Key Takeaways

- An emergency tax code is a temporary tax code applied by HMRC when your income details are incomplete.

- You’re usually emergency taxed after starting a new job, changing employers, or beginning to receive a pension without providing a P45.

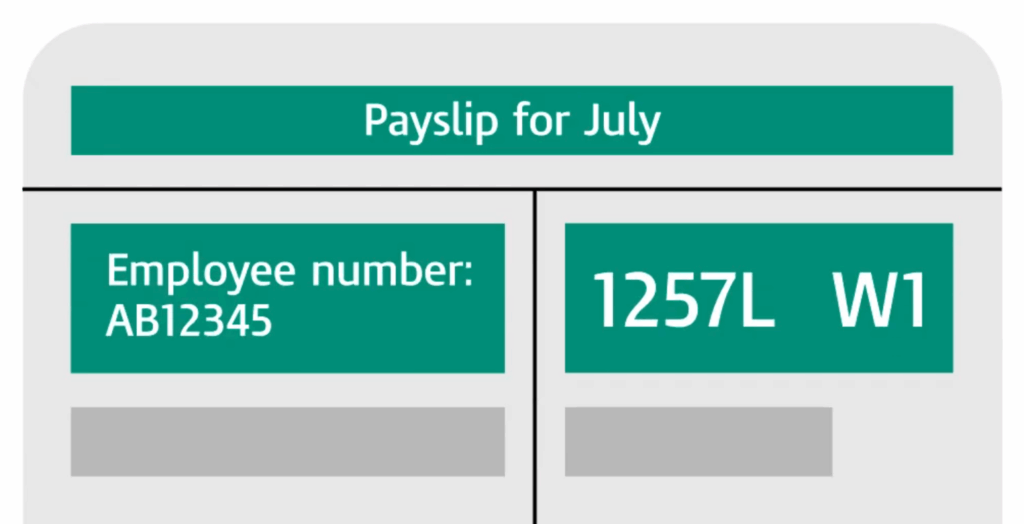

- These codes (1257L W1/M1 or BR), can cause you to pay too much tax until your information is updated.

- You can check if your tax code is wrong on your payslip or through your online tax account on gov.uk.

- To fix it, update your details with HMRC so your tax code will be adjusted automatically.

- If you’ve overpaid, you can claim back emergency tax through PAYE or by submitting a P50 form on gov.uk.

- Refunds are usually processed within four to six weeks once your correct tax code is applied.

- To avoid emergency tax in future, always give your employer your P45 and keep your HMRC records up to date.

Here’s how HMRC officially explains it:

Table of contents

- 1. What an emergency tax code means and why you’re emergency taxed?

- 2. When you get an emergency tax code

- 3. How emergency tax affects how much tax you pay

- 4. How to check if your tax code is wrong

- 5. How to update your tax code with HMRC

- 6. How to claim back emergency tax you’ve already paid

- 7. How to avoid emergency tax in the future

- 8. When to contact HMRC if your tax code is wrong

- 9. Need help sorting out your emergency tax or refund?

1. What an emergency tax code means and why you’re emergency taxed?

An emergency tax code is a temporary tax code that HMRC uses when they don’t have your complete income details. It’s their way of making sure you still pay income tax, even if your records aren’t up to date yet.

You’re usually emergency taxed when:

- you start a new job

- change employers or

- begin receiving a pension

without giving your new employer a P45 from your previous one.

In these cases, HMRC can’t calculate the correct amount of tax, so they apply a default code:

- 1257L W1: this code means you get the normal personal allowance but your tax is calculated only for the current week (non-cumulative), usually as a temporary emergency code if you’re paid weekly

- 1257L M1: this code means you get the normal personal allowance but your tax is calculated only for the current month (non-cumulative), usually as a temporary emergency code if you’re paid monthly.

- BR tax code: this code means all your income is taxed at the basic rate (20%) with no personal allowance applied, typically when you have more than one job or your tax details are not fully known by HMRC.

These emergency tax codes are applied on a “week 1” or “month 1” basis, which means each payday is treated as if it’s the start of the tax year. That’s why you may end up paying more tax or seeing that your tax code includes W1 or M1 on your payslip.

You can always check what your current code means on the gov.uk website or through your online tax account.

2. When you get an emergency tax code

You can be put on an emergency tax code for a few reasons. It doesn’t mean you’ve done anything wrong! It means HMRC doesn’t (yet) have the full picture of your income for the current tax year.

You might get an emergency tax when:

- You’ve started a new job and didn’t give your new employer a P45 from your previous job.

- You’ve begun receiving a pension, and HMRC hasn’t updated your record.

- You’ve switched from being self-employed to PAYE.

- Your details in the tax code are missing or outdated.

Sometimes, a temporary emergency tax code is also applied if your employer hasn’t received your tax code by sending details to HMRC in time. When that happens, the code will stay in place until your record is corrected.

3. How emergency tax affects how much tax you pay

When you’re on a temporary emergency tax code, you’ll notice that you’re paying too much tax.

HMRC calculates your income tax each payday as if it’s the first week or month of the tax year, instead of spreading your tax-free personal allowance across the full year.

In practice, that means your wages or pension are taxed at the basic rate every pay period, even if you shouldn’t be.

