Creative Takeaways

- VAT registration isn’t optional once your taxable turnover exceeds £90,000.

- You must register for VAT within 30 days or risk paying VAT back and penalties.

- Some businesses must register immediately – those based outside the UK selling goods or services here, or when taking over a VAT-registered company.

- Small businesses can register voluntarily to reclaim VAT on purchases.

- The process is completed online through GOV.UK using a Government Gateway account.

- You’ll receive a VAT registration number, start charging VAT on invoices, and submit VAT returns to HMRC regularly.

Here’s how to register for VAT in the UK, along with other frequently asked questions answered by HMRC:

Table of contents

1. Who needs to register for VAT

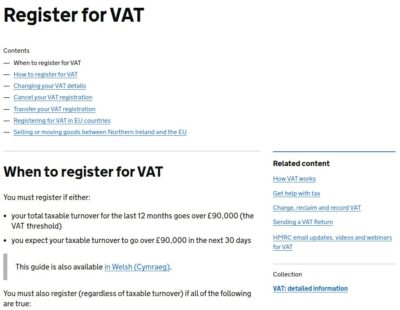

Not every business has to register for VAT, but once your taxable turnover exceeds the VAT threshold of £90,000, registration becomes mandatory.

Here’s when you need to register for VAT:

- Turnover exceeds the threshold – If your taxable turnover in the past 12 months went over the threshold, or if you expect it to in the next 30 days, you must register within 30 days.

- Non-UK businesses – If your business is outside the UK but you sell goods or services here, you must register immediately. The VAT threshold does not apply to you.

- Business takeovers – If you take over a company that is already VAT registered, you’ll need to register too.

- Voluntary registration – Small businesses can register voluntarily even if their turnover is below the threshold. This lets you reclaim VAT on purchases and may improve how your business is perceived by clients and suppliers.

If you want to learn more about what is the VAT threshold, check out this blog post:

2. When and why VAT registration timing matters for small businesses

HMRC gives businesses 30 days to register for VAT once their taxable turnover exceeds the VAT threshold.

If you went over the threshold in the past 12 months or you expect to exceed it in the next 30 days, you must register within that timeframe.

If you miss the deadline, HMRC can backdate your registration.

That means you’ll still need to pay VAT from the date you should have registered – plus possible penalties!

In practice, late VAT registration can cost small businesses more than just the VAT owed – it can also affect cash flow and client relationships.

Registering on time keeps you compliant, avoids unnecessary fines, and ensures your VAT registration number and effective date of registration are correct from the start.

| Creative Tip You can also opt-in for voluntary VAT registration. Check our post on benefits, risks, pros & cons of voluntary VAT registration. |

3. What you need before VAT registration

Before you register for VAT, make sure you have the right details and accounts ready.

HMRC will ask for:

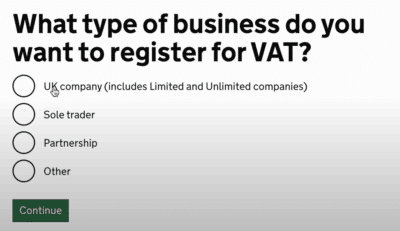

- Business type – whether you’re a sole trader, limited company, or partnership

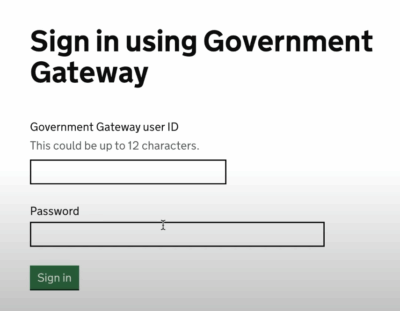

- Government Gateway account – you’ll need one to register online through GOV.UK

- Unique Taxpayer Reference (UTR) – your business tax reference number

- Bank account details – linked to your business for VAT payments and refunds

- Taxable turnover figures – the total value of goods and services you sell that are not exempt from VAT

You’ll also need to decide which VAT scheme works best for your business.

Small businesses often use the Flat Rate Scheme or Cash Accounting Scheme, while larger companies stick with the Standard VAT scheme. Be aware: choosing the right one can affect how much VAT you pay and when you need to submit your VAT return to HMRC.

4. Step-by-step guide: How to register online via GOV.UK

Most businesses register for VAT online. Here’s how the process works:

- Go to GOV.UK – Start on the official VAT registration page.

- Sign in to your Government Gateway account – Enter your user ID and password, or create an account if you don’t already have one.

