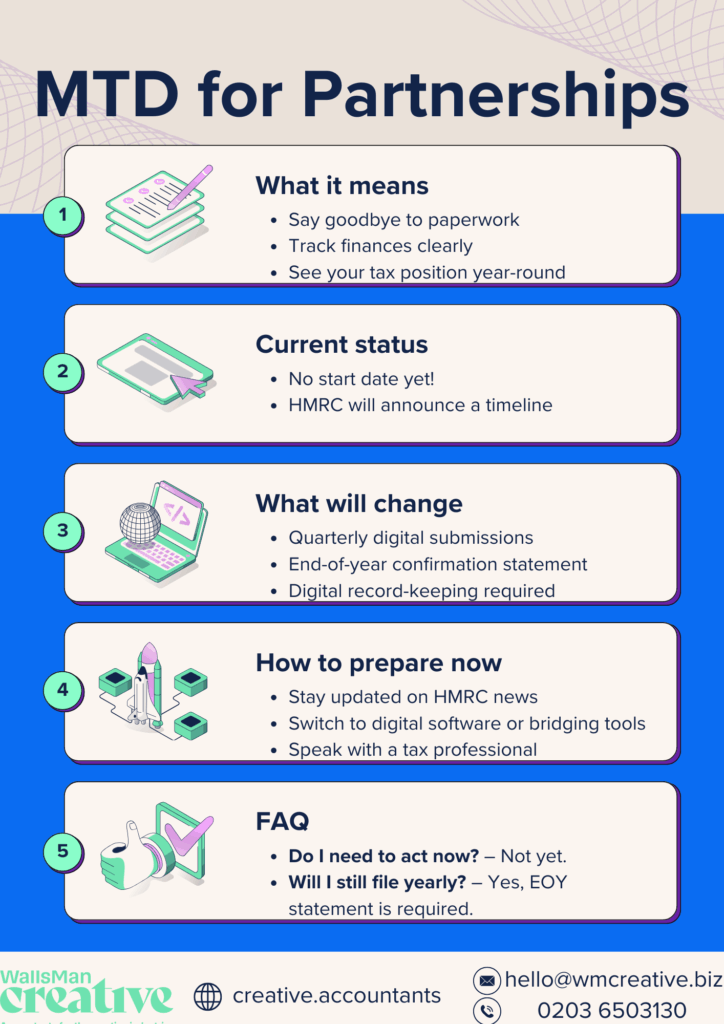

MTD for partnerships is HMRC’s initiative to simplify how partnerships report income tax.

Under Making Tax Digital, partnerships will be required to digitally record and submit financial updates quarterly. This changes the old method of submitting a single annual tax return.

The digital-first approach reduces common errors in tax reporting, and in HMRC’s hopes, it will improve accuracy, and streamline the tax process for partnerships overall.

What does MTD for partnerships mean?

Les manual paperwork, clearer financial tracking, greater visibility into your tax position throughout the year.

Creative Takeaways

- MTD for partnerships has no set start date yet, but HMRC plans to include them in the future.

- An end-of-year statement will still be required to confirm all quarterly updates.

- Partnerships should start preparing now by moving to digital record-keeping and considering MTD-compatible or bridging software.

- Current rules still apply – partnerships continue filing annual SA800 returns until MTD begins.

- HMRC will announce a specific compliance timeline later, so staying informed is key.

Table of contents

1. Check if your partnership needs to comply with MTD

As of now, HMRC has not mandated a specific start date for partnerships to comply with MTD.

It’s anticipated that partnerships will be required to adopt MTD for Income Tax in the future. According to HMRC, they will provide a timeline for this at a later date. For now, you can check out Making Tax Digital timeline on our website:

In the meantime, partnerships can prepare by:

- Staying informed about HMRC announcements regarding MTD timelines for partnerships.

- Evaluating current record-keeping practices and considering transitioning to digital systems.

- Consulting with tax professionals to understand potential future obligations under MTD.

For the last recommendation, you can book a FREE call with WallsMan Creative anytime: we’ll explain everything in simple terms – no accounting jargon!

2. What changes for partnerships at HMRC under MTD?

While specific requirements for partnerships under MTD have not been finalised, it’s expected that, similar to sole traders and landlords, partnerships will need to:

- Submit digital summaries of income and expenses quarterly to HMRC.

- Provide an end-of-year statement confirming these quarterly updates (regardless of submitting the quarterly reports).

- Maintain digital records that are accurate and readily accessible.

Knowing everything we now know about Making Tax Digital for Income Tax, adopting to these practices will likely necessitate the use of reliable accounting software. The best MTD software for your needs depends on what exactly looking for, whether you handle your own submissions, or work together with accountants.

| Creative Tip You can still use your spreadsheets, but in that case, you have to opt-in for a different type of software, so-called bridging software for MTD. |

3. FAQ about MTD for partnerships

Not currently. HMRC has indicated that partnerships will need to use MTD for Income Tax in the future, but a specific timeline has not been established.

Yes, partnerships are included in HMRC’s plans for MTD. The exact requirements and timelines will be detailed in future announcements.

Currently, partnerships file an annual partnership tax return (SA800) and provide each partner with a copy of their partnership statement. Under MTD, it’s anticipated that partnerships will need to submit quarterly digital updates and an end-of-year statement, but specific procedures will be clarified by HMRC in due course.

As of now, MTD for Income Tax is mandatory for sole traders and landlords with annual income over £50,000 from April 2026, and over £30,000 from April 2027. Partnerships are expected to be included in the future, with timelines to be announced.

4. Prepare for MTD easy with WallsMan Creative

Making Tax Digital is going to be a huge change in the UK tax reporting system. WallsMan Creative is here to assist.

We specialist in supporting UK-based creatives, partnerships, small & large businesses with accountancy problems. Book a free call with us now, and ensure a seamless transition to digital tax processes.

From selecting the right accounting software to training your staff, WallsMan Creative offers comprehensive support every step of the way.

PS. WallsMan Creative’s Making Tax Digital Guide is one of the best resources to be up-to-date with everything related to MTD. Make sure to check it out from time to time!