Key Takeaways

- Registering as a sole trader with HMRC is free and can be completed online in just a few minutes.

- You must register for Self Assessment if you earn more than £1,000 from self-employment in a tax year.

- The deadline to register is 5 October after the end of the tax year in which you started trading.

- As a sole trader, you keep all profits after tax but are personally responsible for business debts and liabilities.

- Sole traders pay Income Tax and Class 2 and Class 4 National Insurance on profits through an annual Self Assessment tax return.

- You can trade under your own name or a separate business name.

- Most sole traders do not need to register for VAT unless turnover exceeds the VAT threshold (£90,000) or voluntary registration is beneficial.

What are the deadlines you need to look out for, what taxes you pay once you start trading, and what does it all have to do with VAT?

Table of contents

- 1. What is a sole trader?

- 2. When you must register with HMRC as a sole trader

- 3. How to register as a sole trader: step-by-step guide (with screenshots)

- 4. How to choose a sole trader business name?

- 5. How to pay tax as a sole trader? | Taxes and National Insurance explained

- 6. FAQ about sole traders

- 7. Need to register? WallsMan Creative helps with self-employment

1. What is a sole trader?

A sole trader is the simplest way to set up as self-employed. You run the business as an individual, keep the profits after tax, and you’re personally responsible for any debts.

Unlike limited companies, there’s no legal separation between you and your business. That means you carry all the rewards, but the risks as well!

You’re considered a sole trader if you start trading on your own. It doesn’t matter if that’s about selling services, freelancing, or running a small shop. Many sole traders also keep a regular job alongside their business, as long as they declare their self-employed income.

Pros of being a sole trader ✅

- Easy and quick to set up

- Fewer reporting requirements

- Full control of profits and business decisions

- Flexible – scale up or move to a limited company later

Cons of being a sole trader ⛔

- You’re personally responsible for debts and liabilities

- You may pay more tax once profits grow

- Less access to finance than limited companies

- Fewer options for tax planning and pensions

2. When you must register with HMRC as a sole trader

You’ll need to register as a sole trader if you earn more than £1,000 from self-employment in a single tax year (6 April to 5 April). Even if it’s just a side gig, crossing that threshold means HM Revenue and Customs expects you to register.

The deadline is 5 October after the end of the tax year when you started trading: if you began working for yourself in June 2024, you must register with HMRC by 5 October 2025.

If you miss the deadline, you risk an HMRC penalty and interest on late payments.

Not everyone needs to register though. If your income stays below £1,000 in a tax year, you don’t have to tell HMRC. But if you want to claim expenses or prove self-employment for things like mortgage applications, it’s worth registering anyway.

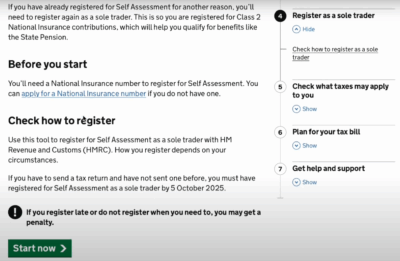

3. How to register as a sole trader: step-by-step guide (with screenshots)

Registering as a sole trader is done through 👉 HMRC’s Self Assessment service.

Here’s how the process works from start to finish:

- Check what you’ll need before starting – You’ll need a National Insurance number, your personal details (address, contact info), and the date you started trading. If you don’t already have a National Insurance number, you’ll need to apply for one before registering.

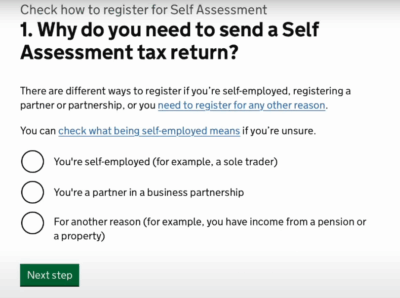

- Confirm why you need to register – HMRC will ask: Why do you need to send a Self Assessment tax return? Choose “You’re self-employed (for example, a sole trader)”.

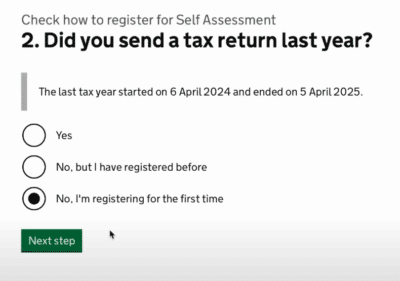

- Tell HMRC if you’ve registered before – You’ll be asked: Did you send a tax return last year? Select “No, I’m registering for the first time” if this is your first registration.

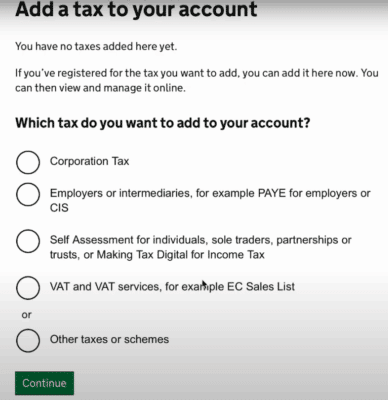

- Select the tax you want to add – HMRC will ask which tax you’re registering for. Choose “Self Assessment for individuals, sole traders, partnerships or trusts”. This automatically covers Class 2 National Insurance contributions.

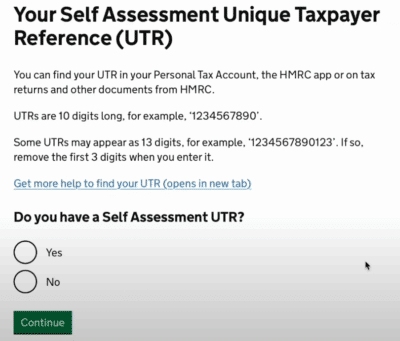

- Provide your Unique Taxpayer Reference (UTR) if you have one – If you already have a UTR, enter it here. If not, HMRC will issue you a new one after registration.

