MTD stands for Making Tax Digital. And as of things stand, you’ll need to prepare for MTD for income tax sooner or later.

It’s a government plan to change how some people report their income tax. Instead of sending one tax return each year, you’ll keep digital records and send smaller updates to HMRC every few months.

This change affects sole traders and landlords. If your gross income from self-employment and property is over £50,000, you’ll need to follow the new rules from April 2026.

If it’s over £30,000, the rules start from April 2027. People earning over £20,000 will join another year later.

Gross income means income before you take off any costs or taxes. HMRC will look at the total from your latest tax return to decide when you need to start.

Under MTD, you’ll use software to send your updates. These updates are summaries of your income and costs. At the end of the year, you’ll still confirm everything is correct, just like with a normal tax return.

This change is part of a wider move to modernise the tax system. It won’t change how much tax you pay, only how and when you report it.

Key Takeaways

- MTD (Making Tax Digital) for Income Tax applies to sole traders and landlords only.

- You must join if your gross income (before costs or tax) is over £50k from April 2026, over £30k from April 2027, or over £20k from April 2028.

- You’ll need HMRC-approved software to keep digital records, send quarterly updates, and submit your final declaration each year.

- Tax deadlines and payment rules stay the same – only the reporting method changes.

- You may qualify for an exemption if digital reporting isn’t possible due to age, disability, or poor internet access.

- Voluntary sign-up is available for anyone under the threshold who wants to start early.

- Partnerships are excluded for now, but HMRC plans to include them later.

Table of contents

1. Who and when needs to comply with Making Tax Digital for income tax?

MTD for Income Tax doesn’t apply to everyone straight away.

HMRC is rolling it out in stages. And the government is starting with people who earn the most.

The key figure is your gross income, just as we mentioned earlier. That’s the total you make from self-employment and property before any costs or tax are taken off.

If your gross income from these combined sources is over £50,000, you’ll need to start using MTD from 6 April 2026.

If it’s between £30,000 and £50,000, your start date will be 6 April 2027.

From 6 April 2028, those earning over £20,000 will be included.

HMRC will use the income you report on your 2024–25 tax return to decide whether you qualify. So, if your income goes up or down year to year, your MTD start date might change. You won’t get signed up automatically. You or your accountant will need to register.

If you earn below £20,000, you won’t be required to join, but you can sign up voluntarily – more on this later.

These dates only apply to sole traders and landlords. Partnerships and other types of taxpayers aren’t covered by these rules yet.

Here’s a clear breakdown – visualised:

| Start Date | Who Needs to Comply | Gross Income Threshold |

|---|---|---|

| 6 April 2026 | Sole traders and landlords | Over £50,000 |

| 6 April 2027 | Sole traders and landlords | £30,001 – £50,000 |

| 6 April 2028 | Sole traders and landlords | £20,001 – £30,000 |

| Voluntary anytime | Anyone who wants to start early | Under £20,000 |

2. MTD for income tax – digital record keeping

This change isn’t just about swapping paper for software.

HMRC aims to modernise the whole system, so it encourages you to keep digital records and report income to HMRC throughout the year.

Instead of sending one tax return annually, you’ll send quarterly updates using MTD-compatible software that connects to HMRC’s systems. These updates are summaries of your income and expenses, not full returns.

The global idea is to keep your records up-to-date, so your tax information is accurate.

Nevertheless, you still send a Final Declaration after the tax year ends. This is where you make adjustments, add other income (like interest or dividends), and confirm everything is correct.

You won’t have to send in receipts or item-by-item details. You’ll just keep digital records and let your software handle the rest. It will total things up and guide you through what to submit.

What’s changing is how often you report and how you do it. What’s not changing is when tax is due or how it’s calculated.

You’ll still pay through payments on account or by 31 January after the end of the tax year, just as you do now. (You can check other important UK tax deadline information on our blog.)

If you use an accountant or bookkeeper, they can do the submissions for you – but your records still need to be digital and up to date!

