Changing from sole trader to limited company?

It’s a big step, but if you’re already considering it, it might just be the right time for your creative business!

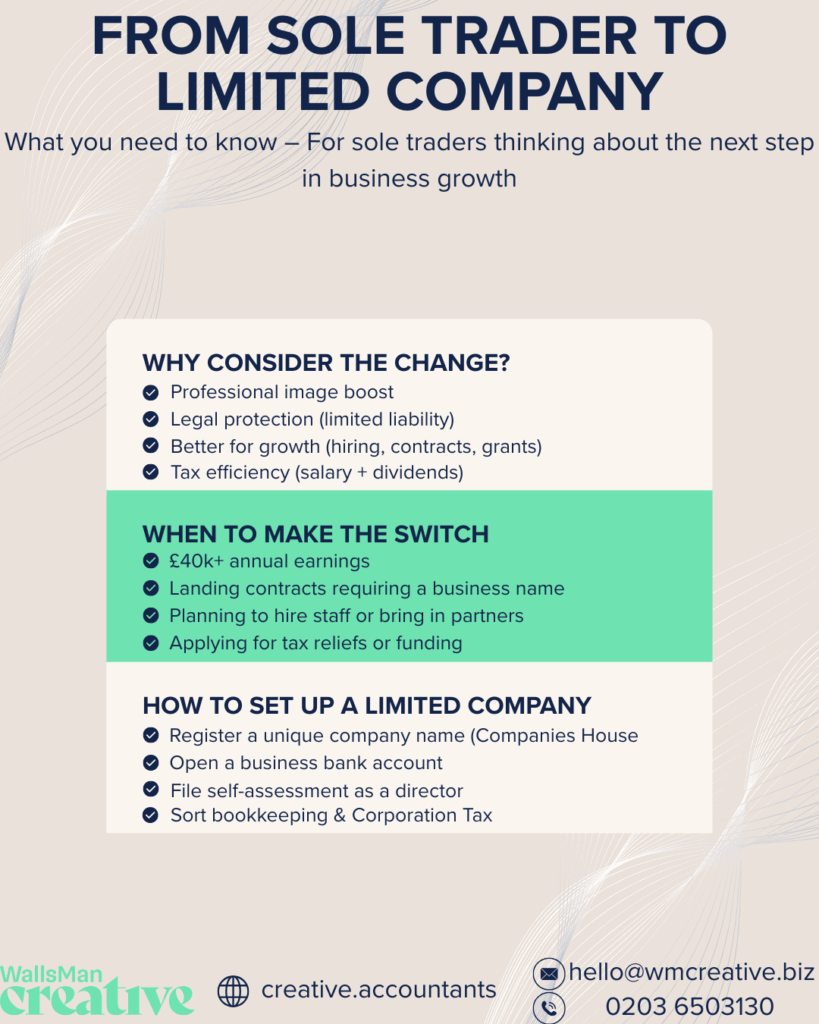

A limited company looks more professional. It’s useful if you’re pitching for bigger projects or you’re working with other agencies. With a limited company, you’re protecting yourself legally and you’re opening up other options:

- hiring staff

- applying for funding.

There are pros and cons of changing from sole trader to limited company. You’ll deal with a bit more admin – or you’re delegating these tasks to accountants. If you’re creative business grows organically, the benefits usually outweigh the extra work.

WallsMan Creative’s experience say that most creatives make the move when they’re earning more than £40k a year, or when they get contracts that need a business name attached.

Creative Takeaways

- Changing from sole trader to limited company gives your business a more professional image and helps secure bigger projects.

- A limited company offers limited liability, protecting your personal assets from business debts.

- It is often the right move when your income exceeds £40–50k or when contracts require a formal business name.

- As a limited company, you can hire staff, apply for funding, and access industry-specific tax reliefs like audio-visual expenditure credits.

- Running a limited company involves more admin, but it provides tax efficiency by combining salary and dividends.

- To set up, you must register with Companies House, notify HMRC, open a business account, and manage annual accounts.

Table of contents

1. Sole trader vs limited company: what’s the difference?

As a sole trader, you and your business are the same. You keep all the profits, but you’re also personally responsible for any debts or legal trouble.

A limited company is a separate legal body. It has its own bank account, pays its own tax, and takes on its own risks.

