If you’re unsure whether MTD applies to you, check HMRC’s eligibility tool or speak to your accountant. Here’s everything you need to know about Maxing Tax Digital timeline!

| Date | What Happens |

|---|---|

| December 2015 | HMRC announces Making Tax Digital as part of Budget 2015 to modernise the UK tax system. |

| April 2017 | MTD pilot begins. Selected businesses and agents join early testing. |

| April 2019 | MTD for VAT goes live for businesses with taxable turnover above £85,000. |

| April 2020 | Start of the soft-landing extensio. |

| April 2021 | Digital links become fully mandatory for all VAT-registered businesses within MTD. |

| April 2022 | MTD for VAT becomes mandatory for all VAT-registered businesses, regardless of turnover. |

| April 2025 | Public beta for MTD for Income Tax opens. |

| April 2026 | MTD for Income Tax (ITSA) begins for self-employed individuals and landlords with income over £50,000. |

| August 2026 | First quarterly ITSA updates due (7 August) for those starting in 2026. |

| April 2027 | MTD for ITSA expands to those earning over £30,000. |

| April 2028 | MTD for ITSA to expand to those earning over £20,000. |

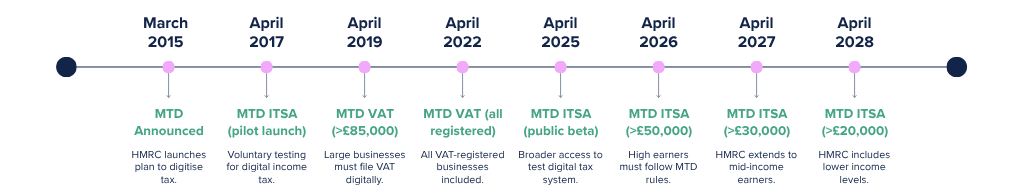

MTD’s rollout began in 2015 as HMRC’s push to digitalise tax reporting. After a few years of consultation and pilots, the first phase launched in April 2019 for VAT-registered businesses above the £85,000 threshold.

The pandemic slowed progress, but by April 2022, all VAT-registered businesses had to comply –regardless of turnover.

For Income Tax Self Assessment, MTD starts in April 2026 for those earning over £50,000, and in April 2027 for those between £30,000 and £50,000.

Table of contents

1. Key Making Tax Digital dates from HMRC

Making Tax digital didn’t become a thing overnight. The first announcement was made in Budget 2015. Here’s how the history of MTD looks so far, and what’s to come:

December 2015 – MTD Announced

HMRC officially outlines its vision for a fully digital tax system, aiming to improve accuracy, reduce paperwork, and provide more real-time tax information.

This announcement marks the starting point of the entire MTD programme.

April 2017 – MTD pilot launch

HMRC launched a pilot scheme for Making Tax Digital by choosing a specific group of businesses and agents before a wider rollout. The pilot was designed to test the new digital tax system.

April 2019 – MTD for VAT (large businesses)

The first phase goes live: VAT-registered businesses above £85k turnover must keep digital VAT records and file returns using approved software.

This phase served as a real-world testbed for wider MTD rollout.

April 2020 – start of soft-landing extension

MTD digital links were meant to be mandatory by now, but HMRC extended the soft-landing period to give businesses more time.

During this extension, copy-and-paste transfers were temporarily allowed while companies upgraded systems.

April 2021 – digital links become mandatory

The soft-landing period ended and full digital-link compliance is required. All VAT data must flow electronically between systems: spreadsheets, accounting tools, and bridging software must connect without manual input.

April 2022 – MTD for all VAT-registered businesses

MTD for VAT became universal: even businesses below the VAT threshold (voluntary registrants) must follow MTD rules from here on.

This marked the completion of the VAT phase and the move toward broader MTD adoption.

April 2025 – Public beta for MTD

The public beta phase for MTD became available in April 2025 to test the wider rollout before it goes live officially. During this public beta testing phase, HMRC didn’t issue any penalties for late submission of quarterly updates.

April 2026 – MTD for Income Tax (MTD for ITSA) launches for £50k+

Self-employed individuals and landlords earning over £50,000 enter the new system.

They must use compatible software, keep digital records, and submit quarterly updates instead of relying solely on an annual Self Assessment return.

