If you’re wondering how to check if a company is VAT registered, the process is simpler than you might think.

There are times when you want to confirm a VAT status quickly:

- When you get an invoice that includes VAT

- Before reclaiming VAT on business expenses

- When working with a new supplier or contractor

- If an invoice looks suspicious or incomplete

- For cross-border trade

- When your own business is audited.

This blog post shows you the simple steps and tools you need to check if a company is VAT registered.

Creative Takeaways

- You can check if a company is VAT registered quickly using official tools.

- The UK GOV.UK VAT checker validates UK businesses.

- The EU VIES system checks VAT numbers for European suppliers.

- VAT registration is mandatory if a business turnover exceeds £90,000.

- Invoices without a valid VAT number are not compliant and can’t be used for reclaiming VAT.

- Confirming VAT numbers helps prevent fraud, errors, and penalties.

Table of contents

1. How to check if a company is VAT registered in the UK & EU

Use these official tools to confirm VAT status:

Enter the VAT number and you’ll get an instant result. Use the GOV.UK checker for UK businesses and VIES for EU suppliers. Let’s check it step-by-step now!

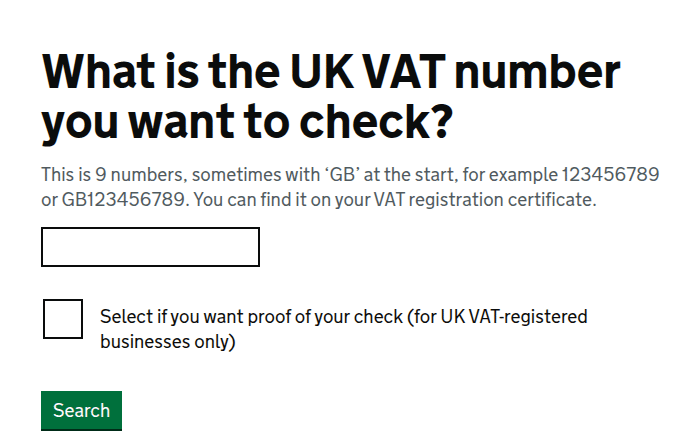

How to check if a company is VAT registered in the UK – with UK VAT number checker

Start with the UK VAT number checker:

- Enter the VAT number – Type the 9-digit VAT number into the box. It may also start with “GB” (e.g., GB123456789).

- Optional: Request proof – If you need proof of your check (useful for UK VAT-registered businesses), tick the box below the input field.

- Click “Search” – Press the green Search button.

- Review the result – The system will confirm whether the VAT number is valid and belongs to a UK-registered business.

- Download proof (if selected) – If you ticked the proof box, you’ll be able to download confirmation of your VAT check.

