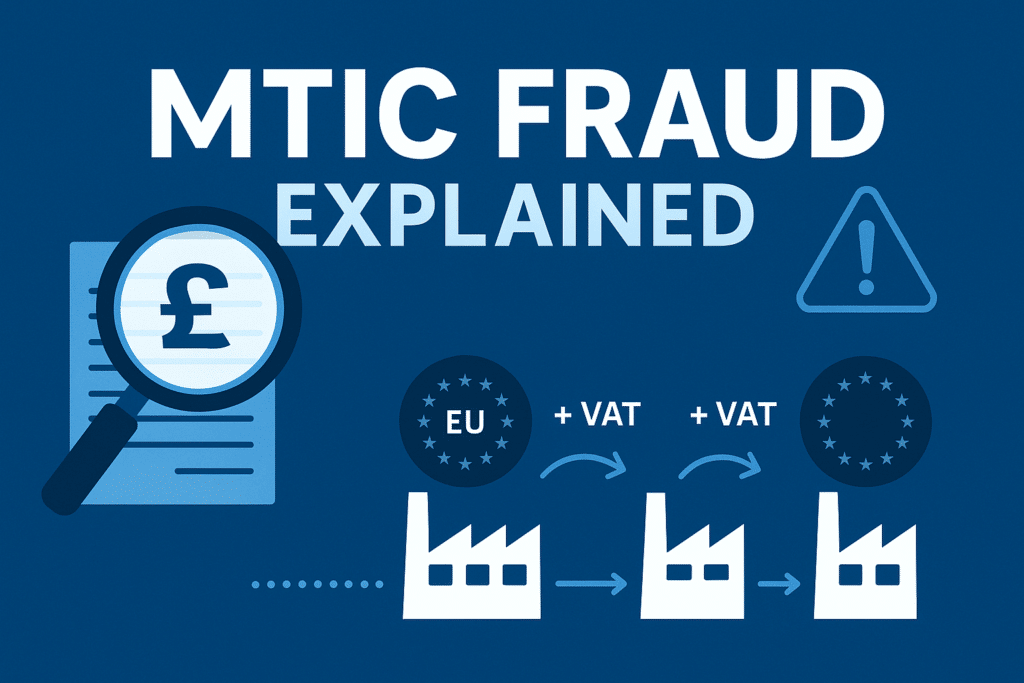

MTIC fraud (short for Missing Trader Intra-Community fraud) is a type of VAT fraud that happens when businesses exploit rules on cross-border trade within the EU.

Goods traded between EU countries are often zero-rated for VAT. This means a company in one EU country can sell goods to a business in another EU country without adding VAT. (You can learn more about selling to EU on our blog.)

In a typical MTIC fraud case, a company in the UK buys goods VAT-free from an EU supplier. The goods are then sold on within the UK with VAT added. The fraud occurs when the seller – in this case, known as the missing trader – disappears before paying the VAT to HMRC.

The goods can change hands multiple times in a chain involving other companies. And some companies are not even aware that they are part of a fraud.

The fraud is often called carousel fraud: the goods cycle through different businesses and return to the original EU supplier. The process repeats, and generates large VAT losses for HMRC.

MTIC fraud happens in some sectors more frequently, and HMRC monitors them closely.

Creative Takeaways

- MTIC fraud is VAT theft through cross-border EU trade.

- Missing traders disappear without paying VAT to HMRC.

- Carousel fraud cycles goods through businesses, reclaiming unpaid VAT.

- High-risk goods include electronics, metals, energy, and telecom services.

- Legal consequences can include up to 10 years in prison and asset seizures.

- Businesses must protect themselves with checks: verify VAT numbers, research suppliers, watch red flags, keep records, seek advice.

Table of contents

1. How does MTIC fraud work?

Simply put: MTIC fraud is a loop that moves goods across borders and through different companies, all the while VAT vanishes along the way. The process includes multiple steps, and although it can seem complex, it’s not that brilliant of a VAT fraud.

MTIC fraud follows a fraud that repeats until it’s detected. Let’s break it down step-by-step so you know what it’s all about!

Step 1: Buy goods VAT-free

A UK company (missing trader) buys goods from an EU supplier. These goods are zero-rated for VAT because they are part of cross-border trade.

The company pays no VAT upfront.

Step 2: Sell goods with VAT

The missing trader sells the goods to another UK business, charging the standard UK VAT rate. But instead of sending the VAT to HMRC, the missing trader keeps the VAT and disappears.

Step 3: Pass goods through the chain

The goods are sold through other UK businesses. Each company adds VAT and pays it up the chain, unaware that the VAT at the top has not been paid.

This chain makes it harder to trace the missing trader.

Step 4. Export goods back to the EU

The goods eventually reach a broker, who exports them back to an EU customer. The broker charges no VAT on the export, following cross-border trade rules.

Step 5. Claim a VAT Refund

The broker reclaims the VAT they paid on the goods. HMRC refunds this VAT, unaware that it was never paid by the missing trader. This is where HMRC loses money.

To put all of this into visuals. It looks like this:

EU Supplier → Missing Trader → UK Business 1 → UK Business 2 → Broker → EU Customer

(Arrows showing goods and VAT payments flowing in a loop)

2. Most common industries for VAT carousel fraud

MTIC fraud usually targets goods and services that are easy to move but also high in value.

Why?

Criminal groups like these items because they can trade large amounts in short periods. Fewer checks slow them down in this carousel fraud, and the goods pass through multiple businesses quickly.

The faster they pass these items through the businesses, the better for them: it’s harder for tax authorities to spot the fraud.

The cycle is especially effective with items that do not need much storage space and can cross borders with little notice.

