The UK tax year for 2025/2026 runs from 6 April 2025 to 5 April 2026. If you’re self-employed or running a creative business, this is the period HMRC will assess when reviewing your income, expenses and tax return.

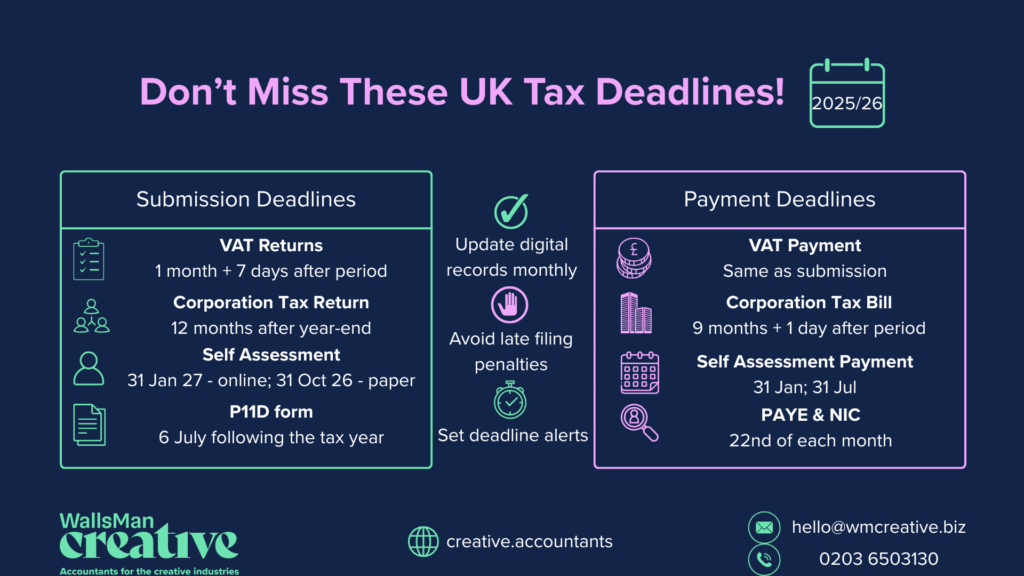

To keep you in HMRC’s good books, we created a timeline of the most important UK tax deadlines in a standard year for the average small business owner or freelancer in the UK.

Some dates will change a little from year to year but the UK tax deadlines always broadly fall at the same time, so its good practice to remember when they are.

Creative Takeaways

| Category | Details |

|---|---|

| UK Tax Year Dates | 6 April 2025 to 5 April 2026 |

| Accounts Deadline | 9 months after year-end |

| Corporation Tax Payment | 1 January 2026 (for 31 March 2025 year-end) |

| VAT Return Deadlines | Quarterly + 1 month & 7 days |

| PAYE Deadlines | 19th (postal payment), 22nd (electronic payment) |

| P11D Filing Deadline | By 6 July 2026 |

| Self Assessment Filing | 31 October 2026 (paper), 31 January 2027 (online) |

Table of contents

1. Key UK tax deadlines for 2025/2026

This guide explains the key dates for the 2025/2026 tax year, along with what you can do if you can’t file or pay on time. You have to know your UK tax deadlines, so you avoid penalties and stay in control.

Accounts – 9 months after financial year-end

After the end of its financial year, your private limited company must prepare:

- Full annual, statutory accounts

- A company Tax Return (CT600)

File annual accounts with Companies House 9 months after your company’s financial year ends.

For example, if your company’s financial year end is 31st March 2025 – the annual accounts need to be submitted to Companies House on 31st December 2025.

A company tax return deadline is 12 months after the end of the accounting period it covers, however, there is a separate deadline to pay your corporation tax bill. It’s usually 9 months and 1 day after the end of the accounting period.

For example, if your company’s financial year end is 31st March 2025, a company tax return needs to be submitted by 31st March 2026 BUT payment for the bill needs to be done by 1st January 2026.

| Creative Tip You can check out HMRC guidance on how to file your accounts. |

VAT return deadlines

The vast majority of small businesses that are VAT registered will file a VAT return four times a year, whether through Government Gateway or through Making Tax Digital (MTD).

The most common set of quarterly VAT return dates is:

| Period Covered | Deadline for Submission and Payment |

|---|---|

| 1st January – 31st March | 7th May 2025 |

| 1st April – 30th June | 7th August 2025 |

| 1st July – 30th September | 7th November 2025 |

| 1st October – 31st December | 7th February 2026 |

Each VAT return is due for filing 1 month and 7 days after the end of one of these quarterly periods.

| Creative Tip Double-check when need to send your VAT return on HMRC. |

PAYE – electronic vs postal payment

Every month you have to pay HMRC.

