If you miss a deadline with MTD, Making Tax Digital penalties are triggered fast. In these terms, HMRC isn’t really forgiving.

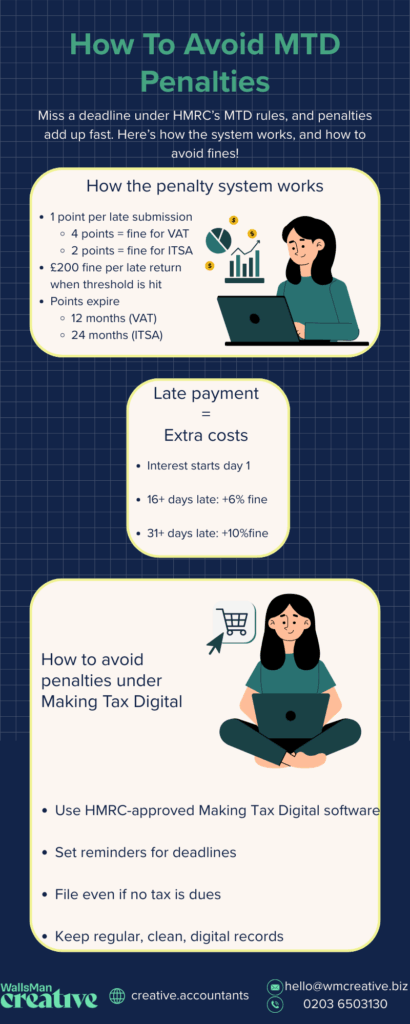

For every late submission, you’ll get a penalty point. Once you hit the threshold, the points turn into real fines.

For VAT, that’s four points, for Income Tax Self Assessment (ITSA), just two:

- Submit one VAT return late? You’re warned.

- Submit four VAT returns late? You’re fined £200 – every time after that.

- ITSA is stricter: miss two and you’re already fined.

Late payments bring even more pain. If you pay your VAT or income tax late under MTD, interest starts building right away. And you also have to count for extra penalties if you’re over 15 or 30 days late.

HMRC penalty system is built to punish repeat offenders, and not the ones who accidentally miss one important deadline. Read on to learn how you can avoid Making Tax Digital VAT penalties or Making Tax Digital late payment penalties.

Creative Takeaways

- Penalty points are given for each late submission under MTD.

- Thresholds apply – VAT fines start after 4 late submissions, ITSA after just 2.

- £200 fines are charged for every late return once the threshold is reached.

- Late payments add extra costs – interest from day 1, 6% fines after 16 days, 10% more after 31 days.

- Points can expire if you stay compliant – 12 months for VAT, 24 months for ITSA.

- Appeals are allowed, but only with valid reasons (illness, HMRC/system errors, bereavement).

Table of contents

- 1. MTD penalty system explained

- 2. Why MTD penalties for late submission happen?

- 3. Making Tax Digital late submission and late payment penalties

- 4. MTD for VAT penalties vs MTD for income tax penalties

- 5. Avoid penalties with digital compliance

- 6. HMRC appeals: challenging a penalty

- 7. Quarterly updates and penalty changes for 2026

- 8. Use digital records and stay compliant with WallsMan Creative

1. MTD penalty system explained

HMRC introduced a new points-based system to handle Making Tax Digital penalties. It’s all designed to hit repeat offenders, not one-off mistakes.

One point per late submission

Every time you miss a return deadline, HMRC adds a point to your record.

Penalty thresholds

For VAT returns, you’re fined after 4 points. For income tax under MTD ITSA, you’re fined after 2 points.

Fines after the threshold

Once you hit the threshold, you’re fined £200 for every late submission going forward.

Points can expire

Stay compliant and points drop off after a set period: 12 months for VAT, 24 months for annual ITSA returns.

To truly understand how MTD penalties work, you first have to understand how HMRC wants to modernise the tax system in the UK. Check out our guide here:

2. Why MTD penalties for late submission happen?

You don’t need to do anything dramatic to get hit with Making Tax Digital penalties. The most common triggers are small mistakes that slip under the radar.

Here’s what gets you in trouble:

Late submissions

Miss your MTD filing deadline? That’s a penalty point, even if you owe nothing.

Late payments

Pay your tax after the due date? You’ll be charged interest and, after a few weeks, extra penalties.

