Key Takeaways

- Limited companies must file a Company Tax Return and pay Corporation Tax to HMRC.

- Corporation Tax must be paid 9 months and 1 day after the end of your accounting period; returns are due within 12 months.

- You can pay online through HMRC using Direct Debit, bank transfer, or debit/corporate credit card.

- Each payment must include the correct 17-character Corporation Tax reference number to link it to the right accounting period.

- Direct Debit: 3–5 working days; BACS: 3 days; Faster Payments: (usually) same day; CHAPS: same day if before cutoff.

- Missing deadlines leads to HMRC charging interest and penalties, even if your return is not yet filed.

- If you cannot pay on time, you can contact HMRC for a Time to Pay arrangement to spread the cost.

Running a limited company in the UK means you must file a Company Tax Return and pay Corporation Tax to HMRC. Here’s exactly how to handle your Corporation Tax payment online, step by step, explained by HMRC:

Table of contents

- 1. Go straight to HMRC to pay your Corporation Tax bill

- 2. Check corporation tax deadlines before you make a tax payment

- 3. Ways to pay Corporation Tax with HMRC online

- 4. Use the correct Corporation Tax payment reference number

- 5. Step-by-step: how to pay your Corporation Tax bill through HMRC

- 6. What to do if you cannot pay your Corporation Tax bill on time

- 7. Stay ahead of Corporation Tax deadlines in the UK with WallsMan Creative

1. Go straight to HMRC to pay your Corporation Tax bill

The fastest way to pay your Corporation Tax is through HMRC’s online services.ű

