Key Takeaways

- The Enterprise Investment Scheme (EIS) is a UK government-backed initiative that encourages investment into early-stage, high-risk companies through tax relief.

- EIS helps creative and innovation-led businesses raise growth capital without relying on debt or giving up excessive control.

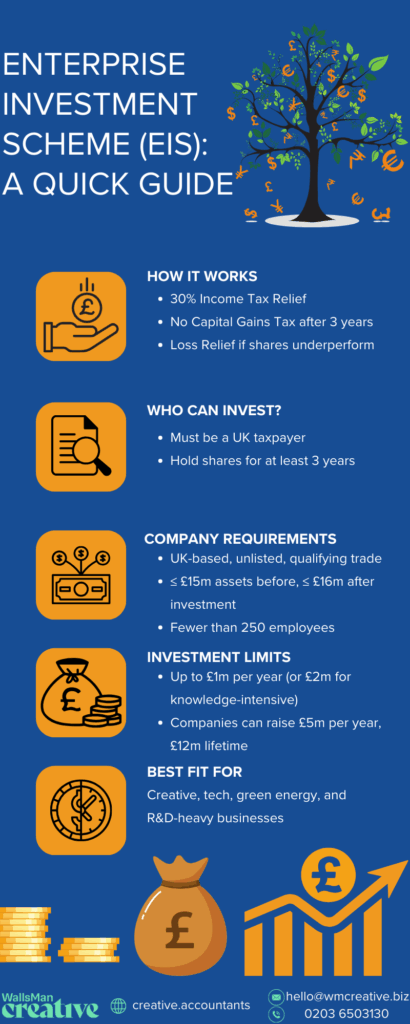

- Investors benefit from 30% income tax relief, no Capital Gains Tax on profits, loss relief, Capital Gains Tax deferral, and potential Inheritance Tax relief.

- Only UK individual taxpayers can invest through EIS, and they must hold shares for at least three years without controlling or being connected to the company.

- Eligible companies must be UK-based, unlisted, have fewer than 250 employees, meet asset limits, and carry out a qualifying trade.

- The EIS application process is company-led and involves Advance Assurance, issuing qualifying shares, submitting the EIS1 compliance statement, and providing EIS3 certificates to investors.

The ultimate goal is to support smaller, high-risk businesses that struggle to raise money through other traditional channels. How does the Enterprise Investment Scheme (EIS) work?

Table of contents

1. Which companies are eligible for EIS?

Not every business qualifies for the Enterprise Investment Scheme (EIS).

To be eligible, a company must meet several conditions set by HMRC. These rules are all in place to help the scheme stay genuine, so it supports early-stage businesses

Basic company criteria for EIS

- The company must be UK-based and carry out most of its trading in the UK.

- It must be unlisted (not on a recognised stock exchange) when the shares are issued.

- It must have fewer than 250 full-time employees.

- Its gross assets must not exceed £15 million before the investment and £16 million after.

- It must not be controlled by another company.

Age of the company

The business must issue EIS shares within 7 years of making its first commercial sale. For knowledge-intensive companies, this limit extends to 10 years – as stated earlier.

Qualifying trades for EIS

EIS is available to most sectors, but some trades are excluded!

Excluded sectors are banking, property development, legal or accountancy services and many more. You can see the full list of excluded activities on HMRC’s website.

Creative industries (film, animation, design, publishing etc.) are generally safe, as long as they’re run as trading businesses – and not purely for investment.

Meeting these rules is key to securing advance assurance from HMRC and attracting investors looking for EIS tax relief.

2. Who can invest through the Enterprise Investment Scheme (EIS)?

Not everyone can invest through the Enterprise Investment Scheme (EIS). Those who can invest in EIS, need to meet a few basic conditions.

Who can invest under EIS?

You must be a UK taxpayer to benefit from the tax reliefs.

Most individual investors qualify, but you can’t use EIS through a company or a trust. The scheme is meant to reward private investors who are putting their own money at risk.

Limits on your stake

You can’t control the company.

Your total stake – when combined with any shares held by close relatives – must be less than 30% of the company’s ordinary shares, voting rights, and rights to assets.

Keep in mind that if you go over this limit, you’ll lose the tax benefits.

Your responsibilities as an investor

To keep your tax relief:

- You must hold the shares for at least three years.

- You can’t have a connection to the company as an employee, director (in most cases), or paid consultant before the investment.

