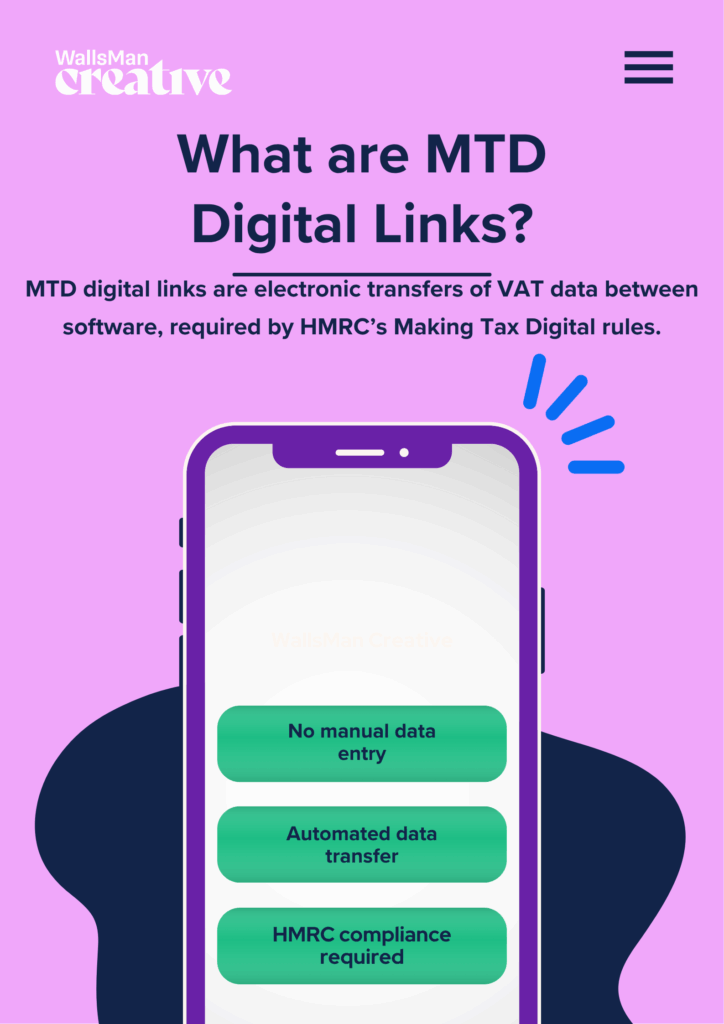

An MTD digital link is just a way of passing VAT data between systems without any manual steps in between.

That means no copying and pasting, no exporting to email, no retyping numbers into a new spreadsheet.

HMRC brought in this rule as part of Making Tax Digital (MTD) to reduce errors and tighten up how VAT returns are handled.

If you’re using software to manage your books, those systems now need to talk to each other directly – and the link between them has to be fully digital.

Creative Takeaways

- MTD digital links mean your VAT data must move between systems without manual input – no copy-paste, retyping, or emailing files.

- You must use HMRC-compliant software such as cloud accounting tools or bridging apps.

- Manual steps break compliance – even accurate numbers don’t count if the process isn’t digital.

- Digital links are mandatory.

- Non-compliance brings fines, interest, and HMRC scrutiny, even if your VAT figures are correct.

Table of contents

- 1. What counts as an MTD digital link?

- 2. What isn’t considered a digital link (and could get you in trouble)

- 3. Do businesses need to use digital links?

- 4. How to set up digital links for MTD?

- 5. What HMRC says about MTD for VAT

- 6. Non-compliance with HMRC

- 7. Digital record keeping with WallsMan Creative

1. What counts as an MTD digital link?

HMRC isn’t asking for anything wild. HMRC only asks that your systems pass data to each other without you getting involved.

What does HMRC consider as an MTD digital link?

- Formulas that link cells between spreadsheets

- Software that connects via APIs

- CSV files imported automatically between tools

- MTD bridging software that links spreadsheets to HMRC’s portal

Basically, if the data moves without you having to touch it manually, it likely qualifies.

If you’re using something like Xero, QuickBooks, or FreeAgent, chances are the digital link is already built in.

For spreadsheets, it gets a bit trickier – but bridging tools can make you compliant without switching your whole setup.

Popular Making Tax Digital software for bridging

If you’re not ready to move to full accounting software, bridging tools are a solid workaround. These act like a digital connector between your spreadsheet and HMRC.