With a limited company, you’re a director and shareholder. You get paid through a mix of salary and dividends, which can help lower your tax bill.

There’s more paperwork, but you get more protection too.

It’s really easy to explain it with an example:

If you’re a freelance illustrator working on one-off projects, staying as a sole trader might make sense. If you’re running a small design studio, with a business name, staff, or regular contracts, a limited company gives you more structure and security.

Here’s how they compare:

| Feature | Sole Trader | Limited Company |

|---|---|---|

| Legal Status | You and the business are one | Separate legal entity |

| Tax | Income Tax on all profits | Corporation Tax + personal tax on pay |

| Financial Risk | You’re personally liable | Limited liability |

| Admin | Low admin, self-assessment return | More admin (accounts, filings, payroll) |

| Profits | All go to you | Can split between salary and dividends |

| Professional Image | Informal | Usually seen as more established |

| Suitable For | Freelancers, early-stage creatives | Growing businesses, teams, bigger jobs |

2. Why and when to change from sole trader to limited company

There comes a point where staying as a sole trader can hold you back.

If your income is going above £40,000 to £50,000, or you’re starting to land contracts that need a business name, it’s time to look at switching.

Another reason to make the switch is when you’re thinking about hiring someone or you want to bring in a partner. You’ll likely need more structure for this in your limited company.

But money isn’t the only reason you can make the switch. As a limited company, you’re better set up to deal with licensing, royalties, and with intellectual property altogether. Chances are high that you’re working on projects that qualify for grants or other industry support, maybe AVEC or VGEC. If you’re applying for these tax reliefs and credits, you’ll need to be a limited company to apply.

The creative sectors are full of these tax reliefs or expenditure credits. All of them can reduce the tax you pay on production costs.

Let’s continue with our example, and take it a step further:

You’re a freelance illustrator working on a series of animated shorts.

As a sole trader, you’re handling everything under your own name. You do the job, get paid, and that’s it. Once you form a limited company, you can apply for the audio-visual expenditure credit, claim back on eligible costs, and separate your personal income from business profits.

Still, you can be the only director and shareholder in this company, it just gives you more control and more options over your own things.

3. How to change from a sole trader and set up a limited company

Decided? Time to take action!

Switching to a limited company takes a few steps, but it’s not that complicated. Here’s how to go about it: from setup to keeping your accounts in good shape!

Choose a company name and register with Companies House

Pick a name that’s not already taken and meets the legal rules.

You can check name availability and register your company on the Companies House website. It costs £50 and usually takes less than 24 hours if you apply online.

You’ll need:

- A unique company name that complies with naming rules

- A registered office address in the UK

- Details of at least one director and one shareholder

- Information about the company’s shares and shareholdings

File your self-assessment tax return as a director

Once your company is set up, you still have file a self-assessment tax return!

Yes, even if you’re a company director: it’s exactly the same return, so you don’t need to tell HMRC that you’re stopping as a sole trader – they will see it in your next return.

You can do this online by signing into your Government Gateway account.

Set up a business bank account

A company must have its own Ltd company account – for that, you need a certificate of incorporation.

You can start the whole process of incorporation on HMRC.

| Creative Tip Keep all business income and costs separate from your personal money! |

Sort out your bookkeeping and tax

You’ll need to file annual accounts and pay Corporation Tax.

Use software like Xero to manage this. Or get an accountant – ideally one who knows the creative industry – to help with setup and ongoing support. It’ll save you time and headaches.

You can always reach out to WallsMan Creative: we know the ins and outs of the creative sector, we know how and when you need to convert from sole trader to limited company.

4. Time to convert from sole trader? Ask WallsMan Creative!

Changing from a sole trader to a limited company can feel like a big decision, but for many creatives, it’s the right move.

You get better legal protection, a professional image, and more room to grow. If you’re earning more, signing contracts, or working on bigger projects, this structure gives you the tools to take your work further.

You’ll have to manage a bit more admin, but with the right support, it’s all very doable. If you’re unsure what the next step looks like, you don’t have to figure it out on your own.

WallsMan Creative works with freelancers, studios, and creative teams every day. If you’re thinking about setting up a limited company, we’ll help you prepare for the change, set things up properly, and avoid the usual snags.

Reach out to us to chat about what’s next!