approved software.

- Pay your tax and National Insurance by the deadlines HMRC sets, based on the figures you’ve reported.

| Creative Example You invoice a client £1,000. After subtracting business expenses, say £200, you declare £800 as taxable profit. Your Income Tax and NI are worked out on that figure. |

5. Tax policy for business taxes

If you run a company rather than working as a sole trader, there are extra taxes to think about:

- Corporation Tax: Companies pay this on their profits after expenses. It’s separate from personal Income Tax.

- VAT (Value Added Tax): If your business turnover passes a set threshold, you’ll need to register for VAT. You then charge it on sales and pass it to HMRC, minus any VAT you’ve paid on purchases.

- Employer responsibilities: If you employ staff, you also need to handle their PAYE and National Insurance contributions.

For small studios or creative businesses, getting this right makes a big difference. Many owners choose to work with an accountant so they don’t miss deadlines or overpay.

6. Other common UK taxes at a glance

Beyond Income Tax, NI, and VAT, there are others you might come across at different points in life:

- Capital Gains Tax: Charged when you sell or dispose of an asset (like shares or a second property) for more than you paid.

- Inheritance Tax: Applied on estates above a certain threshold when someone dies.

- Council Tax bands: How much you pay depends on your property’s band, set by its value.

- Stamp Duty Land Tax: Paid when you buy property above a set price.

- Vehicle Tax (Car Tax): Based on your car’s emissions and fuel type.

Keep calm and don’t panic! You won’t face all of these at once 🙂

But it helps to know they exist, so you can plan ahead when big life events come up. Also, UK taxes are pooled together: for example, car tax does not go into a specific fund for maintaining roads. National insurance in practice is just another tax.

But you don’t need to handle all this alone, as you’ll have help both from HMRC and from your accountant.

7. FAQ about taxation

Yes, if your income goes over the personal allowance, even as a student, you’ll pay Income Tax. Most part-time jobs stay under the limit.

No. Income Tax funds public services, while National Insurance builds up your entitlement to benefits like the State Pension.

Yes. Money from freelancing, selling online, or gig work is taxable. If you make more than £1,000 a year from it, you need to declare it.

Your tax code tells your employer how much of your pay should be tax-free. If it looks wrong, you can ask HMRC to check it.

Yes. Using allowances and reliefs – like claiming business expenses if you’re self-employed or tax-free savings accounts – helps lower what you owe.

8. How to stay updated on tax rates and allowances

Tax doesn’t have to be complicated, but it’s easy to miss something if you’re juggling work, clients, and deadlines. That’s where WallsMan Creative comes in!

We specialise in accountancy for creative businesses in the UK. From sorting your self-assessment to structuring your studio’s finances, we’ll help you stay compliant and keep more of what you earn.

Get in touch and let’s make tax one less thing to worry about.