After Brexit, you might have asked yourself this question: do I just bite the bullet and register for EU VAT in at least one EU country?

Key Takeaways

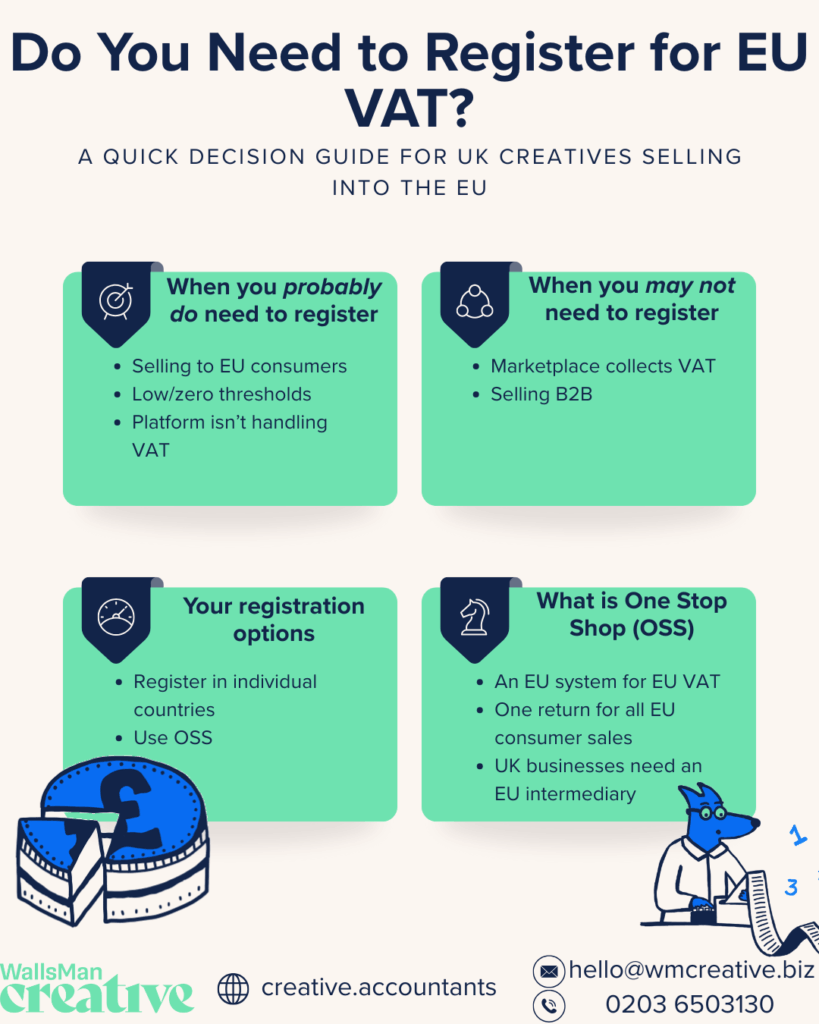

- UK and non-EU businesses may need to register for EU VAT when selling goods or services to customers in EU countries.

- You must register for EU VAT if you exceed the €10,000 distance-selling threshold, store stock in the EU, import goods, or supply digital services to EU consumers.

- The One Stop Shop (OSS) and Import One Stop Shop (IOSS) schemes can simplify EU VAT registration by allowing cross-border B2C sales to be reported through a single EU VAT return.

- Registering for EU VAT means obtaining an EU VAT identification number and meeting ongoing compliance obligations.

- Failing to register or comply correctly can lead to penalties, interest, and backdated VAT liabilities.

Table of contents

- 1. Who needs to register for VAT in the EU?

- 2. When you must register for EU VAT

- 3. One Stop Shop (OSS) and Import One Stop Shop (IOSS): how to simplify EU VAT registration

- 4. How to register for VAT and obtain a EU VAT identification number?

- 5. VAT registration for UK and non-EU businesses

- 6. What is an intra-Community VAT number?

- 7. Managing VAT returns and compliance in EU countries

- 8. Penalties and common mistakes when you register for EU VAT

- 9. EU VAT registration for marketplaces and importers

- 10. Need VAT experts to guide your registration process?

1. Who needs to register for VAT in the EU?

You need to register for VAT in the EU if your business sells goods or services to customers in any EU member state.