For example: if your code is 1257L W1/M1 or BR, your employer is required to tax you at the basic rate without considering previous earnings or tax reliefs.

- The difference is that 1257L W1/M1 is an emergency code that gives you some personal allowance for that pay period only, while BR taxes all of your income at the basic rate with no personal allowance applied.

This kind of tax calculation can make you feel like you’re losing more from your take-home pay than usual. The good news is that this isn’t permanent! It’s just a temporary tax situation.

Once your details are corrected, HMRC will apply your correct tax code and you’ll automatically receive a tax refund for any amount of tax you’ve overpaid.

If you think your tax code is wrong or you’re being emergency taxed longer than expected, it’s worth checking your online tax account at gov.uk to see what your tax code means and confirm the tax you owe is accurate. Feel free to reach out to WallsMan Creative if you don’t know how to sort this out:

4. How to check if your tax code is wrong

If you think your tax code is wrong, don’t ignore it!

Checking early can save you from paying too much tax.

Most people only spot a temporary emergency tax code when their payslip looks lower than usual or shows a code that doesn’t match previous months.

Here’s how to check what your tax code means (and whether it’s correct):

- Look at your payslip: any code ending with W1 or M1 means you’re being emergency taxed on a temporary tax basis.

- Sign in to your online tax account: use the personal tax account service to see what tax codes you’ve been given for the current tax year.

- Compare your code with your expected allowance: your tax code includes a number that reflects your tax-free personal allowance (usually 1257L). If that number looks off, your code may be wrong.

- Check for multiple sources of income: if you’re getting paid from more than one employer or a pension, your tax code may be split or temporarily set to BR.

If something doesn’t add up, contact HMRC using your online tax account. They can confirm whether your tax code is wrong and help you update your details so you’re paying the right amount of tax.

5. How to update your tax code with HMRC

Once you realise your tax code is wrong, the fix is usually simple. You just need to update your details with HMRC so they can issue your correct tax code to your employer or pension provider.

Here’s how to update your tax code step by step:

- Log in to your online tax account on gov.uk: it’s the quickest way to update your information.

- Go to the section called ‘Check your Income Tax’ and choose ‘Update your details’.

- Add or correct anything that’s changed: your employer, pension, income level, or tax benefits.

- HMRC will give you a tax code update and send it directly to your employer.

- On your next payslip, your tax code will be adjusted, and any temporary emergency tax code will be removed automatically.

If you’ve been paying too much, you’ll either see your refund in your next payslip or receive a tax rebate directly from HMRC. You don’t need to fill out any special form unless you’ve left work.

6. How to claim back emergency tax you’ve already paid

If you’ve been emergency taxed, chances are you’ve paid too much tax. The good news is that HMRC will usually return that money once your correct tax code is in place.

There are two main ways to claim back emergency tax:

- Automatic refund through PAYE: when your tax code is adjusted, your employer applies the correct amount of tax going forward. Any tax you owe or have overpaid is recalculated, and your next payslip will reflect the refund automatically.

- Manual refund if you’ve left work: if you’ve stopped working or are between jobs, you can claim a refund using form P50 on gov.uk. It lets you request a tax refund for a tax year that’s already ended or one where you’ve overpaid mid-year.

Most tax refunds arrive within four to six weeks. HMRC might pay the money directly into your bank account or send a cheque, depending on how your online tax account is set up.

7. How to avoid emergency tax in the future

The easiest way to avoid being emergency taxed again is to keep your tax details accurate and up-to-date with HMRC.

But keep in mind: an emergency tax code isn’t an HMRC penalty. It happens when the system doesn’t have enough information about you.

Here’s how to avoid emergency tax next time!

- Give your new employer your P45 from your previous job as soon as you start.

- Update your details in your online tax account on gov.uk whenever you change jobs or start a pension.

- Check your payslip regularly to make sure your tax code includes the right numbers and letters.

- If you notice you’re paying too much, don’t wait! Contact HMRC to check your tax code by sending details directly through your account.

Learning how HMRC tax code works helps you spot a temporary emergency tax code before it affects your take-home pay.

| Creative Tip A quick check at the start of each tax year can save you from an unexpected tax back issue later. |

8. When to contact HMRC if your tax code is wrong

Most of the time, HMRC will automatically correct your emergency tax code once your employer sends through the right information. But if you’ve waited more than a couple of pay periods and your code is wrong or you’re still paying too much, it’s time to reach out.

You should contact HMRC if:

- You’re still on a temporary emergency tax code after two months.

- Your tax refund hasn’t appeared, even though your tax code was adjusted.

- You think your tax code includes the wrong figures or doesn’t match your current job or pension.

- You believe you’ve paid too much tax and want to claim it back.

9. Need help sorting out your emergency tax or refund?

If you’ve been emergency taxed or think your tax code is wrong, don’t wait for the end of the tax year to fix it. A quick check with HMRC can make sure you’re paying the right amount of tax and not losing money you could easily claim back.

At WallsMan Creative, we help UK creatives, freelancers, and small business owners understand their tax codes and stay fully compliant.

Whether you’ve been on a temporary emergency tax code, want to claim back emergency tax, or just need help making sense of your income tax and pension setup – we’ll guide you through it in plain English, without the jargon!

Reach out if you’d like a hand getting your tax sorted and your finances running smoother. We make sure you keep more of what you earn. Without the stress 😉