Not using approved software

MTD requires compatible digital tools. If you file manually or through outdated systems, it counts as non-compliance.

Poor record-keeping

HMRC expects all records to be digital and stored correctly. If they audit and find gaps, penalties apply.

This applies across the board – from HMRC Making Tax Digital penalties to those tied to VAT or self-assessment. One missed step is all it takes.

3. Making Tax Digital late submission and late payment penalties

Let’s break down what Making Tax Digital Penalties actually cost you. No jargon, just real figures.

£200 flat fine

After reaching your points threshold (4 for VAT, 2 for ITSA), you’re fined £200 for every late return.

Late payment penalties

These kick in based on how many days late you are:

- 1–15 days late: You won’t be fined yet, but interest starts ticking (currently 3% ).

- 16–30 days late: 6% of the unpaid tax added as a fine.

- 31+ days late: Another 10%, plus ongoing interest until paid.

So, if you ignore Making Tax Digital late payment penalties, the cost climbs fast.

Repeat late returns = repeat £200 fines

Once over the threshold, each late submission hits you again.

This is true no matter what you’re dealing with: MTD VAT penalties or filing income tax under MTD.

4. MTD for VAT penalties vs MTD for income tax penalties

The rules for Making Tax Digital penalties aren’t one-size-fits-all. HMRC treats VAT and Income Tax Self Assessment (ITSA) differently under the MTD regime.

| Feature | VAT (Making Tax Digital) | Income Tax (ITSA – MTD) |

|---|---|---|

| Filing Frequency | Quarterly | Annually (will shift to quarterly from April 2026) |

| Penalty Threshold | 4 points | 2 points |

| Points Expiry Period | 12 months of compliance | 24 months of compliance |

| Fine After Threshold | £200 per missed return | £200 per missed return |

| MTD Compliance Deadline | Already mandatory | Expanding in 2026 |

This difference is key for anyone prepping for Making Tax Digital penalties 2026, when more sole traders and landlords will fall under MTD for ITSA.

5. Avoid penalties with digital compliance

Avoiding Making Tax Digital penalties isn’t hard, but it does take consistency! Most fines come from people forgetting to submit, missing deadlines, or not setting things up properly.

Use HMRC-approved MTD software

Manual spreadsheets or random apps won’t cut it. Make sure your system can file directly to HMRC.

Set reminders

MTD deadlines aren’t flexible. Automate calendar alerts to keep your submissions and payments on track.

File even if there’s no tax to pay

Zero return? You still need to submit. Missing it earns you a point.

Keep digital records

HMRC expects all data stored digitally – no paper-only systems. If you’re audited and can’t show clean records, that’s a penalty risk.

Act early for 2026 changes

If you’re not yet on MTD for ITSA, start preparing now! The Making Tax Digital penalties 2026 rollout will bring stricter compliance checks for more people.

If you’re not sure about something, it’s best to chat to an accountant – from WallsMan Creative, for example!

6. HMRC appeals: challenging a penalty

If you get hit with Making Tax Digital penalties and think it’s unfair, you can appeal.

But!

You’ll need a solid reason and a quick response. All appeals are handled digitally with the help of your government gateway account. After that, head to your VAT or ITSA penalty section, and state your reason clearly.

Acceptable excuses include:

- Serious illness

- Software/system failure

- HMRC error

- Bereavement

| Creative Tip “Forgot” or “was busy” won’t cut it. |

You also have to submit your appeal fast: you’ve usually got 30 days from the date of the penalty notice to respond. And make sure to keep the documentation (screenshots, emails, doctor’s note), whatever supports your case. Just as with a lot of other things with HMRC – the more detail, the better!

Even if you appeal an HMRC Making Tax Digital penalty, you’re still expected to fix the problem moving forward – no pass on future deadlines.

7. Quarterly updates and penalty changes for 2026

The MTD rules are expanding – and if you’re not ready, the penalties will hit harder.

Check our Making Tax Digital timeline blog post, and be up-to-date with whatever changes are coming!

Waiting until the deadline could mean software issues, missed filings, and fast-moving fines.

8. Use digital records and stay compliant with WallsMan Creative

WallsMan Creative works with accountants who know the MTD system inside-out. We help creative businesses stay compliant, keep digital records clean, and never miss a filing.

If you want to avoid penalties (and the stress that comes with them), we’ve got you covered.

Let’s make tax digital without the drama. You can book a free conversation with us right now!