August 2026 – First quarterly updates due

Early adopters must file their first ITSA quarterly submission by 7 August 2026.

This begins the new reporting rhythm, with four updates per year plus a final declaration.

April 2027 – ITSA expands to £30k+

The scope widens as the threshold drops to £30,000. This brings many smaller sole traders and landlords into the digital reporting regime.

April 2028 – ITSA to expand to £20k+

Government planning documents indicate the threshold will fall again to £20,000.

This phase is expected to pull in a large portion of micro-businesses and small renting operations, nearing full adoption for most individuals with business or property income.

2. Who needs to comply with MTD – and when

Whether or not you fall under Making Tax Digital depends on how you earn and how much you make. If you’re VAT-registered, you’re already in – MTD for VAT became mandatory in April 2022, regardless of your turnover.

If you’re self-employed or a landlord, things get more specific. From April 2026, MTD for Income Tax will apply if your annual income from self-employment or property is over £50,000. If you’re earning between £30,000 and £50,000, your start date is April 2027.

Below that threshold?

You’re off the hook – for now. HMRC hasn’t yet confirmed when (or if) those earning under £30,000 will be brought into the system.

Partnerships and limited companies aren’t affected by MTD for ITSA just yet. But they should keep an eye on updates. HMRC is likely to expand the scope once the initial rollout settles.

In short: if you’re earning a decent income from your business or property, it’s time to get familiar with MTD. The earlier you prep, the smoother it’ll go. 🙂

3. What you need to do (now) to use Making Tax Digital

If you’re in the MTD bracket – or soon will be – don’t wait around. Getting set up early means less panic when the deadlines hit!

Start by checking your eligibility.

Use HMRC’s MTD checker or speak to your accountant to confirm if your income or business type means you’re affected. If you are, the next step is to choose MTD-compatible software. HMRC maintains a list of approved tools, but you can also check out our dedicated blog post about popular picks like Xero, QuickBooks, and FreeAgent.

Make sure whatever you pick can handle both record-keeping and submission.

You’ll also need to register for MTD.

If you’re self-employed, that means signing up through your personal tax account.

From there, start keeping your records digitally.

This isn’t optional – spreadsheets alone won’t cut it unless you’re using bridging software. And finally, get used to quarterly submissions. Instead of one annual tax return, MTD means sending updates to HMRC every three months, plus an end-of-year finalisation.

It’s a change, but it doesn’t have to be painful. Sort your systems early, and it becomes just another routine.

4. Making Tax Digital timeline FAQ & deadlines

Yes – if your rental income tops £50,000, you’ll need to follow MTD rules from April 2026. If you’re between £30,000 and £50,000, you’ve got until April 2027. Under £30k, but over £20k? You’re getting enrolled in April 2028.

Only if you connect them to HMRC using special “bridging software.” On their own, spreadsheets don’t meet MTD’s digital record-keeping rules.

Nope. Under MTD, you’ll send HMRC quarterly updates, then a final statement at the end of the year. It’s more frequent, but in smaller chunks.

Quarterly returns begin once you fall into the MTD ITSA regime. For most people, this will be from 6 April 2026 (if earning £50k+) or 6 April 2027 (if earning £30k+).

The reporting periods are:

– 6 April – 5 July

– 6 July – 5 October

– 6 October – 5 January

– 6 January – 5 April

Each quarterly update is due one month after the period ends:

– 7 August

– 7 November

– 7 February

– 7 May

The first-ever MTD quarterly deadline will be 7 August 2026 for those starting in 2026.

Late quarterly updates may lead to penalty points and financial penalties once thresholds are reached. MTD will use a “points-based” penalty system similar to VAT. Landlords also need to file quarterly.

No – you just need to switch to MTD-compliant submissions using recognised software. Your VAT registration doesn’t change.

5. Trusted links + help from WallsMan Creative

If you’re trying to make sense of Making Tax Digital, these are the links worth saving:

- HMRC’s official MTD hub – the source of truth, straight from the government

- WallsMan Creative’s Guide – well-designed and kept up to date

Still feeling unsure?

If you run a creative business in the UK and don’t want tax tech eating your time, WallsMan Creative can help. We translate HMRC jargon into plain English – and make sure you’re covered before the deadlines hit.

Drop us a message if you’d rather focus on your work and leave the numbers to someone who gets the creative world.