VAT (Value Added Tax) is a tax you charge on goods and services if your business is registered in the UK. You must register for VAT if your taxable turnover goes over £90,000 in any 12-month period. This includes most sales, unless they are exempt.

You can also do voluntary registration for VAT if your turnover is below the threshold. Some businesses choose to do this to claim back VAT on expenses.

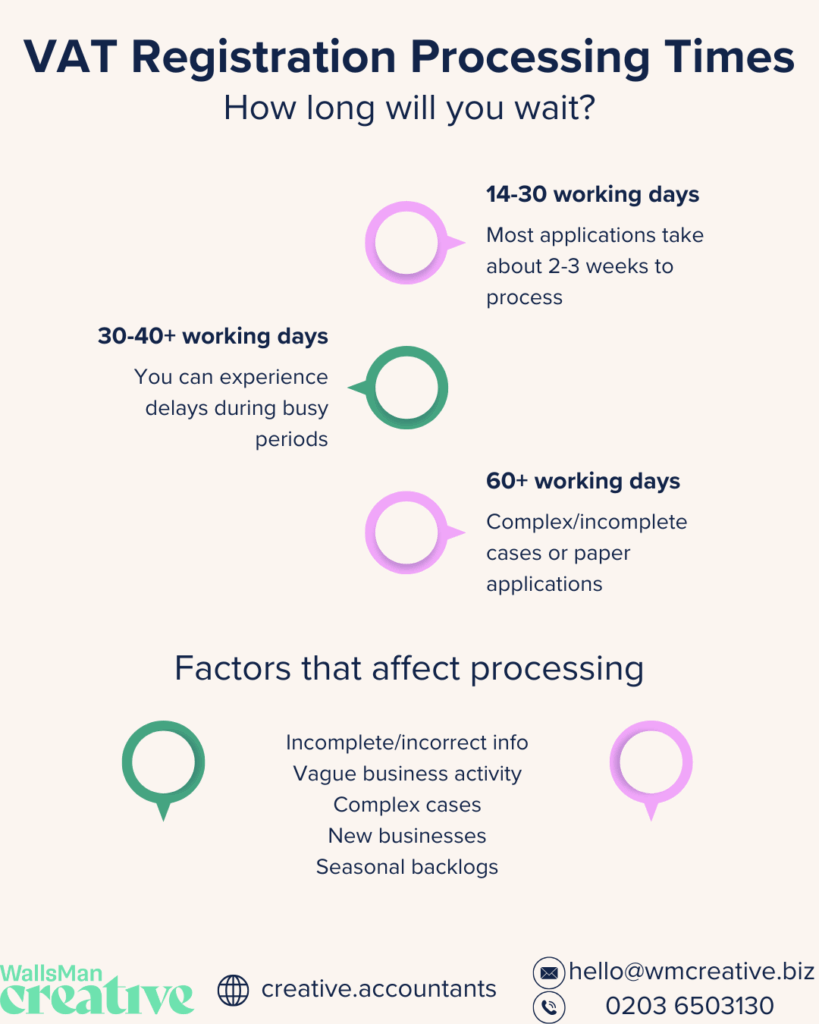

WallsMan Creative can provide the service to register clients or VAT, either voluntary, or after they pass the £90k threshold. We will submit the necessary forms to HMRC on clients behalf – and it can take up to 40 working days to hear back from HMRC.

In some cases, the VAT registration processing times can pass the date the client was supposed to be registered. In this case, they will be running as expected to be VAT-registered for a short period of time with no VAT number for proof, but we still advise clients to add VAT to their sales from the date we applied to be registered from.

Once you apply, you’ll get a VAT registration number. You need this number to charge VAT and submit VAT Returns.

Creative Takeaways

- VAT registration processing usually takes 14–30 working days, but can extend to 40+ days depending on complexity.

- Delays are common for new or low-trading businesses and if applications are incomplete or unclear.

- Paper applications are much slower than online submissions and are only accepted in special circumstances.

