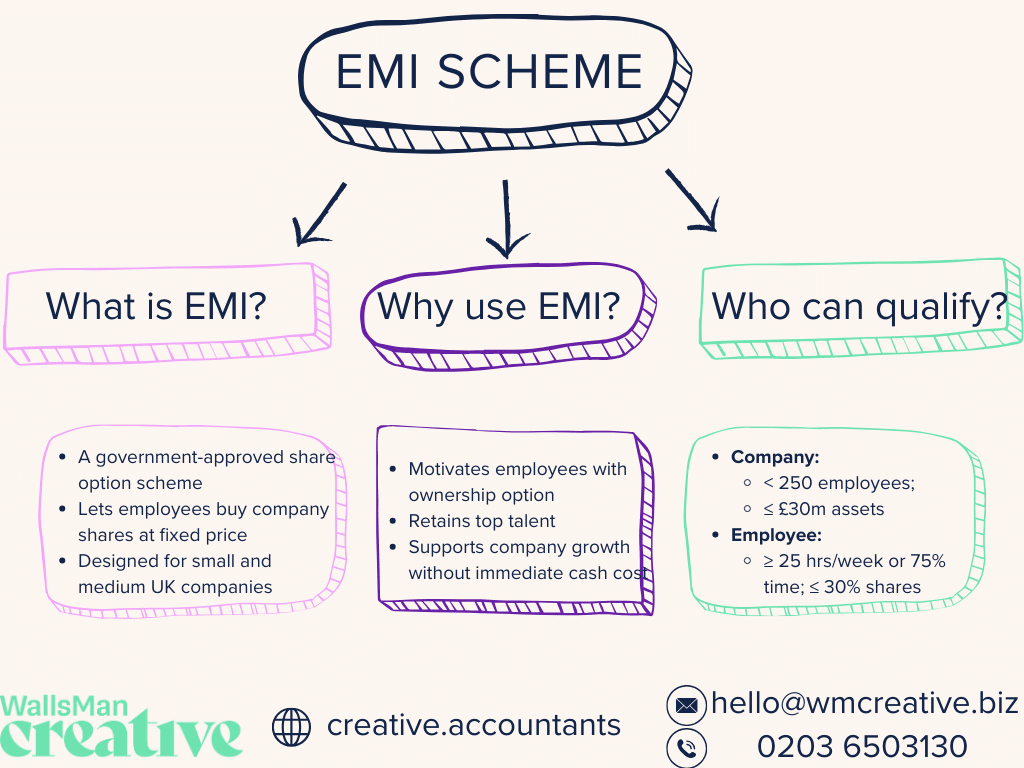

An EMI scheme (Enterprise Management Incentive) is a tax-advantaged share option plan used by UK companies.

The scheme lets businesses grant selected employees the right to buy shares at a set price in the future. EMI schemes are popular with smaller, high-growth companies that want to reward and retain key staff without paying large cash bonuses.

Creative Takeaways

- An EMI scheme is a tax-advantaged share option plan for UK companies.

- Companies must meet eligibility rules: gross assets under £30 million, fewer than 250 employees, and carrying on a qualifying trade.

- Employees must qualify too: working at least 25 hours a week (or 75% of their time) and not holding over 30% of company shares.

- Tax benefits apply: no income tax or national insurance when options are granted at market value; profits on shares are taxed under Capital Gains Tax, often at lower rates.

- Employers benefit: attract and retain talent, align staff with long-term goals, and gain corporation tax deductions.

- Employees benefit: build ownership, pay less tax, and enjoy long-term rewards without upfront costs.

Table of contents

1. Benefits of an EMI scheme

EMI schemes offer clear tax advantages and flexibility for both businesses and employees.

It’s a great for companies to reward key staff without large cash outlays, and in exchange, employees can have better tax options. If you’re working as a creative business, you can retain talent with this scheme.

But what are are all the benefits for employers? And what are they for employees?

Benefits for employers

EMI schemes allow creative businesses to compete for top talent, even when budgets are tight. Here are some of the most common benefits the Enterprise Investment Management scheme offers for employers:

- Grant share options without an upfront cash cost

- Attract and retain skilled employees in competitive industries

- Offer a reward that aligns employee interests with long-term business goals

- Secure corporation tax deductions on the difference between the market value at exercise and the option price

- Retain flexibility in setting option terms (e.g. vesting conditions)

- Enhance business stability by reducing staff turnover

Benefits for employees

Sounds good for employers, right?! What about employees?

