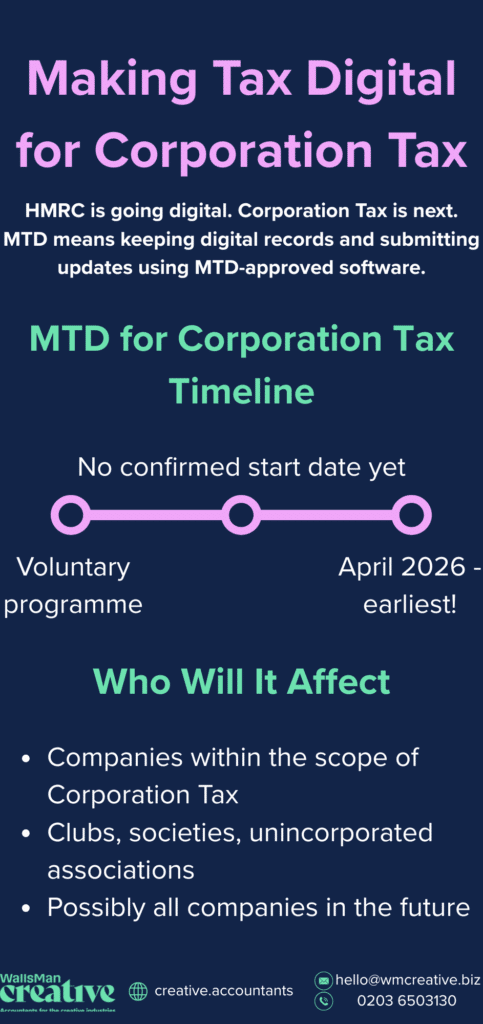

Making Tax Digital for corporation tax is HMRC’s plan to modernise how UK companies report and pay corporation tax.

Just like with other types of MTD (MTD for VAT, MTD for Income Tax), instead of submitting everything manually or using old systems once a year, businesses will need to keep digital records and use HMRC-approved MTD-software to submit their CT600 tax return online.

Making Tax Digital for corporation tax is still in its rollout phase, but it’s coming! You have to stay compliant with new rules that aim to make tax reporting faster, more accurate, and less reliant on paper or spreadsheets.

Table of contents

1. Making Tax Digital for corporation tax – timeline

MTD for corporation tax is set to become mandatory in April 2026 at the earliest! If you run a UK limited company that pays corporation tax, this change is going to affect you.

Right now, the new system is in a pilot phase. HMRC is testing how it works with selected businesses and software providers. But once it goes live, all companies – big or small – will need to:

- Maintain digital accounting records

- Use compatible software to calculate tax

- Submit returns directly through that software

There may be exceptions for very small businesses or those with specific challenges (check out MTD exemptions), but for most companies, this shift is inevitable.

If you’re already using MTD for VAT, this won’t be a massive leap, but it’s still a separate requirement.

2. Changes under MTD for corporation tax

The biggest shift is how you manage and report your corporation tax.

- Digital recordkeeping – You’ll need to keep accounting records in a digital format. No more relyinh on paper files or manual spreadsheets.

- Approved software only – You must use software that’s recognised by HMRC. It needs to handle everything from recordkeeping to submitting your CT600.

- Direct online submissions – Instead of uploading forms manually, your tax return will be sent directly from your MTD-compatible software to HMRC.

- Real-time accuracy – Because your data stays digital from start to finish, there’s less room for error. HMRC gets your info faster.

Keep this in mind: this isn’t just an admin update! It has to be a full system shift, and if you prepare now, you will save a lot of time (and stress) down the line.

3. How to get ready: step-by-step MTD for corporation tax

An HMRC penalty will affect you if you don’t know how to handle MTD for corporation tax. (They usually have clear explanations, but HMRC doesn’t care if you don’t follow the news. You will be a subject to penalty.)

Choose MTD-compatible software

Start by picking accounting software that’s officially recognised by HMRC for MTD for corporation tax.

Look for something that fits your business size, has solid support, and makes tax reporting straightforward. (Check out our best MTD software roundup.)

Set up digital bookkeeping

Move your financial records into the software:

- income

- expenses

- assets

Everything your accountant would usually comb through at year-end. If you’re still using spreadsheets, it’s time to level up!

Align with your accountant

Make sure your accountant is on board and using compatible tools. You’ll need a system that allows both of you to collaborate seamlessly – especially during the transition.

Feel free to reach out to WallsMan Creative, as we’re an accountancy agency focusing on the creative sectors – we know the ins and outs of what you’re dealing with! 😉

Review your reporting process

Think about when and how you’ll submit your CT600 under MTD.

Set calendar reminders. Turn on your notifications. Use the MTD software to your advantage as they usually have built-in tools

Make sure you’re capturing everything in real time, and you won’t have to chase receipts at year-end.

4. MTD for CT vs VAT & Income Tax

If you’ve already gone through Making Tax Digital for VAT or income tax, you might be wondering: what’s different this time?

Not much, but let’s check how MTD for corporation tax compares:

| Feature | MTD for VAT | MTD for Income Tax (ITSA) | MTD for Corporation Tax |

|---|---|---|---|

| Mandatory from | April 2019 (for most) | April 2026 (self-employed/landlords earning £50k+) | April 2026 (at the earliest!) |

| Who it affects | VAT-registered businesses | Self-employed & landlords | UK limited companies |

| Return types | VAT returns (quarterly) | Income tax returns (quarterly + EOPS) | CT600 annual return |

| Digital records require | Yes | Yes | Yes |

| Software requirement | HMRC-recognised | HMRC-recognised | HMRC-recognised |

While the foundation is the same (digital records + compatible software), each tax type has its own process, frequency, and deadlines.

So, even if you’ve handled MTD for VAT, don’t assume you’re automatically covered for CT.

5. HMRC tools that help your tax system

You don’t need to build a new system from scratch – plenty of accounting platforms are already gearing up for MTD for corporation tax.

Here are a few worth checking out:

- Xero – Simple interface, strong UK compliance features, and direct CT600 filing options planned.

- QuickBooks – Well-known and widely supported. Offers digital recordkeeping and seamless MTD integrations.

- FreeAgent – Especially popular with freelancers and small businesses. Clean dashboard and built-in MTD compatibility.

- TaxCalc – More accountant-focused, but great if you want precise control over your submissions.

Before picking the tool you like the most, check if it’s officially listed on HMRC’s approved software page.

| Creative Tip If you would still like to keep your spreadsheets, you can set up digital links for MTD. |

6. WallsMan Creative helps you with UK tax system

Big changes are coming!

That doesn’t necessarily mean that you have to turn on your panic mode, and shout into the void. Take a deep breath, relax, and… reach out to WallsMan Creative!

We explain every change, and every single detail to you without the accountancy jargon, so you can stay on top of your finances. Contact us now if you have any questions, and we’ll help you along the way. Your first consultation call is FREE!