- You can trade while waiting for your VAT number, using “VAT pending” on invoices and later reissuing with the VAT number once received.

- If no response after 30 working days, contact HMRC at 0300 200 3700 with your reference number.

- Backlogs occur during busy periods like April and January, extending wait times.

Table of contents

1. Typical VAT registration processing times in the UK

Most VAT registration applications are made online through HMRC, and a government gateway account.

On average, HMRC takes 14 to 30 working days to process these – but as stated previously, this can be more than 40 days. This is the typical range for straightforward cases where all details are complete and accurate.

In more complex cases, or if HMRC decides to review the application in more detail, it can take up to 60 days or longer. WallsMan Creative’s experience says that this happens when the business is brand-new, trading internationally or doesn’t yet have a clear trading history.

Register for VAT via paper

Paper applications are much slower. These are now only accepted in special circumstances and can take several weeks longer than online forms.

Recent reports from applicants show that while many of you receive their VAT number within 3 weeks, others wait 6 to 8 weeks or more. Busy periods are April or January.

If you haven’t heard back after 30 working days, it’s a good idea to contact HMRC to check the status of your application.

2. What affects VAT registration service processing time?

If everything goes smooth – okay. But in reality, some factors can slow down your VAT registration.

HMRC may need more time to review your application if there are questionable details, or some are incomplete.

Missing or incorrect business details

If you leave out information or input the wrong figures, HMRC won’t be able to process your application straight away.

| Creative Tip Double-check your company name, address, and contact details before submitting. |

Vague activity descriptions

You need to clearly describe what your business does. If your description is too general or confusing, HMRC may contact you for clarification.

This will add time to the process your registration.

New businesses with no trading history

If you’ve just set up your business and haven’t started trading yet, HMRC may run extra checks.

They usually ask for proof that you’re planning to trade or that your business is genuine – understandable, right?!

Seasonal backlogs affecting VAT in the UK

At certain times of the year (e.g. end of the tax year), HMRC receives more applications.

This can slow things down – even for complete and accurate forms.

| Creative Tip Make sure every information you submit is correct, so you’re not wasting any more than you would need for your VAT number. |

3. Trading while waiting for VAT registration number

The short answer to the question whether you can trade while waiting for your VAT number is: yes.

But!

There are rules you need to follow.

Using “VAT pending” on invoices

If you’ve applied for VAT and are waiting on HMRC, you can still issue invoices.

On those invoices, write “VAT number pending” instead of a number. You must still show the VAT amount you’re charging and keep a copy for your records.

Backdating VAT once you get your number

Once HMRC gives you your VAT number, you’ll need to go back and reissue those invoices with the number included.

The date on the invoice stays the same, you just need to add the VAT number.

Accounting for VAT during the wait

You still have to charge and account for VAT from the date you’re registered, even if your number hasn’t arrived yet.

Keeping records clear from the start will make things much easier once your VAT number comes through.

4. What to do if you haven’t heard back from HMRC

If you’ve applied for VAT and haven’t heard anything after 30 working days, it’s totally okay to follow up.

HMRC doesn’t send progress updates, so if it’s gone quiet, you’ll need to take the first step.

How to get in touch

You can contact HMRC’s VAT helpline on 0300 200 3700 (open Monday to Friday). Have your application reference number ready as this will help speed things up.

You can also write to HMRC, but our experience says that phone tends to be quicker.

Should you get an accountant involved?

If it’s been over six weeks and you’re still in the dark, speaking to an accountant can help.

We can chase HMRC on your behalf and make sure there were no issues in your application. If you’re already trading and need things sorted quickly, we can speed things up for you.

What if HMRC rejects or loses your application?

Mistakes happen.

If your application is rejected, you’ll need to fix what went wrong and reapply.

If HMRC confirms they never received your application, you’ll need to resubmit everything. (That’s why keeping copies and emails is a good idea.)

If you’re stuck, worried, or just want to delegate some of these tasks, don’t worry: WallsMan Creative is here to help you!

Reach out, and we’ll help get it sorted without the stress.