The most common sectors targeted by MTIC fraud:

- Mobile phones

- Computer chips and IT equipment

- Precious metals like gold and silver

- Telecommunication services

- Carbon credits

- Gas and energy products

Why these?

These sectors have goods that are usually high value, they are small enough and easy to sell across borders.

Fraudsters aim to collect as much VAT as possible in a short time and vanish without paying a penny back to the authorities.

3. Legal consequences of Missing Trader Intra-community VAT fraud explained

MTIC fraud is a crime. If you’re involved in it – doesn’t matter if on purpose or by accident – you could go to jail.

HMRC treats MTIC fraud as a very serious offence. If they prove you played a part in the fraud, you could face up to 10 years in prison. That’s the maximum sentence for MTIC fraud in the UK.

It’s not just jail time, though. HMRC can take your assets, like your car, house, or savings, if they believe they were bought using the proceeds of fraud. You could also get a heavy fine.

Sometimes, even innocent businesses get caught up in MTIC fraud. If you’re in the chain of transactions, it can still lead to big problems. HMRC might withhold VAT refunds or take you to court.

If you’ve been contacted by HMRC, get advice straight away.

MTIC fraud cases are complex, and it’s not easy to spot when a deal looks suspicious. A lawyer can help you understand your position and avoid making things worse.

4. How to protect your business: 5 actionable tips

MTIC fraud can hit any business, big or small. We have more than 10 years of experience working with sole traders, small and growing agencies. WallsMan Creative knows these cases very well, so here are 5 actionable tips to protect your business.

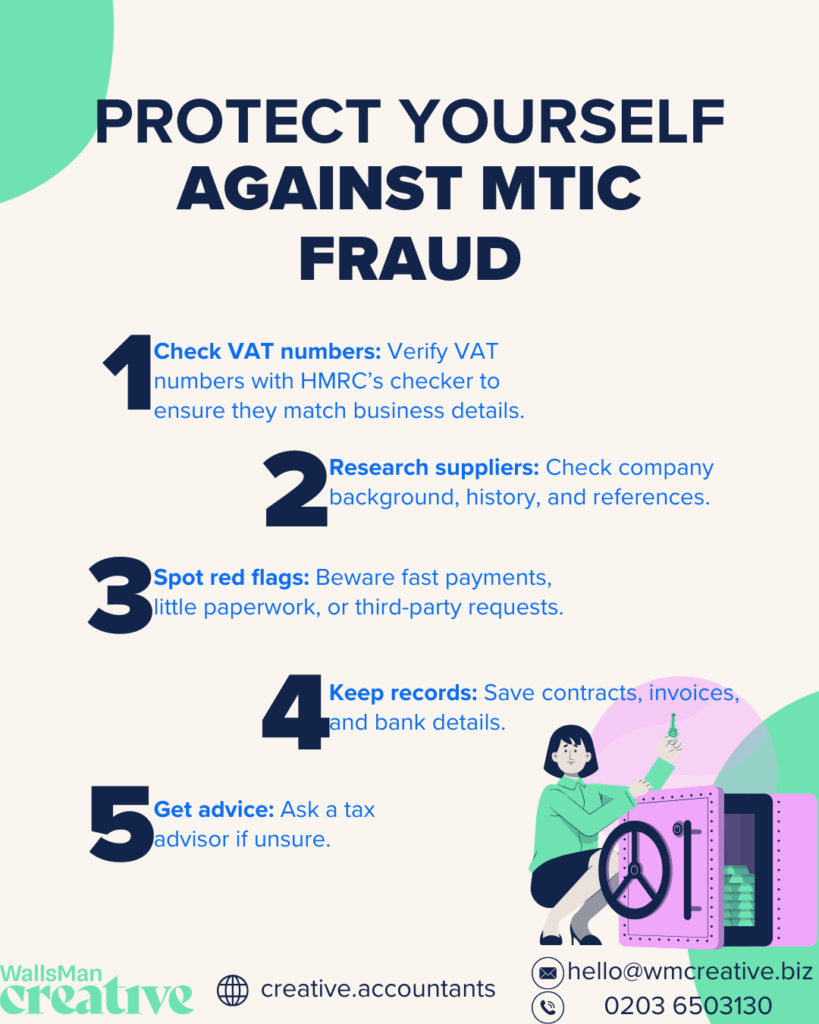

Tip 1: Check VAT numbers

Before doing business with a new supplier or customer, verify their VAT number using HMRC’s VAT checker. Make sure the number matches the business details.

This is a basic step that can flag potential issues early.

Tip 2: Research your suppliers

Know who you’re dealing with.

Look into the company’s background, check their trading history, and ask for references. Be wary if a company has no track record or if their deals seem too good to be true.

Tip 3: Watch out for red flags

Be cautious of high-value deals with little paperwork, pressure to pay quickly, or requests for payments to third parties.

Tip 4: Keep detailed records

Keep clear records of all transactions, including contracts, invoices, and bank details. If HMRC investigates, you’ll need this paperwork to show you’ve done your checks.

Tip 5: Get professional advice

If a deal feels risky or confusing, speak to a tax advisor or solicitor. They can help you review the risks and give guidance on what to do next.

5. Follow HMRC VAT rules with WallsMan Creative

At WallsMan Creative, we work hard to help businesses like yours avoid risks like MTIC fraud.

We understand how the rules around VAT and cross-border trade can seem complex, but you don’t have to figure it all out alone.

Our team keeps up with the latest HMRC regulations, so you can focus on your work knowing you’re on the right side of the law.

We’re here to make sure you understand what’s required, keep your records in order, and help you avoid getting caught in fraudulent schemes.

If you’re looking for support to help you protect your business and stay compliant, we’re ready to help. Let’s have a conversation about how we can keep your creative work secure.