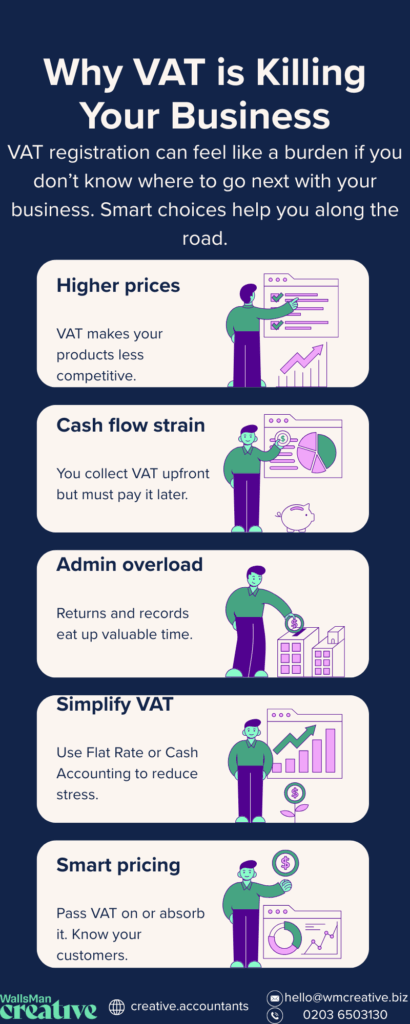

Being VAT registered is killing my business – that’s a phrase many small business owners find themselves saying once their turnover exceeds the VAT threshold.

VAT registration can feel like a punishment: higher prices, more admin, and constant VAT returns to HMRC.

If you’re struggling with VAT payments or unsure how to reclaim VAT on business expenses, you’re not alone. But VAT registration shouldn’t kill your business: let’s see how you can fix your business with smart management.

Creative Takeaways

- VAT registration can burden small businesses with higher prices, added admin, and cash flow strain.

- Deregistering for VAT is possible if turnover drops below the threshold, though it removes the ability to reclaim VAT.

- Smarter VAT management helps: the Cash Accounting Scheme, Flat Rate Scheme, and reclaiming VAT on expenses.

- Pricing strategy matters: passing VAT costs protects margins, while absorbing them keeps prices competitive but reduces profits.

Table of contents

- 1. Why VAT registered businesses struggle with the VAT threshold

- 2. The advantages and disadvantages of being VAT registered

- 3. When to deregister for VAT if being registered is killing your business

- 4. Smarter ways to manage VAT payments and VAT expenses

- 5. How to price your goods and services when you must charge VAT

- 6. When to get expert advice on VAT registration and HMRC rules

- 7. Get the right support if VAT is killing your business

1. Why VAT registered businesses struggle with the VAT threshold

For many small business owners, the real trouble starts the moment turnover exceeds the VAT threshold.

Once you must register for VAT, your business has to charge VAT on sales, issue VAT invoices, and submit VAT returns to HMRC.

On paper, VAT registration sounds simple. In real-life, it means higher prices that make your small business less competitive. Many registered businesses feel trapped just above the threshold: they are paying VAT while bigger companies absorb the cost more easily.

The impact of VAT on your business doesn’t stop at pricing.

VAT accounting adds layers of admin, from tracking VAT expenses to using a VAT online account. Business owners who only recently had to register for VAT, the sudden cash flow hit can feel overwhelming. It’s no wonder so many say: being VAT registered is killing my business.

But it shouldn’t be like that. WallsMan Creative has more than 10 years of experience with the creative industry in the UK, and we know all about it. (We even know some tax burdens you could get rid of, you wouldn’t even think of!) The important part here is to have a great system in place. We can give you that for FREE, you just need to book your first call with us:

2. The advantages and disadvantages of being VAT registered

When business owners first register for VAT, the focus is often on the negatives.

And yes, there are real disadvantages of being VAT registered:

- Charging VAT can push your prices up: this makes it harder to compete with non-registered businesses.

- Extra admin: filing VAT returns, tracking VAT expenses, and paying VAT to HMRC on time.

- Cash flow: it becomes tighter, and many small business owners feel like VAT registration is killing their business rather than helping it.

But there are advantages too!

Once you have a VAT registration certificate, you can:

- Reclaim VAT: reclaim business purchases and expenses (equipment, materials, or other significant purchases).

- Credibility: larger clients expect to see a VAT invoice.