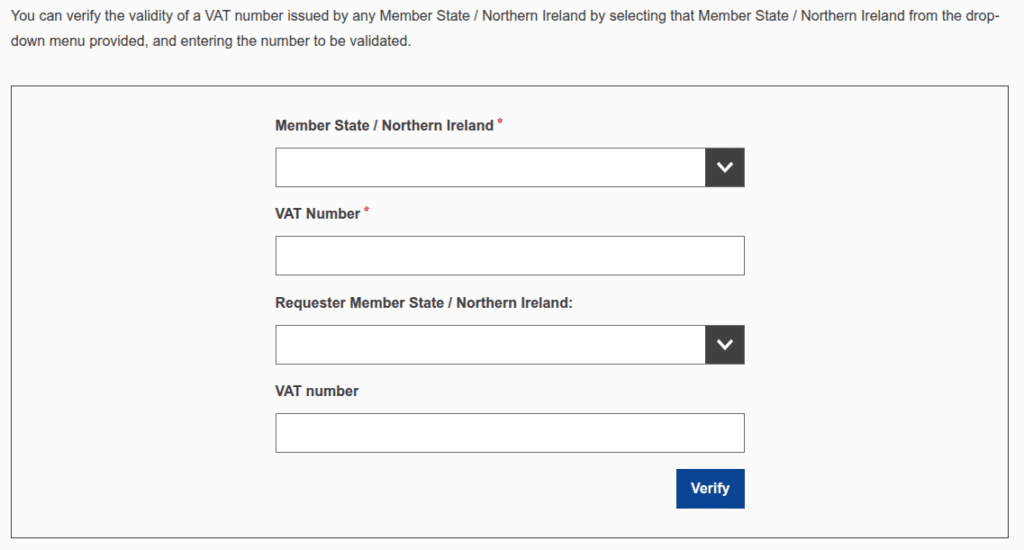

How to check if a company is VAT registered in the EU – with EU VAT number checker

Start with EU VAT number checker:

- Select the country – From the dropdown next to “Member State / Northern Ireland”, choose the country where the business is registered.

- Enter the VAT number – Type the business’s VAT number in the “VAT Number” field.

- (Optional) Add requester details – If you want proof of the check, you need to fill out the “Requester Member State / Northern Ireland” and enter your own VAT number below it.

- Click “Verify” – Hit the blue Verify button.

- Check the result – The system will confirm whether the VAT number is valid and belongs to a registered EU business.

- Download proof (if requester details were added) – You’ll get an official confirmation of your check.

2. What VAT registration means

VAT registration means a business meets the rules for charging VAT and has told HMRC.

In the UK, any business with a taxable turnover above the threshold (currently £90,000) must register. Some smaller businesses register voluntarily to reclaim VAT on costs or to look more professional. You can learn more about voluntary VAT registration on our blog:

Once registered, HMRC issues a unique VAT number. This goes on invoices and proves the business can charge VAT.

Across the EU, the process is similar. Each country issues its own VAT numbers, which you can validate centrally through the VIES system.

3. Why a VAT number matters

Although the VAT number looks just like a string of digits, it’s more important than that. The VAT number shows a business is playing by the rules.

Check it to avoid costly mistakes:

- Reclaiming VAT – You can only reclaim VAT from invoices that show a valid VAT number.

- Avoiding fraud – Fake or copied VAT numbers are a red flag. A quick check protects you.

- Making sure invoices are valid – An invoice without a correct VAT number isn’t compliant.

- Confirming legitimacy – A valid VAT number signals recognition by HMRC or an EU tax authority.

- Staying compliant yourself – If you reclaim VAT you weren’t entitled to, you carry the risk and potential penalties.

- Cross‑border business – In the EU, VAT numbers determine if VAT should be charged on international sales.

4. If you don’t have a VAT number

What happens if you don’t have a VAT number to hand?

You can get it by:

- Check the invoice – VAT‑registered businesses must show their VAT number on invoices.

- Ask the business directly – A legitimate supplier will provide it without hesitation.

- Check their website or paperwork – Many list VAT numbers in the footer, terms, or contracts.

- Use Companies House (UK) – It won’t show VAT numbers, but it confirms incorporation details.

- Don’t assume – Charging VAT doesn’t prove registration. Always ask and verify.

If you can’t get a valid VAT number, be cautious. Paying VAT to an unregistered business is a risk that usually falls back on you.

Don’t know what you’re dealing with? No problem! Make sure to find an accountant near you who can explain and help you.

5. FAQ about VAT registration numbers

Use the GOV.UK VAT number checker or the EU VIES system.

No. VAT registration depends on turnover, not company type.

Yes. If you’re under the threshold you don’t have to register, unless you choose to.

If your turnover goes over the threshold, you must register within 30 days.

No. A company number is from Companies House. A VAT number is from HMRC.

No. It’s illegal to charge VAT if you’re not registered.

6. WallsMan Creative guide to VAT compliance and checking UK or EU VAT numbers

Checking VAT status takes a minute and protects you from tax errors and compliance issues. With the GOV.UK checker for UK businesses and the VIES tool for EU suppliers, you can confirm VAT numbers quickly and for free.

WallsMan Creative helps creative businesses in the UK keep VAT and compliance simple. If you want expert support, we’re here to help.