This applies whether you’re based in the UK, within the EU, or outside it entirely. Once your sales reach a certain VAT threshold or you store goods in an EU country, you’re required to register for VAT there.

If you’re selling across borders (e.g. shipping products to several EU countries), you can usually register through the One Stop Shop (OSS) scheme instead of applying for local VAT registration in each country.

Some businesses must also appoint a fiscal representative, especially if they’re established outside the EU. This local representative helps with the VAT registration process, filing returns, and communicating with the tax authorities.

Disclaimer: There’s no single “EU VAT system.” Each EU member state has its own tax authority and registration process. When we refer to “registering for EU VAT,” it means registering for VAT in one EU country.

2. When you must register for EU VAT

You must register for EU VAT when your business reaches the VAT threshold or starts making taxable supplies.

For distance sellers, the EU-wide threshold is €10,000 in total cross-border sales per year. Once you pass that limit, you’re required to register for VAT in the EU, either through the One Stop Shop (OSS) scheme or by registering locally in each country where you sell.

If you store goods in an EU warehouse, work with fulfilment centres like Amazon FBA, or supply digital services to EU consumers, you also need to register for VAT even if your turnover is below the threshold!

Remember!

If your business operates in several EU countries, you may need multiple VAT registration numbers unless you use the OSS or Import One Stop Shop (IOSS) system.

3. One Stop Shop (OSS) and Import One Stop Shop (IOSS): how to simplify EU VAT registration

If you’re selling into the EU, OSS and IOSS are designed to reduce how often you need to register for EU VAT, but they don’t remove the obligation entirely.

What is the One Stop Shop (OSS)?

The One Stop Shop (OSS) is an EU VAT scheme that lets you report and pay VAT for multiple EU countries through a single VAT return.

Instead of registering for VAT in every EU country where you have customers, you can submit one quarterly OSS return covering all eligible EU sales.

OSS applies to:

- B2C sales of goods shipped across EU borders

- B2C supplies of services to EU consumers

- EU distance sales above the €10,000 annual threshold

For UK businesses, OSS can reduce the need to register for EU VAT in multiple countries, provided your sales meet the scheme’s criteria.

What OSS does not cover:

- Goods stored in the EU

- Domestic sales within a single EU country

- B2B transactions

- Situations where you have a fixed establishment in an EU country

This is where many businesses misunderstand OSS and register too late.

What is the Import One Stop Shop (IOSS)?

IOSS is a separate VAT scheme specifically for imported goods.

It applies when you sell goods directly to EU consumers and:

- The goods are imported into the EU

- Each shipment is valued at €150 or less

- You sell on a B2C basis

With IOSS, VAT is charged at checkout and declared through a single monthly IOSS return. This avoids customers being hit with unexpected VAT and handling fees on delivery.

IOSS is commonly used by:

- Ecommerce businesses shipping from the UK or outside the EU

- Shopify and WooCommerce stores

- Marketplaces selling low-value goods into the EU

If you don’t use IOSS, VAT is usually collected by the courier on delivery, which can lead to poor customer experience and refused shipments.

4. How to register for VAT and obtain a EU VAT identification number?

Register for EU VAT is easier than you think!

We broke it down, step-by-step. Check it out, and learn how to get your VAT identification number.

Step-by-step EU VAT registration process

- Decide where to register: Choose whether to register for VAT in a single EU member state or use the One Stop Shop (OSS) or Import One Stop Shop (IOSS) scheme if you sell across multiple EU countries.

- Gather your business information: You’ll need your company registration details, proof of trading activity, bank information, and identification for company directors.

- Complete the local VAT registration form: Each EU country has its own registration procedure. Forms are usually available through the national tax authority’s website.

- Submit your application: Send your completed registration form, along with supporting documents, to the relevant tax authority or fiscal representative (if required).

- Receive your VAT identification number: Once approved, you’ll get a unique VAT number (also known as your VAT registration number) that identifies your business as a taxable entity within the European Union.

5. VAT registration for UK and non-EU businesses

If your business is based in the UK or outside the European Union, you may still need to register for VAT in the EU.

After Brexit, UK companies are treated as non-EU businesses, which means you can’t rely on your UK VAT number for sales within EU countries.