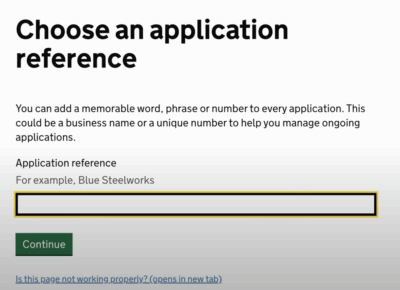

- Choose an application reference – Add a memorable reference (like your business name) to track your application.

- Select your business type – Choose whether you’re registering as a UK company, sole trader, partnership, or other.

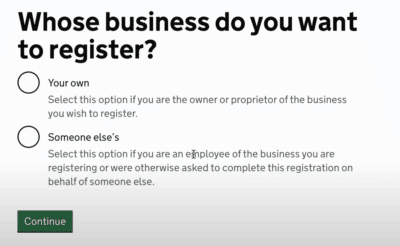

- Confirm whose business you’re registering – State whether you’re registering your own business or doing it on behalf of someone else.

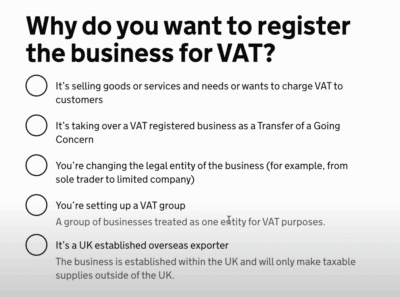

- State the reason for registration – Select why you’re registering (e.g. exceeding the VAT threshold, taking over a VAT-registered business, or exporting).

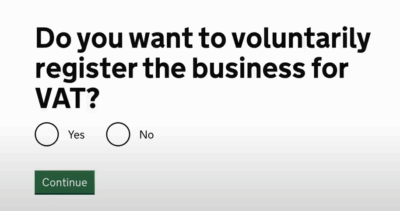

- Decide on voluntary registration – If you’re below the VAT threshold, choose whether to register voluntarily.

- Enrol for Making Tax Digital – Confirm that your business will keep digital VAT records and submit returns through compatible software.

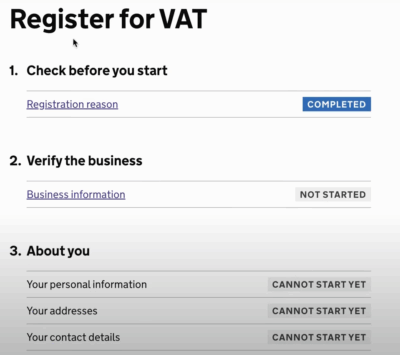

- Complete the registration sections – Work through the online form, entering your business details, personal information, addresses, and contact details.

- Submit your application – Send your VAT1 form to HMRC for review.

- Wait for your VAT number – HMRC will usually issue your VAT registration number and certificate within 2–4 weeks. (Learn more about VAT registration time for unusual cases.)

If you can’t register online, you may need to apply using a paper VAT1 form. This applies in some cases (when joining a group registration or applying for exemption).

Making Tax Digital for VAT-registered businesses

Once you’re VAT registered, you must keep digital VAT records and submit your VAT returns using Making Tax Digital compatible software. HMRC no longer accepts manual submissions. You’ll need accounting software or MTD bridging software that connect with your VAT online account through your Government Gateway.

5. What happens after VAT registration

Once HMRC approves your application, you’ll receive a VAT registration number and a VAT registration certificate. The certificate confirms your effective date of registration, when you must start charging VAT, and when your first VAT return is due.

From that date:

- Charge VAT on invoices – You must add VAT to the goods and services you sell, unless they’re zero-rated or exempt.

- Keep digital VAT records – All VAT-registered businesses must use Making Tax Digital compatible software to record transactions.

- Submit VAT returns online – Log in to your VAT online account through your Government Gateway to file each VAT return to HMRC.

- Reclaim VAT – You can reclaim VAT paid on eligible business purchases, which helps with cash flow.

If your business circumstances change, you can later apply for VAT deregistration or cancel your registration through GOV.UK.

| Creative Tip You can also claim pre VAT registration expenses going back 4 years for goods, and 6 months for services. |

6. WallsMan Creative helps businesses register for VAT

Registering for VAT can feel like another layer of admin on top of running a business, especially for small businesses and creative companies.

If you’d rather not deal with forms, deadlines, and HMRC paperwork, WallsMan Creative can take care of the process for you – from VAT registration to filing your VAT return. We make sure you stay compliant while keeping your focus on the work that really matters: your first call is FREE!