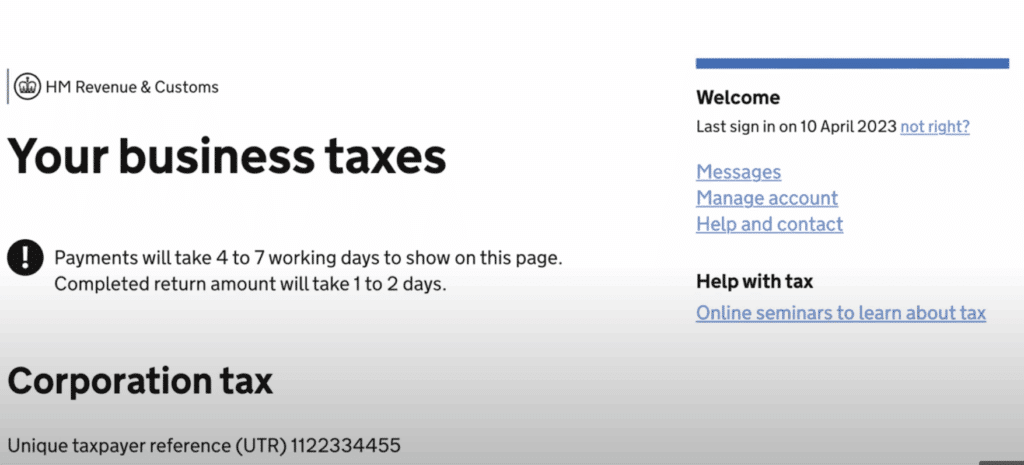

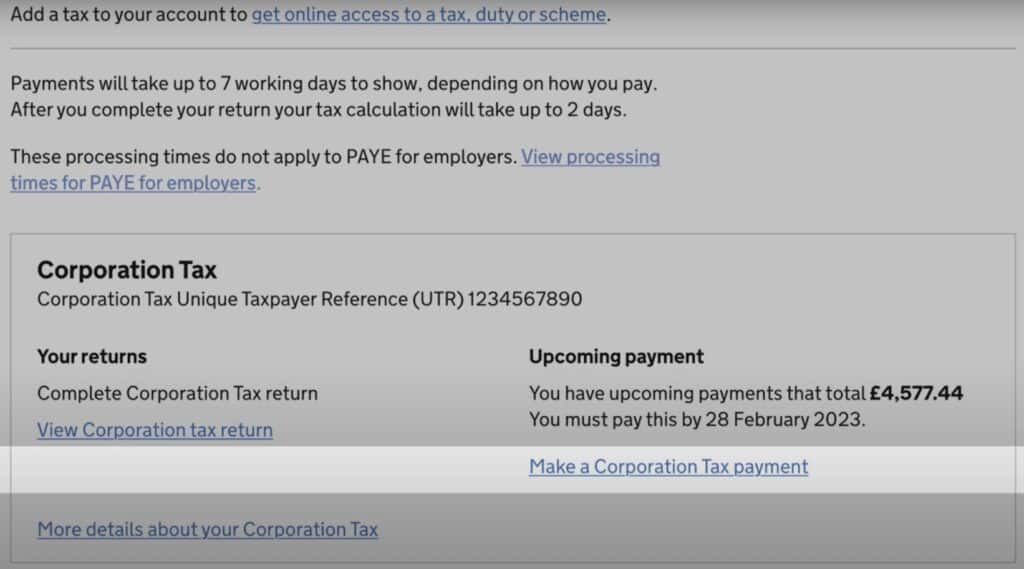

If you have a Business Tax Account, simply sign in and go to the “Make a Corporation Tax payment” option on your welcome page.

You’ll then be able to choose your payment method and confirm your corporation tax payment reference number. This ensures HMRC links your payment to the correct accounting period.

If you don’t yet have a Business Tax Account, you can still pay your Corporation Tax bill online. Just search “Pay your Corporation Tax bill” on GOV.UK and follow the instructions provided.

2. Check corporation tax deadlines before you make a tax payment

There are two important HMRC deadlines you need to know:

- File your Company Tax Return: due 12 months after the end of your accounting period.

- Pay your Corporation Tax bill: due 9 months and 1 day after the end of your accounting period.

For example: if your company’s accounting period ends on 30 March, you must pay your corporation tax liability by 31 December.

If you miss the payment deadline, you will get an HMRC penalty, and they will add interest. Even if you still need time to finalise your Company Tax Return, you must pay your tax on time.

| Creative Tip Make sure to check other submission deadlines on our site. |

3. Ways to pay Corporation Tax with HMRC online

HMRC gives you different ways to pay your Corporation Tax bill.

The method you choose is up to you, but make sure that you allow enough working days for the payment to go through before the deadline.