We have a dedicated blog post about the best MTD-compatible software that you can check out. If you’re looking for other options that serve better as digital connectors, here are some options:

- TaxCalc

- VitalTax

- BTCSoftware

- Absolute Excel VAT Filer

- Easy MTD VAT

- QuickBooks Bridging Tool (for Excel users)

Each works a little differently, but they all aim to take your existing spreadsheet and create a compliant digital journey for your VAT submission. Most are plug-and-play and HMRC-recognised.

If you’re looking for an in-depth overview of these bridging software with pros and cons, check this blog post:

2. What isn’t considered a digital link (and could get you in trouble)

HMRC’s pretty clear on this: manual steps break the chain. If you’re copying values from one place to another, you’re not compliant.

Same goes for retyping data, using cut-and-paste, or emailing files between systems.

Here’s what DOESN’T qualify as a digital link:

- Manually entering figures from one spreadsheet to another

- Copying and pasting VAT totals into your submission tool

- Printing data and re-entering it

- Exporting to PDF or email, then uploading

Even if your numbers are accurate, the process matters.

Why?

HMRC wants a clean, auditable trail from your records to your VAT return. That means software needs to talk directly – no human hands in the middle.

3. Do businesses need to use digital links?

If you’re VAT-registered and your taxable turnover is above £90,000, then yes – MTD rules and digital links are mandatory.

You’ve got no wiggle room on this.

HMRC expects every step of your VAT reporting process to be digitally connected.

But even if you’re below the threshold, it’s not a free pass forever. Voluntary VAT-registered businesses were brought into the MTD scope from April 2022. And HMRC has made it clear: income tax and corporation tax are next in line.

So even if you’re not technically required now, future-proofing your setup is smart: check out the Making Tax Digital timeline on our website.

In short: if you’re still using disconnected tools or manual workflows, it’s only a matter of time before you’ll need to upgrade. Better to get ahead now than scramble later!

4. How to set up digital links for MTD?

You don’t need a full IT team or a complete systems overhaul. Getting MTD-compliant can be surprisingly straightforward if you pick the right tools.

Here are your main options:

- Cloud accounting software – Xero, QuickBooks, FreeAgent, Sage, and similar platforms handle digital links out of the box. They connect your records, calculate your VAT, and file directly to HMRC.

- Bridging software – Perfect if you use Excel or Google Sheets. Tools like TaxCalc, VitalTax, or Easy MTD VAT let you keep your current spreadsheet setup while creating that compliant link.

- End-to-end systems – Some businesses use integrated ERP or finance tools where everything’s already connected behind the scenes. If that’s you, you’re likely covered.

Choose whatever suits your workflow – just make sure your data moves without any manual steps. HMRC doesn’t care what tools you use, as long as the process is seamless and auditable.

| Creative Tip To fully understand how you must adapt to MTD, make sure to check out our Making Tax Digital Guide. |

5. What HMRC says about MTD for VAT

If you’re second-guessing whether your setup ticks the right boxes, go straight to the source: VAT Notice 700/22. It’s HMRC’s official guide to Making Tax Digital for VAT, and it spells out exactly what they expect.

You’ll find clear examples of:

- What counts as a digital link

- What breaks compliance

- How bridging software fits in

- What’s acceptable for spreadsheet users

The notice even includes flowcharts and specific do’s and don’ts, which can be a lifesaver if you’re working with a mix of tools.

Don’t worry if you’re still confused after reading it.

You’re not alone – that’s why most people end up asking for help.

6. Non-compliance with HMRC

Skipping MTD rules (or assuming HMRC won’t notice) is a risky move.

Non-compliance can trigger loads of things:

- Fines and penalties for each incorrect or late VAT submission

- Interest charges on unpaid VAT

- Increased scrutiny from HMRC, especially if you’re flagged more than once

- Stress and cleanup when you have to retro-fix months of records

And here’s the kicker: HMRC has digital tools of its own!

They’re actively monitoring VAT returns, looking for patterns and anomalies that suggest manual interference.

Even if your numbers are spot on, how you get them there matters just as much. It’s not just about paying VAT – it’s about showing you’ve followed the digital rules all the way through.

7. Digital record keeping with WallsMan Creative

WallsMan Creative helps UK creatives stay sharp with HMRC. We handle everything from VAT to digital links and everything in-between. If you’re unsure about your setup or just want someone to double-check it, we’re here to make things easier.

No jargon. Just clean, compliant systems that let you focus on the work that matters.

Let’s get you sorted now!