Bank feeds are automated systems that allow your bank transactions to be imported directly into your accounting software or financial management tools.

Instead of manually entering your financial data, bank feeds sync your bank accounts and credit cards with platforms (QuickBooks, Xero, Sage, or Wave) to ensure transaction records stay up-to-date.

This service needs to be set up every 90 days and it is important to keep on top of this so there aren’t any gaps when reconciling.

Key Takeaways

- Bank feeds save time on manual data entry.

- You can set up bank rules that apply logic to recurring transactions, further increasing efficiency.

- Expense tracking is simplified, making tax prep and VAT returns much easier.

- Bank feeds help you manage multiple income streams from clients, royalties, or e-commerce.

- They are secure, offering encrypted, read-only access and compliance with financial regulations.

Table of contents

1. The benefits of bank feeds

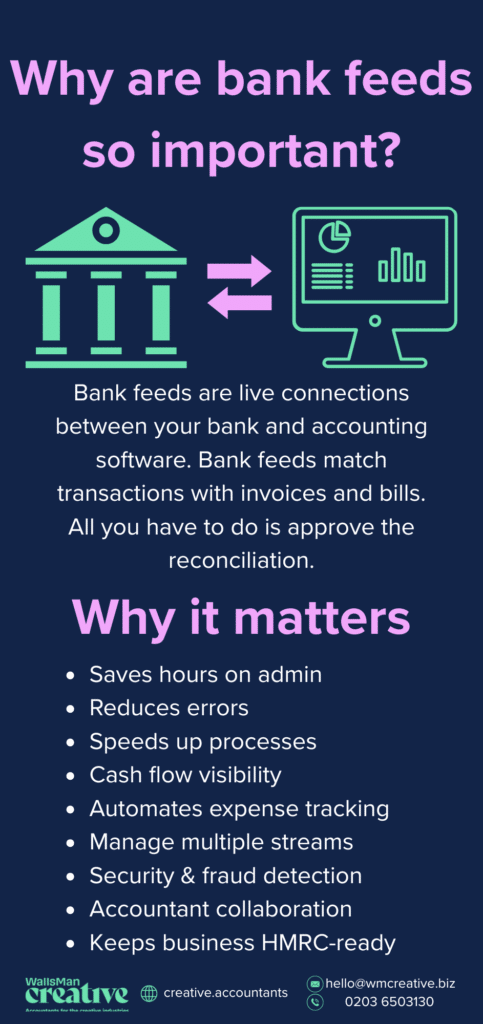

The benefits of bank feeds include:

- Faster processing for everyone – Bank feeds help to speed up the process for everyone. As accountants, we can reconcile your bank quicker and easier.

- Automatic transaction matching – Bank feeds can match transactions with invoices and bills. All you have to do is approve the reconciliation.

- Time-saving with bank rules – You can set up bank rules which can further cut down the time taken to reconcile. Once set up, these processes will be carried out automatically.

- Better financial overview for business owners – As the business owner, it gives you a clearer overview of how your business is performing.

- More accurate decision-making – This clearer view enables you to make better and more educated decisions for your business.

- Compatible with various software – There are lots of different accounting software packages a business can use.

One of the leading accounting systems is Xero. We are Xero Gold partners and it is our software of choice.

2. Are bank feeds safe to use?

Generally, yes, bank feeds are safe.

You can be sure of this especially when your bank feed is provided by trusted accounting platforms and secure third-party aggregators. Their safety depends heavily on the security practices of your accounting software provider, the feed aggregator, and your own security measures.

What can you do to make sure your bank feeds stay safe? Look out for:

- Encrypted Connections (SSL/TLS) – Data transmitted between banks and accounting software is encrypted, similar to online banking security.

- Read-Only Access – Bank feeds usually provide read-only access to transactions, meaning no money transfers or payments can occur through the feed.

- Regulatory Compliance – Leading aggregators (e.g., Plaid, Yodlee, TrueLayer) and software providers (QuickBooks, Xero, Sage) comply with strict financial regulations (such as GDPR in Europe or PSD2 Open Banking requirements).

- Multi-Factor Authentication (MFA) – Top providers require multi-factor authentication.

- Secure API Integrations (Direct Feeds) – Direct bank feeds (officially provided by the banks) typically offer higher security, as they don’t involve third-party screen-scraping. Banks explicitly support these integrations.

3. How to set up bank feeds in an accounting software?

The instructions below show you how to set it up in Xero.

- In the Accounting menu, select Bank accounts.

- Click Add Bank Account.

- Select from popular banks, or start typing your bank’s name, then select from the list: If the name of your bank doesn’t appear in the list, click Add it anyway. Xero doesn’t have a direct feed with this bank and you’ll need to manually import your bank statements.

- You’ll be taken to your bank to log in, enter your online banking credentials and any multi-factor authentication required.

- Select the accounts you want to share with Xero and complete the sharing steps before you are redirected back to Xero.

- Check that the right bank accounts have been selected. Choose a different bank account if necessary or add a new account.

- Confirm the date you’d like your transactions to start from. You can import up to 12 months’ worth of transactions. For bank accounts already in Xero, this will default to the last transactions imported into the account and there is no need to change it.

- Click Finish and you’re ready to go!

4. How bank feeds make your business more efficient

The truth is, managing finances shouldn’t slow you down.

Bank feeds automate transaction imports, reduce errors, and keep your records up to date, so you can focus on growing your business.

Let’s see how bank feeds can really help you:

- Saves you hours on admin: No more downloading statements or manually entering transactions. Bank feeds pull everything in automatically.

- Reduces human error: Automated imports mean no typos, missing transactions, or duplicated entries.

- Speeds up bank reconciliation: Most accounting software suggests matches for transactions, so you can reconcile accounts in seconds.

- Cash flow visibility: Get real-time updates on income and expenses.

- Automates expense tracking: Transactions are automatically categorised. Tax prep and VAT returns are effortless.

- Manages multiple revenue streams: Bank feeds bring royalties, client payments, sales into one place for easy tracking.

- Security & fraud detection: Encrypted, read-only access means no one can move your money – just track it.

- Accountant collaboration: Your accountant gets instant access to up-to-date records, so tax time is stress-free.

- Keeps your business HMRC-ready: Accurate records mean smooth VAT returns, self-assessments, and tax compliance.

5. Bank feeds successfully give you an up-to-date view of your business

With open banking bank feeds, you can automate the flow of transaction data between your bank account and accounting software. Wouldn’t it be great to eliminate the need for manual data entry

We help businesses set up bank feeds successfully. We help you make the connection between your bank and accounting software, simplifying the process of bookkeeping, tax compliance, or financial data management, so you can save time, keep your data safe, and focus on making better business decisions.

You can reach out to us today to connect your bank, and take the hassle out of managing transactions.