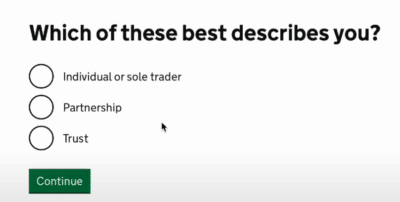

- Confirm your business type – You’ll be asked: Which of these best describes you? Select “Individual or sole trader”.

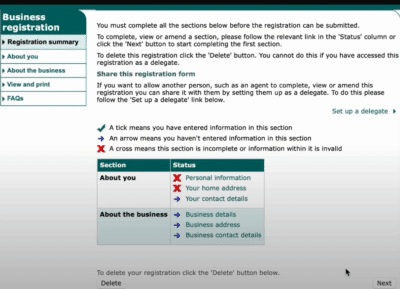

- Complete the business registration form – You’ll need to fill in: about you (personal info, home address, contact details) and about the business (business details, business address, business contact info). All sections must be complete before you can submit.

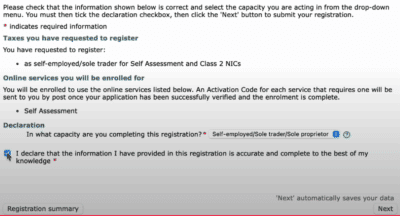

- Submit and receive confirmation – Once you’ve checked your details, declare they’re correct, and submit the form. HMRC will confirm you’re registered as self-employed/sole trader, you’re set up for Self Assessment and Class 2 NI contributions, and your Unique Taxpayer Reference (UTR) will be sent by post.

After this, you’re officially registered and can start filing Self Assessment tax returns each year.

4. How to choose a sole trader business name?

As a sole trader, you can trade under your own name or create a separate business name. Both options are allowed, but the rules are slightly different.

Set up as a sole trader with your own name

Many sole traders simply trade under their personal name. For example:

- Alex Smith Design

- Olivia White Photography

Become a sole trader with a separate trading name

If you want a distinct business identity, you can register a trading name. HMRC doesn’t treat this as a separate legal entity, but you can use it for branding, invoices, and marketing.

Rules for naming your business

- You can’t use terms like “Ltd,” “limited,” or anything that suggests you’re a company

- Avoid offensive or misleading names

- Certain words (like “charity” or “trust”) are restricted and need approval

- Check that no other business in your sector is already using the name

How to register your sole trader trading name?

You don’t need to register a sole trader business name with Companies House, but you should:

- Check domain availability if you want a website

- Make sure the name isn’t trademarked

- Use it consistently on invoices, contracts, and HMRC records

5. How to pay tax as a sole trader? | Taxes and National Insurance explained

Once you register as a sole trader, you’ll need to pay tax and National Insurance on your profits. Everything is reported through the Self Assessment system.

Don’t worry if you’re lost in all of this, we’re here to help! We specialise in offering services directly for the creative industries: that means that we know all about your sector, we know how to handle your taxes, Self Assessment, incorporation, and even the tax credits and reliefs you might be able to get. Let’s chat about your opportunities:

Sole traders pay Income Tax

You pay income tax on profits after expenses. The tax bands are the same as for employed people:

- 0% on income up to the personal allowance (£12,570 in 2025/26)

- 20% basic rate, 40% higher rate, and 45% additional rate apply above that

(Scotland has different tax rates.)

National Insurance contributions for sole traders

Sole traders usually pay:

- Class 2 NICs – a flat weekly rate if your profits are above the small profits threshold

- Class 4 NICs – a percentage of profits, with rates increasing at higher profit levels

These contributions count towards benefits like the State Pension.

Register for Self Assessment tax return

Each year you must file a Self Assessment tax return online by 31 January following the end of the tax year. That’s where you declare your earnings, expenses, and calculate the tax due. What is tax good for? Well, you also benefit from it in various areas of your life, so it really makes sense to pay them on time.

Do you need VAT registration as a sole trader?

Most sole traders don’t need to worry about VAT at first. But if your turnover goes above the VAT threshold (£90,000 in 2025/26), you must register for VAT with HMRC. You can also register voluntarily if it suits your business: check the benefits of VAT.

6. FAQ about sole traders

Becoming a sole trader offers simplicity and flexibility. You have full control over your business, fewer administrative requirements than a limited company, and you keep all profits after tax. It’s often the easiest way to start a business in the UK.

Registering as a sole trader is quick. You can complete the process online, but it may take up to 15 days to receive your Unique Taxpayer Reference (UTR) from HMRC.

No, it’s free to register as a sole trader. You should budget for other business expenses like insurance, accounting support, and tax obligations.

Yes. You can run your business as a sole trader while also being employed. You’ll pay PAYE tax through your employer and complete a Self-Assessment for your sole trader income.

7. Need to register? WallsMan Creative helps with self-employment

To register as a sole trader with HMRC, you don’t need complex tech knowledge. It’s simple and free.

Staying on top of your Self Assessment, tax returns, and National Insurance can quickly become a headache though. You’ll need to track income and expenses, understand what you can claim, keep deadlines in mind, and be prepared if HMRC asks for more detail.

Many self-employed people also find it hard to balance day-to-day creative work with the admin of running a business.

That’s where WallsMan Creative comes in. We specialise in helping sole traders and creative businesses in the UK stay compliant without the stress. From guiding you through your first tax return to setting up better bookkeeping systems, we make sure you stay organised and in control.

With the paperwork handled, you can put your energy back into the work you love.