PAYE and NI contributions must be received by:

- Electronic Payment – Must be cleared by HMRC’s bank account by the 22nd of the following month (or the last working day before the 22nd of the following month).

- Postal Payment – Must be received by HMRC by the 19th of the following month (or the last working day before the 19th of the following month).

| Creative Tip Check out how to pay and what you’re paying via the official guidance. |

P11D – 6th of July following the tax year

The P11D form is used to report benefits in kind.

These are items or services which you (or your employees) receive from your company in addition to your salary, such as private healthcare, interest-free loans (to pay for train season tickets, for example) and company cars.

The annual P11D form allows you to report these items to HMRC on your annual Self Assessment return.

P11D must all be filed by 6th July following the tax year in question.

For example, the P11D for the tax year running 6th April 2025 to 5th April 2026 must be filed by 6th July 2026.

| Creative Tip There are other other expenses and benefits for employers. There’s a guidance on how to submit a P11D or P11D(b) form on the government’s website. |

Self Assessment tax return – standard tax return form

This is a standard tax return form.

As a business owner, you will need to send a report of your annual earning to HMRC. This self-assessment tax return should also include the sources of your earnings.

For example, for the tax year 2025/2026, the below are your deadlines:

| Date | Description |

|---|---|

| 31st October 2026 | Deadline for paper tax return submission (by midnight). |

| 31st January 2027 | Deadline for online tax return submission (by midnight). |

| 31st January 2027 | Deadline for balancing payment for previous tax year and first payment on account. |

| 31st July 2027 | Deadline for second payment on account (if your Self Assessment bill is over £1,000). |

So, remember…

Each payment is half your previous year’s tax bill. Payments are usually due by midnight on 31 January and 31 July.

| Creative Tip Everything you need to know about Self-Assessment can be found via HMRC’s overview. |

2. What happens if you miss a tax return deadline?

If you miss the Self-Assessment filing deadline, HMRC will charge a fixed £100 penalty. This happens even when you don’t owe any tax.

There’s a room for making things right after it, but…

If you still haven’t filed your return three months later, HMRC adds a £10 daily penalty. This continues up to 90 days, so this could mean an extra £900 in fines.

At the six-month mark, you’ll get an additional penalty of £300, or 5% of the tax you owe. Which penalty you get? It all depends on whichever is higher. The same applies again if you still haven’t filed after 12 months.

If you also miss the payment deadline, HMRC charges interest on the unpaid tax. They may also add late payment penalties – this start at 5% of the amount owed.

Confusing? Let’s check it with an example!

If a freelancer misses the 31 January 2027 filing and payment deadline and doesn’t file until August, they could face the £100 penalty, £900 in daily fines, and two £300 charges!

If they owed £2,000 in tax, they might also pay over £100 in interest and late payment penalties. All of this accounts to more than £1,600 in extra costs.

3. How to appeal a late tax return penalty

What happens if you miss a UK tax deadline?

No need to worry – at first!

If you’ve missed a tax return deadline and received a penalty, you can appeal to HMRC using form SA370. This form allows you to explain why your return was late ask for the penalty to be cancelled.

You might have a reasonable excuse – if that’s the case, HMRC may cancel the penalty. The reasons could be:

- a serious illness

- a bereavement close to the deadline

- problems with HMRC’s online system.

HMRC won’t accept excuses like forgetting the deadline, relying on someone else to file for you, or not understanding the rules.

HMRC can still reject your appeal. If you still think that the penalty is unfair, you can take your case to the First Tier Tribunal, which is an independent body. You’ll need to show clear evidence – such as hospital records, correspondence, or screenshots – to support your claim.

4. Avoid UK tax deadline stress – let us handle it for you

Staying on top of tax deadlines can be overwhelming… We know all about it.

When you’re juggling creative work, irregular income, and the day-to-day demands of running a business, it can be a nightmare. There’s a lot to track, and missing a deadline can quickly become expensive.

The good news is, you don’t have to manage it all on your own!

We specialise in supporting creative professionals with their tax and accounting needs.

We’ll handle every deadline, form, and submission – on time, every time. You can rely on us to keep your finances in order, communicate clearly, and take the pressure off, so you can focus on your work.

Let us take care of the details. No missed deadlines. No unexpected penalties.

Just calm, expert support when you need it. Get in touch today to find out how we can help.