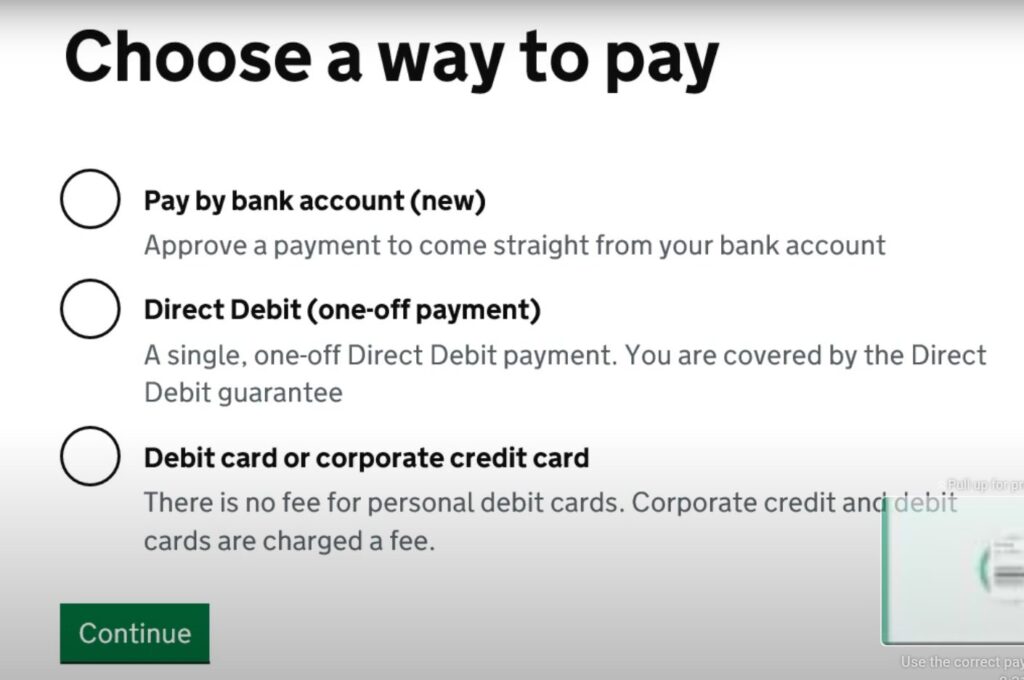

Direct Debit (one-off payment)

- A simple way to pay corporation tax online through your Business Tax Account.

- The first time you set up a Direct Debit, allow 5 working days.

- After it’s authorised, payments usually take 3 working days to clear.

- This is not a recurring payment: you’ll need to approve it each time!

Bank transfer (Faster Payments, BACS or CHAPS)

- Use HMRC’s bank details provided in your online account.

- Faster Payments normally arrive the same or next day.

- BACS takes around 3 working days.

- CHAPS usually clears on the same day if sent before your bank’s cut-off.

Debit or corporate credit card

- You can pay using a debit card or a corporate credit card online.

- HMRC charges a small non-refundable fee for corporate cards.

- There’s no fee if you use a personal debit card.

- Personal credit cards are not accepted.

4. Use the correct Corporation Tax payment reference number

Every corporation tax payment must be linked to the right accounting period, and HMRC does this using a unique reference.

- Your Corporation Tax payment reference number is 17 characters long.

- You’ll find it on your Notice to deliver a Company Tax Return, on payment reminders, or inside your Business Tax Account.

- In your account, go to Corporation Tax statement → Accounting periods → Select the correct period.

If you enter the wrong reference, HMRC may not match your payment correctly. This can lead to delays, penalties, or your company being shown as owing tax even though you’ve already paid.

Always double-check your corporation tax reference number before making a payment.

5. Step-by-step: how to pay your Corporation Tax bill through HMRC

Paying online is straightforward once you’re signed in to your Business Tax Account. Here’s how to complete your corporation tax payment:

- Sign in to HMRC → go to your Business Tax Account.

- Choose “Make a Corporation Tax payment” from the welcome page.

- Select a payment method → Direct Debit, bank transfer, or debit/corporate credit card.

- Enter your Corporation Tax payment reference number → check it matches the accounting period you’re paying for.

- Confirm the details → make sure the tax amount and reference are correct.

- Send the payment → submit through your chosen payment method.

- Save proof → HMRC will show an on-screen acknowledgement once the payment is received. Keep this confirmation for your records.

6. What to do if you cannot pay your Corporation Tax bill on time

If you’re unable to pay your Corporation Tax bill by the deadline, don’t ignore it! HMRC will charge interest and penalties on late payments.

Instead, take action quickly!

- Check your details first: make sure the payment reference number, card type, and bank transfer method are correct.

- Sort out login issues: if you can’t access your Business Tax Account, reset your details through HMRC’s online services.

- Contact HMRC about Time to Pay: if your business can’t meet its corporation tax liability in full, you may be able to set up a payment plan. This allows you to spread the cost across instalments.

- Call the HMRC Corporation Tax helpline if you’re unsure what to do next.

Even if you can’t pay in full, HMRC expects you to tell them and arrange a solution.

7. Stay ahead of Corporation Tax deadlines in the UK with WallsMan Creative

The best way to avoid problems with HMRC is to stay organised throughout your company’s financial year. A few simple habits make a big difference:

- Plan your corporation tax payment early.

- Use accounting software to set up payment reminders so you never miss a deadline.

- Keep funds aside across the year so your tax payment doesn’t become a sudden cashflow issue.

- Work with an accountant if you need help calculating your corporation tax liability or filing your Company Tax Return.

WallsMan Creative helps creative businesses keep on top of HMRC deadlines, file returns correctly, and make every corporation tax payment on time, so you can focus on your work without the stress.