Making Tax Digital – MTD

Ultimate Guide to Making Tax Digital (MTD) – Everything You Need to Know

This dashboard aims to guide sole traders, small & large business owners through the transition from general tax reporting to Making Tax Digital (MTD).

Our Ultimate Guide to Making Tax Digital (MTD) serves as an educational hub, onboarding guide, and referral gateway, presented through an easy-to-follow format with supporting content.

Check out the Making Tax Digital Timeline, then browse through the different topics related to:

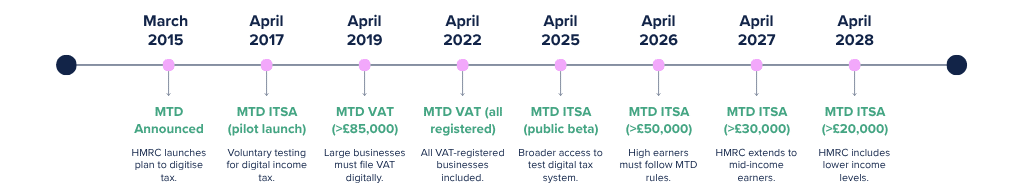

Making Tax Digital Timeline

Frequently Asked Questions About Making Tax Digital

Making Tax Digital is an HMRC initiative that requires taxpayers to keep digital records and submit their tax returns using compatible software.

MTD for VAT applies to all VAT‑registered businesses, while MTD for Income Tax (ITSA) will apply in phases: from April 2026 for those earning over £50,000; from April 2027 for those above £30,000; and from April 2028 for those earning over £20,000.

No. Under MTD, you must submit your returns via HMRC‑approved accounting or bridging software rather than using the HMRC portal.

You need MTD-compatible software such as accounting platforms like Xero, QuickBooks, or Sage, or bridging software if you prefer spreadsheets.

Yes, you can still use spreadsheets, but only if they are connected to HMRC via bridging software to ensure compliance.

MTD for VAT is already mandatory. For ITSA, the roll‑out schedule is: April 2026 (£50k+), April 2027 (£30k+), and April 2028 (£20k+).

Failing to comply with MTD requirements may result in HMRC applying penalties under its new points-based system. Each missed deadline adds a penalty point. Once a threshold is reached, a financial penalty will be charged, and HMRC may also apply interest on any late payments.

Yes. VAT returns remain quarterly, while ITSA introduces quarterly updates with a final annual declaration instead of the traditional Self-Assessment.

You must register via the HMRC website and authorise your chosen MTD-compatible software to connect and submit on your behalf.

MTD helps reduce errors, streamlines record-keeping, strengthens real-time visibility of tax liabilities, and makes the tax process more efficient overall.

Our Making Tax Digital Guides

Quick links for Making Tax Digital

Looking for the essentials on Making Tax Digital?

This section pulls together key links from HMRC to help you get things done.

Whether you need to sign up for MTD, check if your business qualifies, or find compatible software, it’s all here in one place.

Get direct access to what matters.

Keep this list handy as deadlines approach or if you need to double-check any requirements.