HMRC scam calls are on the rise.

These calls often sound serious. The person on the other end may claim you owe tax or are under investigation. They might threaten legal action or ask for your bank details. It can feel alarming, especially if you’re self-employed or managing your own taxes.

HMRC have recently updated their guidance on the way in which scammers and fraudsters try to trick innocent taxpayers. The list is lengthy, including examples of websites, e-mails, letters, text messages, WhatApp chats and phone calls.

Please do be vigilant to this and if you have any doubts at all, get in touch with us.

Creative Takeaways

- HMRC scam calls are becoming more common, and they often try to scare you into acting quickly.

- Watch out for threats of arrest, odd payment requests, or strange-looking phone numbers.

- HMRC won’t ask for full bank details or demand instant payments over the phone.

- Hang up immediately if a call feels aggressive or suspicious, and never press any numbers or share information.

- It’s important to report any scam messages or calls to HMRC or Action Fraud so they can investigate.

Table of contents

1. What are HMRC scam calls?

HMRC scam calls are designed to trick you into handing over money or personal details.

They often use fear to pressure you into acting quickly. The caller may say you haven’t paid the right amount of tax or that your National Insurance number has been linked to fraud. They act in a similar way like HMRC phishing emails.

In many cases, these calls are automated.

A recorded voice might tell you HMRC is filing a lawsuit against you. You’ll be asked to “press 1” to speak to someone. From there, the scammer may demand payment or ask for your bank details.

For example, you might get a call saying you owe £1,200 in unpaid tax and must pay it immediately to avoid arrest. The caller may sound official, but the threat is false.

Some scammers spoof phone numbers, so it may look like HMRC is calling. But HMRC does not use this approach to chase debts.

| Creative Tip: If a call feels rushed, aggressive or threatening, it’s a red flag. Always take a step back and double-check. |

2. How to spot HMRC scam calls

Scam calls often follow a pattern. If you know the warning signs, you can avoid being scammed.

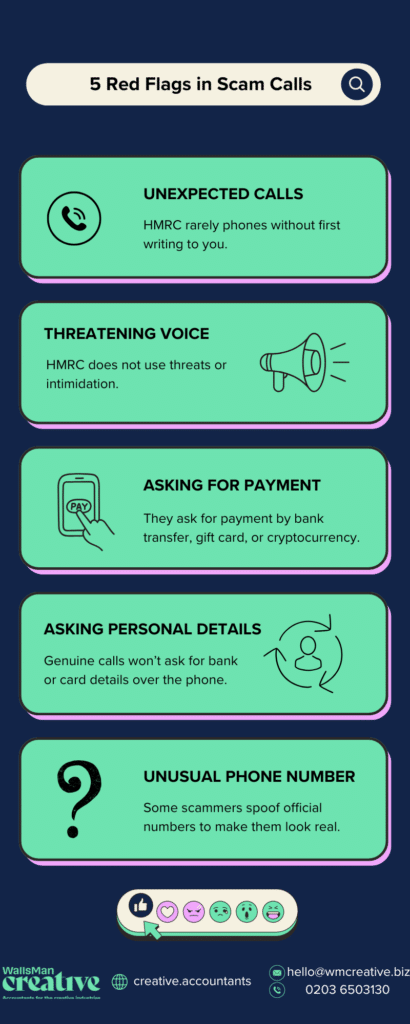

Here are some common red flags:

- The call is unexpected. – HMRC rarely phones without first writing to you.

- You’re asked to press a number. – This is often used to connect you with a scammer.

- The caller threatens arrest or legal action. – HMRC does not use threats or intimidation.

- They ask for payment by bank transfer, gift card, or cryptocurrency. – These are never used by HMRC.

- They want personal details right away. – Genuine calls won’t ask for your full bank or card details over the phone.

- The call is from a mobile number or one that looks unusual. – Some scammers spoof official numbers to make them look real.

What to do when you spot some or all of these signs?

Hang up immediately. Do not give out any information. If you’re unsure, contact HMRC directly using a trusted number from their website.

3. How to avoid HMRC scam calls

While scam calls can be convincing, there are simple steps you can take to protect yourself:

- Don’t answer calls from unknown or suspicious numbers. Let them go to voicemail. Genuine callers will usually leave a message.

- Use call-blocking features on your phone or apps that help screen unwanted or fake calls.

- Never give out personal information unless you’re certain of who you’re speaking to.

- Stay informed about the latest HMRC scam tactics by checking the HMRC website or following trusted financial news sources.

- Save official HMRC contact numbers so you can recognise a real call if it comes through.

4. How to report a suspicious phone call, text & other fraudulent activity

Although the most important step is to completely avoid these scams, if you encounter one, you can also report it!

This helps stop scammers and protects others. There are different ways to report fraudulent activities depending on what type of scam you encounter:

- Scam phone calls: You can report these online at the HMRC phishing and scams page. If the call threatens legal action or payment, you can also report it to Action Fraud, the UK’s national fraud reporting centre.

- Scam texts: Forward the text message to 60599. This goes straight to HMRC’s security team.

- Phishing emails: Forward the email to [email protected]. Don’t click on any links or attachments.

- Social media scams: If someone contacts you through social media pretending to be HMRC, report the message and email [email protected].

If you’re still unsure about what to do, how to spot a scam, or how to report one, don’t be afraid to reach out to us!