So, there are disadvantages but also benefits of being VAT registered. If you understand every aspect, it’s easier to consider options like deregistering if your turnover falls below the VAT threshold.

3. When to deregister for VAT if being registered is killing your business

If being VAT registered is killing your business, one option worth exploring is: deregistration.

HMRC allows a business to deregister for VAT if its taxable turnover falls below the VAT threshold.

Don’t worry! This happens a lot more than you’d expect. Small business owner’s income drop, or stabilises at a lower level.

You can also voluntarily deregister for VAT if you expect your turnover to stay below the limit for the next 12 months. In this case, HMRC will issue confirmation once you cancel your VAT registration, and you’ll no longer need to submit VAT returns or issue VAT invoices.

Deregistering for VAT comes with trade-offs.

Once you’re no longer a VAT registered business, you can’t reclaim VAT on purchases or business expenses. That loss can outweigh the admin relief. Those working with consumers rather than VAT registered businesses, deregistering is the difference between survival and closure.

4. Smarter ways to manage VAT payments and VAT expenses

If you can’t deregister for VAT, the next step is learning how to manage VAT payments more effectively. Many small business owners discover too late that VAT liabilities don’t just affect their tax bill. They impact daily cash flow.

But there are ways to reduce the pressure!

Cash Accounting Scheme

The Cash Accounting Scheme allows you to pay VAT only when your customers actually pay you, rather than when you issue a VAT invoice. This can ease cash flow problems with slow paying customers.

Flat Rate scheme

The Flat Rate Scheme can benefit small businesses by simplifying VAT returns. Instead of tracking every single VAT expense, you pay a fixed percentage of your turnover. This reduces admin and makes it easier to predict what you owe.

Reclaiming VAT on Purchases

Another way to protect cash flow is to reclaim VAT on eligible purchases. If your business has huge expenses (equipment, stock, or even software), reclaiming VAT can save you money.

To do this effectively, you’ll need to:

- Keep accurate VAT invoices

- File VAT returns on time via your VAT online account

- Understand which costs are VAT-taxable

And, you could even claim pre VAT expenses!

5. How to price your goods and services when you must charge VAT

The toughest part might not even be the extra admin or paperwork… it’s pricing!

When you register for VAT, you have to charge VAT on your sales. But how do you do that: do you pass that VAT on to your customers, or do you absorb the VAT yourself? Or find a middle ground? And for every service or goods you sell, or just some of them?

Well…

Passing the VAT cost on keeps your margins stable, but it can make your prices look higher compared to non-registered businesses. This is a common disadvantage of being VAT registered, especially in sectors where customers are price-sensitive and can’t reclaim VAT.

Absorbing the VAT keeps prices competitive but eats into profits, which is why so many say being VAT registered is killing their business.

The right approach depends on your customers. And who else would know your customers the best, if it’s not you?!

If you mostly deal with VAT registered businesses, issuing a VAT invoice (probably) won’t hurt you. They’ll be able to reclaim the VAT either way.

But if your clients are individuals or small business owners exempt from VAT, you’ll need to carefully weigh how VAT payments affect your pricing strategy.

6. When to get expert advice on VAT registration and HMRC rules

Sometimes, no amount of DIY fixes can stop VAT from feeling like it’s killing your business. That’s when it pays to get expert advice.

You should speak to an accountant if:

- Your turnover is approaching £50,000–£60,000 and you’re unsure IF it makes sense to voluntarily register for VAT before hitting the mandatory threshold.

- Your turnover temporarily exceeds the VAT threshold and you’re unsure whether to voluntarily register for VAT.

- You struggle to keep up with VAT returns, VAT invoices, or VAT payments to HMRC.

- Your business ceases trading, falls below the VAT threshold, or you want to deregister for VAT.

- You need clarity on VAT rates and exemptions or how to reclaim input VAT on business expenses

7. Get the right support if VAT is killing your business

If being VAT registered is killing your business, you don’t have to figure it all out on your own.

Many small business owners feel trapped by VAT registration, struggling with VAT returns, HMRC rules, and the impact of VAT on pricing. The right advice can make VAT work for your business instead of against it.

At WallsMan Creative, we specialise in supporting UK creative businesses with tax, VAT, and accounting. VAT doesn’t have to be the reason your business struggles.

Whether you need to reclaim VAT on purchases, manage VAT payments, or decide whether to deregister for VAT, we’ll help you find the smartest path forward. Book a call now, and focus on what really matter: growing your business.