- You must buy new ordinary shares, paid in full and in cash.

Failing to meet any of these conditions could cancel your relief and lead to a repayment of tax.

HMRC has strict but clear rules. If you follow them, you can stay eligible for all EIS tax reliefs.

3. Benefits of the Enterprise Investment Scheme (EIS)

The Enterprise Investment Scheme (EIS) is designed to make investing in small UK companies more attractive by reducing investor risk. In turn, this helps growing businesses (creative and innovation-led sectors, too!) access the capital they need to scale.

Benefits of EIS for small and creative companies

The real strategic value of EIS is what it unlocks for growing businesses.

- Improved access to growth capital: EIS makes your company far more attractive to high-net-worth individuals, angels, and family offices who actively seek tax-efficient investments.

- Long-term aligned investors: Because investors must hold shares for at least three years to retain relief, EIS naturally attracts patient capital rather than short-term speculators — ideal for creative businesses building long-term value.

- No repayment or interest: Unlike debt, EIS funding does not require repayments or interest, protecting cash flow during critical growth phases.

- Founder-friendly funding: EIS allows you to raise equity without the control dynamics often associated with institutional VC at earlier stages.

- Enhanced credibility: HMRC advance assurance and EIS qualification act as a strong external signal that your company meets recognised standards for growth, risk, and governance.

Benefits of EIS for investors

EIS offers one of the most generous tax incentive packages available in the UK, rewarding individuals who commit capital to early-stage, higher-risk businesses.

- 30% income tax relief: Investors can claim income tax relief equal to 30% of the amount invested, up to £1 million per tax year (or up to £2 million if at least £1 million is invested in Knowledge-Intensive Companies). Shares must be held for at least three years. This is a direct reduction of their income tax bill.

- No Capital Gains Tax (CGT) on profits: If EIS shares are sold after the three-year holding period, any gain is completely free from Capital Gains Tax.

- Loss relief: If the company fails, investors can offset their loss (after income tax relief) against income tax or capital gains tax. This downside protection materially reduces the real risk of investing in early-stage companies.

- Capital Gains Tax deferral: Investors can defer CGT on gains from other assets by reinvesting those gains into EIS-eligible shares. The tax is deferred until the EIS shares are sold (or cease to qualify).

- Inheritance Tax relief: After holding EIS shares for two years, they may qualify for 100% relief from Inheritance Tax under Business Property Relief, provided the shares are still held at death.

4. How to apply for EIS as a company: step-by-step guide

Applying for EIS is easy, but it’s a bit different compared to SEIS. It’s a simple process where each step matters both for your company and for your investors.

Don’t worry if you’re a bit lost in it, we’re here to help. Feel free to get in contact with us!

Until then, we’ve prepared a step-by-step guide, so you can do it properly and give your backers the paperwork they need to claim tax relief.

Step 1: Apply for Advance Assurance

Send an Advance Assurance request to HMRC – learn more about it on our blog.

This is a written response confirming your company and share offer are likely to qualify for EIS. It’s not required by law, but most investors expect it before they commit funds.

Step 2: Raise funding and issue shares

Once you’ve received commitments from investors, issue the shares.

These must be new ordinary shares, paid in full and in cash. The shares can’t carry special rights to company assets or be redeemable.

Step 3: Submit EIS1 compliance statement

After the shares are issued, send the EIS1 form to HMRC.

This tells them you’ve completed the investment and are asking to issue tax certificates. They’ll review your case before giving the green light.

You can start the EIS1 compliance statement process with your government gateway account.

Step 4: Provide EIS3 Certificates

Once HMRC approves your EIS1, they’ll authorise you to issue EIS3 certificates.

These are the documents investors need to claim relief. The Enterprise Investment Scheme claim form is based on this certificate.

5. Is EIS Right for You?

The Enterprise Investment Scheme (EIS) gives creative businesses a practical route to funding. EIS can open the door to investors who value innovation, and get tax efficiency on top of it.

But is EIS right for you?

We have more than 10 years of experience working with creatives, and we can safely say that this investment scheme offers a way to raise money without giving up too much control.

If you’re building something with long-term potential and need the right kind of backing, EIS is worth considering.

WM Creative can help you assess your eligibility, prepare your Advance Assurance, and guide you through the full process. If you have any questions regarding this process, ask away: now is your chance!

PS. If you’re hesitant whether you have to apply for SEIS or EIS, check our dedicated EIS vs SEIS blog post.