You must register for VAT in at least one EU member state if you:

- Sell goods to consumers located in the EU

- Store stock in an EU warehouse or fulfilment centre (for example, Amazon FBA)

- Provide digital services to EU customers

- Import goods into the EU and sell them locally

Many EU countries require non-EU businesses to appoint a fiscal representative.

A fiscal representative is a local contact who deals with VAT registration, filings, and payments on your behalf. This person or company is jointly liable for your VAT obligations, so it’s important to choose someone experienced in EU VAT rules.

6. What is an intra-Community VAT number?

An intra-Community VAT number is the VAT registration number issued by an EU member state that allows businesses to trade VAT-free with other VAT-registered businesses across EU borders.

If you register for EU VAT, you’ll receive an intra-Community VAT number for each country where you’re registered to:

- Identify your business for EU VAT purposes

- Apply zero-rating to eligible B2B sales within the EU

- Report cross-border transactions correctly on VAT returns

Before zero-rating an EU B2B sale, the customer’s VAT number must be validated through the VAT Information Exchange System (VIES). If the number is invalid or missing, VAT usually has to be charged.

7. Managing VAT returns and compliance in EU countries

Once you register for EU VAT, the work doesn’t stop. You’re responsible for filing VAT returns correctly and paying any VAT due in each country where you’re registered.

VAT reporting rules are set at country level. Most EU member states require VAT returns either monthly or quarterly, with strict deadlines and penalties for late or incorrect submissions.

How to stay compliant after registering for EU VAT

To manage EU VAT returns effectively, you need clear systems in place:

- Keep accurate records of all EU sales, purchases, and VAT charged or incurred

- File VAT returns on time for every EU VAT registration you hold – deadlines vary by country, so diarising them is essential

- Use the VAT Information Exchange System (VIES) to validate EU customer VAT numbers and apply zero-rating correctly to eligible B2B sales

- Reclaim VAT where possible, particularly local VAT paid on EU business expenses

8. Penalties and common mistakes when you register for EU VAT

Registering for EU VAT creates ongoing legal obligations. Most penalties don’t come from deliberate non-compliance, but from small mistakes made after registration.

Understanding where businesses go wrong helps you avoid unnecessary fines, interest, and retrospective VAT assessments.

Common mistakes after registering for EU VAT

These are the most frequent issues faced by UK businesses once they register for EU VAT:

- Registering late and failing to account for VAT from the correct start date

- Assuming OSS or IOSS removes the need for all local EU VAT registrations

- Missing VAT return deadlines due to different filing schedules across countries

- Applying zero-rating without validating VAT numbers through VIES

- Charging the wrong VAT rate for the customer’s location

- Forgetting to declare stock movements between EU countries

- Failing to deregister when EU VAT registration is no longer required

Many of these errors only surface during a tax authority review, at which point penalties and backdated VAT become much harder to challenge.

What EU VAT penalties can apply?

EU VAT penalties vary by country, but typically include:

- Fixed fines for late VAT returns

- Interest charged on overdue VAT payments

- Percentage-based penalties for under-declared VAT

- Loss of access to VAT simplification schemes such as OSS or IOSS

- Increased scrutiny from local tax authorities

In more serious cases, businesses can be forced to submit returns monthly or provide financial guarantees to remain VAT registered.

9. EU VAT registration for marketplaces and importers

Do marketplaces remove the need to register for EU VAT?

Selling through online marketplaces such as Amazon, eBay, or Etsy does not automatically remove the need to register for EU VAT.

While marketplaces are often responsible for collecting VAT on certain sales, you still need to register for EU VAT if you:

- Store goods in EU fulfilment centres

- Import goods into the EU in your own name

- Sell outside the marketplace’s VAT system

Even where VAT is collected on your behalf, an EU VAT registration is often required to stay compliant.

10. Need VAT experts to guide your registration process?

WallsMan Creative helps UK-based creative businesses explain why and when you need to register for VAT in the EU, obtain valid VAT numbers, and stay compliant through with HMRC at the same time.

If you don’t know whether you need to register for VAT in one or more EU countries, appoint a fiscal representative, or you just want to simplify your VAT compliance setup, reach out! We’ll help yo decide, and make the process clear, quick and stress-free.