Making Tax Digital for Income Tax & VAT – Guide to MTD

What is Making Tax Digital: Everything You Need to Know About MTD

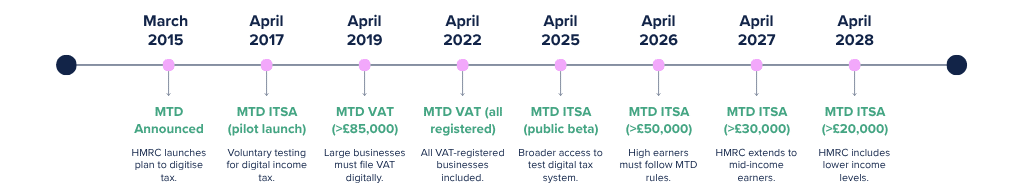

Making Tax Digital is a long-term HMRC initiative designed to move the UK tax system from paper-based processes to digital reporting.

Making Tax Digital (MTD) is already live for VAT-registered businesses. MTD for Income Tax (MTD ITSA) will be introduced in phases from:

- April 2026 for self-employed and landlords earning over £50,000

- April 2027 for those earning £30,000–£50,000

- April 2028 for those earning over £20,000

The digital change means that you must:

- send quarterly updates to HMRC instead of one self-assessment return per year

- use MTD-compatible software

- keep digital records of your business income and expenses

Don’t let these rules scare you! Schedule your free call or reach out via email at [email protected].

Making Tax Digital Webinar

You’ve just read what MTD is – now watch our Making Tax Digital webinar for the full breakdown!

Making Tax Digital Timeline

What is Making Tax Digital for VAT?

Making Tax Digital for VAT is the first phase of the government’s digital tax programme.

It requires VAT-registered businesses to keep digital records and submit VAT returns using compatible accounting software.

If your business is VAT-registered, MTD for VAT already applies – regardless of turnover.

In practice, this means no more manual VAT spreadsheets or typing figures directly into HMRC’s portal.

What is Making Tax Digital for Income Tax?

MTD for Income Tax Self Assessment (MTD ITSA) is the next big change.

It will apply to self-employed individuals and landlords once their total relevant income reaches HMRC’s threshold.

Under MTD ITSA, you will need to:

- Keep digital records of income and expenses

- Send quarterly updates to HMRC through approved software

- Submit an End of Period Statement (EOPS) and a Final Declaration each year (replacing the current Self Assessment tax return)

It’s a new form of Self Assessment, broken into smaller, more frequent digital submissions.

How Making Tax Digital Works in Practice

1. You keep your records digitally

2. Your software connects directly to HMRC

3. You send submissions quarterly

Frequently Asked Questions About Making Tax Digital

Making Tax Digital is a UK government initiative to modernise the tax system by requiring certain taxpayers to keep digital records and submit tax data electronically. A common abbreviation for Making Tax Digital is MTD.

You have to use authorised software to record income and expenses digitally, then send regular updates (usually quarterly) to HM Revenue & Customs (HMRC), instead of doing a single paper or online return once a year. You still need to submit an end-of-year, final declaration under MTD.

MTD for VAT applies to all VAT‑registered businesses, while MTD for Income Tax (ITSA) will apply in phases: from April 2026 for those earning over £50,000; from April 2027 for those above £30,000; and from April 2028 for those earning over £20,000.

You need to keep digital records of all income and expenses related to your self-employment or property business (invoices, rent received, repairs and maintenance, allowable expenses).

A digital record is any record stored in electronic format using MTD-compatible software (or bridging software) that HMRC can access — rather than paper receipts or ledgers.

No. Under MTD, you must submit your returns via HMRC‑approved accounting or bridging software rather than using the HMRC portal.

Yes. Each sole-trade business or property business must keep its own set of digital records and submit its own quarterly updates under MTD.

If you’re a landlord subject to MTD, you’ll use software to track rental income and allowable expenses, submit quarterly summaries to HMRC, and then complete a final declaration at year end instead of a traditional annual Self Assessment return. There are dedicated software for Making Tax Digital for landlords.

You need MTD-compatible software such as accounting platforms like Xero, QuickBooks, or Sage, or bridging software if you prefer spreadsheets.

Yes. You can change MTD-compatible software at any time. Just make sure the new software is properly connected to HMRC before your next quarterly submission.

Yes, you can still use spreadsheets, but only if they are connected to HMRC via bridging software to ensure compliance.

MTD for VAT is already mandatory. For ITSA, the roll‑out schedule is: April 2026 (£50k+), April 2027 (£30k+), and April 2028 (£20k+).

Quarterly update deadlines typically fall end-of-quarter plus about one month (e.g. 7 August, 7 November, 7 February, 7 May), with a final declaration and payment by 31 January after tax-year end.

Failing to comply with MTD requirements may result in HMRC applying penalties under its new points-based system. Each missed deadline adds a penalty point. Once a threshold is reached, a financial penalty will be charged, and HMRC may also apply interest on any late payments.

Yes. If your qualifying income is below the threshold; or if you are “digitally excluded” (e.g. lack of digital access, disability, remote location, etc.), you can apply for an exemption.

Yes. VAT returns remain quarterly, while ITSA introduces quarterly updates with a final annual declaration instead of the traditional Self-Assessment.

You must register via the HMRC website and authorise your chosen MTD-compatible software to connect and submit on your behalf.

MTD helps reduce errors, streamlines record-keeping, strengthens real-time visibility of tax liabilities, and makes the tax process more efficient overall.

Yes. MTD began with VAT-registered businesses and is expanding to income tax for self-employed and landlords. The digitalisation model may be extended further over time. However, there's no deadline yet for partnerships or Corporation Tax.

Yes. Accountants and tax agents can manage your MTD digital records and submit quarterly updates and the final declaration for you, as long as they’re authorised through HMRC.

Still haven’t decided? No worries!

Browse our blog posts here:

Our Making Tax Digital Guides

What Making Tax Digital Means for Accountants & Bookkeepers

MTD fundamentally shifts the workload pattern for accountants and bookkeepers:

- More frequent client touchpoints

Quarterly updates mean you’ll be supporting clients throughout the year, not just at year-end. - More emphasis on clean, real-time bookkeeping

Because submissions happen often, books need to be accurate and up-to-date continuously. - Stronger reliance on digital software

Advisory now includes helping clients choose, set up, and use MTD-compatible tools. - Opportunities for new service packages

Quarterly review services, software onboarding, MTD compliance checks, training sessions, and outsourcing of bookkeeping become much more valuable. - Less manual work, more advisory

Since software does the heavy lifting, accountants can spend more time on forecasting, tax planning, and strategic support.

Official Links for Making Tax Digital

Looking for the essentials on Making Tax Digital?

This section pulls together key links from HMRC to help you get things done.

Whether you need to sign up for MTD, check if your business qualifies, or find compatible software, it’s all here in one place.

Get direct access to what matters.

Keep this list handy as deadlines approach or if you need to double-check any requirements.