For creative professionals, EMI schemes gives a tax-efficient way to benefit from the growth and success of the business they are working for. This way, work turns into long-term rewards:

- Pay no income tax or national insurance when options are granted or exercised at market value

- Access a lower capital gains tax rate (10% with Business Asset Disposal Relief) on profits when selling shares

- Build a financial stake in the business, creating a sense of ownership

- Retain the flexibility to choose when to exercise options

- Benefit from potential long-term gains without upfront costs

2. Enterprise Management Incentive eligibility

Not every business or employee can qualify for an EMI scheme.

The rules are strict, but they are clear. You can avoid problems later on and make the most of this tax-efficient share option plan.

Let’s check how you can apply as a company, and what are the eligibility criteria for employees.

Company eligibility for EMI

For a business to grant EMI options, it must meet several conditions at the time of the grant.

The company must:

- Be independent – meaning it cannot be controlled by another company or group.

- Have gross assets of £30 million or less.

- Employ fewer than 250 full-time equivalent staff across the whole business.

- Have a permanent establishment in the UK.

- Carry on a qualifying trade. Certain sectors are excluded from the scheme: banking, legal services, property development, farming, other financial activities.

It’s important to check the rules before granting EMI options. If a company no longer meets the eligibility requirements after options have been granted, the scheme may lose its tax advantages.

Employee eligibility for EMI

Not all employees qualify for EMI options. To be eligible, an employee must:

- Work at least 25 hours a week for the business, or if their hours are different, spend at least 75% of their working time on the company’s business.

- Not hold more than 30% of the company’s share capital.

- Be a genuine employee: contractors and consultants do not qualify under EMI rules.

3. How to set up an EMI option scheme

You know what the EMI option scheme is, you understand the benefits, and now… you want to set it up. How do you do that?

You must follow this step-by-step guide in the right order to keep the tax benefits. Here’s how it works!

Step 1: Check eligibility

The first step is checking that both the company and the employees qualify for an EMI scheme.

The company must meet the rules on gross assets, staff numbers, independence, and trade type. The employees must meet working time requirements and not hold more than 30% of the shares.

Step 2: Get a company valuation

A fair valuation of the company is needed before granting EMI options. This sets the exercise price for the options.

Many companies ask HMRC to agree on the valuation in advance. Why?

Well, this way, you can avoid disputes later. The valuation should reflect the company’s market value at the time the options are granted.

Step 3: Draft the scheme documents

The scheme needs clear legal documents.

This includes the option agreements and a set of rules for how the scheme works. These documents set out details:

- who gets options

- how many

- the exercise price and

- when they can be exercised.

Step 4: Approve the incentive scheme

The company’s board of directors must approve the scheme before any options are granted.

| Creative Tip Shareholder approval may also be needed if the scheme changes the company’s share capital or structure. |

Step 5: Notify HMRC

Once the scheme is in place and options are granted, the company must tell HMRC.

For options granted after 6 April 2024, a single annual return covers all grants. This is due by 6 July after the tax year.

4. EMI scheme tax considerations: a real-life example

After all this talk, let’s imagine a small creative agency.

They’ve been growing fast and want to reward a key team member, Sam. Sam is their senior graphic designer.

Sam has been with the company for two years. The founders value his work but don’t have the cash to give big bonuses. So…

They offer Sam 1,000 EMI share options at £1 per share. That’s the market value at the time. Sam doesn’t need to pay anything now.

Flash forward three years from now, the company value has grown, and the shares are worth £6 each. Sam decides to exercise his options, buying the 1,000 shares for £1,000. He then sells them for £6,000, making a £5,000 profit!

Because Sam’s options were granted at market value and held for more than two years, he only pays Capital Gains Tax. No income tax or national insurance applies.

The company kept Sam on the team, Sam earned some money, and the company also got a corporation tax deduction for the difference between the option price and the market value at the time of exercise.

5. Set up EMI shares with WallsMan Creative

At WallsMan Creative, we’ve been helping creative businesses manage their finances for over 10 years.

Yes, we understand your challenges: unpredictable income streams need smart tax planning. EMI schemes are one of the most effective options to reward and keep the talented people who help your business grow.

Setting up an EMI scheme can seem complex, but it doesn’t have to be.

We can help you assess if your company and employees are eligible, guide you through the paperwork, and support you with the necessary valuations and HMRC filings. We’ll make sure you stay compliant and take full advantage of the available tax benefits.

Get in touch today to learn how we can support your business with an EMI scheme that rewards your team – while saving you money!