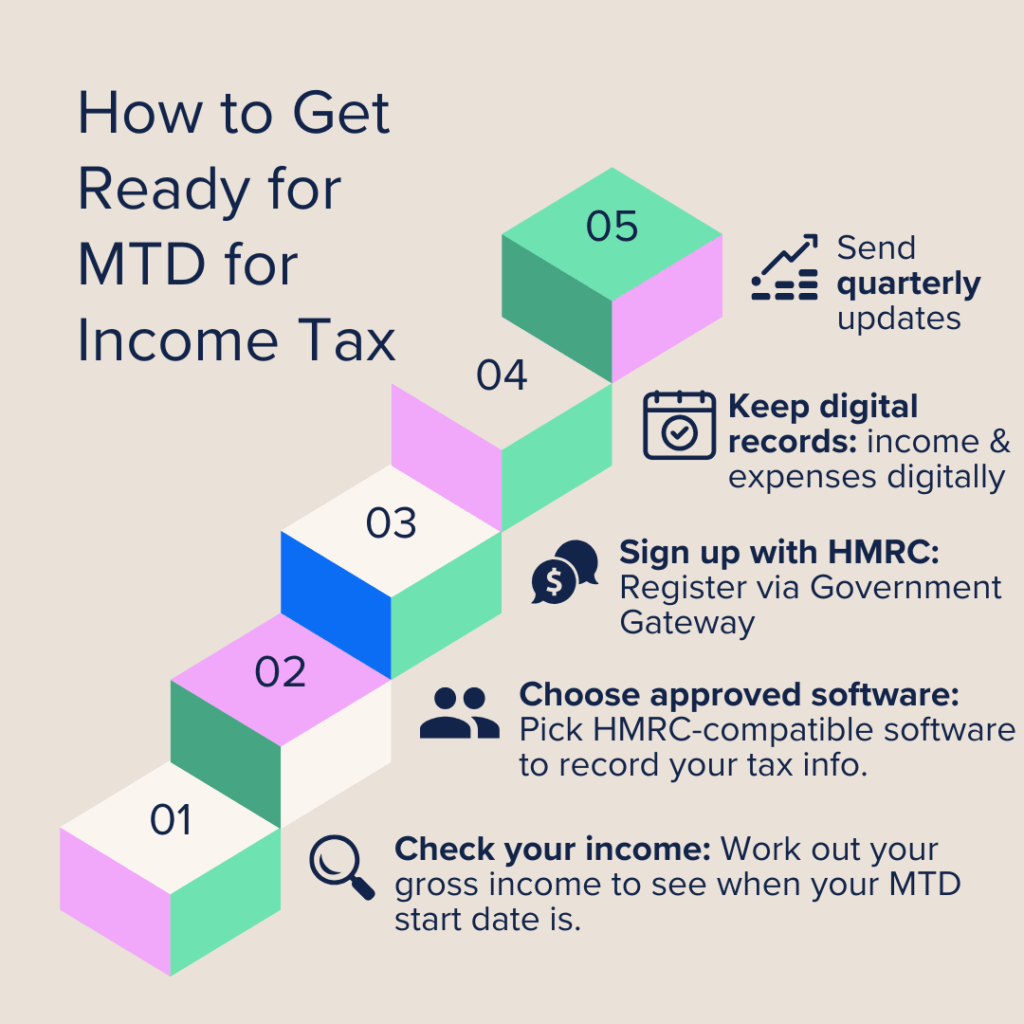

3. Step-by-step guide to comply with HMRC

If you’re a sole trader or landlord, preparing for Making Tax Digital (MTD) for Income Tax involves several steps. (Keep in mind, that MTD for income tax covers all categories. If you’re interested in Making Tax Digital for self-employed, make sure to check out our dedicated post about it.)

In the next few sections, we’ll share all the details you need to know about this change.

Check if you need to comply

First of all, determine your qualifying income, which is your total gross income from self-employment and property before expenses.

If it’s over £50,000, you’ll need to comply from April 2026; over £30,000 from April 2027; and over £20,000 from April 2028.

🔗 Check if you need to use MTD for Income Tax

Choose MTD-compatible software

You’ll need software that works with MTD to:

- Keep digital records of your income and expenses

- Send quarterly updates to HMRC

- Submit your annual tax return

🔗 Find software that’s compatible with MTD for Income Tax

Sign up for Making Tax Digital

Once you’ve selected your software, sign up for MTD through HMRC. You’ll need your National Insurance number, business details, and accounting method.

🔗 Sign up for MTD for Income Tax

Keep digital records

Start recording your income and expenses digitally using your chosen software. This will make it easier to send accurate quarterly updates and your final declaration.

🔗 Create digital records for MTD

Send quarterly updates

Every three months, use your MTD-compatible software to send a summary of your income and expenses to HMRC.

These updates help keep your tax information current and reduce the chance of errors.

Submit your final declaration

At the end of the tax year, you’ll submit a final declaration confirming your income and expenses. This replaces the traditional Self Assessment tax return.

🔗 Submit your tax return under MTD

| Creative Tip Some people may qualify for an exemption from MTD for income tax. This includes those who can’t use digital tools due to age, disability, or location (like poor internet access). Exemptions aren’t automatic: you’ll need to apply and get approval from HMRC! 🔗 Apply for an MTD exemption |

4. MTD for income tax and partnerships

We already stated in the previous sections but as the Latin saying goes: Repetitio est mater studiorum or Repetition is the mother of learning.

At present, partnerships are not required to follow Making Tax Digital (MTD) for income tax. The current MTD rules apply only to sole traders and landlords with qualifying income over specific thresholds.

HMRC has already indicated that partnerships will be included in MTD for income tax at a future date, but no specific timeline has been announced.

For now, partnerships should continue to use the existing Self Assessment process. However, it’s advisable to stay informed about upcoming changes by regularly checking HMRC’s official guidance.

If you’re part of a partnership, you can prepare for the eventual transition by:

- Maintaining digital records of your income and expenses.

- Using accounting software that is compatible with MTD requirements.

- Consulting with a tax professional to understand how future MTD rules may affect your partnership.

You can always stay proactive, and this will ensure a smoother transition when MTD for partnerships becomes mandatory.

5. Prepare for MTD with WallsMan Creative

If you run a creative business as a sole trader, a studio owner, or a landlord with a side hustle, the changes brought in by Making Tax Digital will affect you and how you manage your taxes.

The good news?

You don’t have to figure it out alone.

We specialise in supporting creative professionals like you.

We understand how you work, how your income flows, and what MTD for income tax means for your day-to-day admin.

From choosing the right software to getting your records in shape and sending quarterly updates, we can guide you through every step.

If you’re unsure where to begin or simply want to make sure you’re on the right track, get in touch!

We’ll help you prepare for MTD with calm, practical advice, and without unnecessary jargon.

(MTD for Income Tax is just one aspect of HMRC’s initiative to modernise the system. We have a dedicated page on how Making Tax Digital will transform the way you’re handling your taxes.)