Making Tax Digital for self-employed means you keep business records and submit tax information using digital tools instead of paper forms.

The government set up this system to reduce mistakes and help you keep on top of your tax.

Making Tax Digital for self-employed changes a few things about tax reporting. You use MTD software to track your income and costs, and you send updates online to HMRC during the year. Not just once at the tax year’s end!

With your figures updated every quarter, you have a clearer picture of your business and your tax as you go. Digital records are quicker to manage and reduce the risk of errors that happen with paper records.

Most of you will fall under new rules with Making Tax Digital for self-employed – unless you get permission from HMRC to opt out!

Creative Takeaways

- Making Tax Digital (MTD) will replace paper tax submissions for the self-employed.

- Quarterly updates to HMRC will replace the single annual return.

- You must use MTD-approved software to record and send your business income and expenses.

- The rollout starts April 2026 for self-employed earning over £50,000, and April 2027 for those earning £30,000–£50,000.

- Keeping digital records reduces errors, avoids penalties, and gives a clearer view of tax as you go.

Table of contents

1. Making Tax Digital self-employed timeline: April 2026

There are key dates that self-employed people must keep in mind for Making Tax Digital.

These dates explain when you need to start keeping digital records and sending information to HMRC using approved MTD-compatible software.

The full rollout of Making Tax Digital for self-employed is planned to begin from April 2026.

- If you’re self-employed and your total income from self-employment or property is above £50,000 a year, you will need to follow the rules from April 2026.

- If your income is between £30,000 and £50,000, you will need to follow the rules from April 2027.

- The government may announce future dates for those with lower income, but so far, only these two thresholds have been set.

Under Making Tax Digital, you need to send quarterly updates to HMRC showing your income and expenses for each period.

Now → April 2026 (income over £50,000: start MTD) → April 2027 (income £30,000-£50,000: start MTD) → Ongoing (quarterly updates, annual declaration, penalties, updates for lower incomes)

2. How to set up Making Tax Digital for self-employed people

To use Making Tax Digital for self-employed, you need to prepare before your start date.

First, gather your personal and business details. You will need your National Insurance number, business name, business address, and your Government Gateway user ID. Have these details ready before you begin.

Next, choose MTD-compatible software approved by HMRC. This software will keep your digital records and send your tax updates.

Now, create or use your existing Government Gateway account. You can register for Making Tax Digital by logging in and following the steps to sign up as a self-employed business. This process links your business information to the digital system. Your software will guide you through this step.

Once you are signed up, start entering your business income and expenses into your MTD software. Update your digital records as you go. The system will prompt you to submit reports every three months.

At the end of the tax year, you’ll submit a final declaration.

If you are moving from paper records, set aside time to move your information into the digital system. If you need help, most software providers offer guides or customer support. Or, you can reach out to an accountant to handle your taxes for you.

3. Digital requirements to replace self assessment

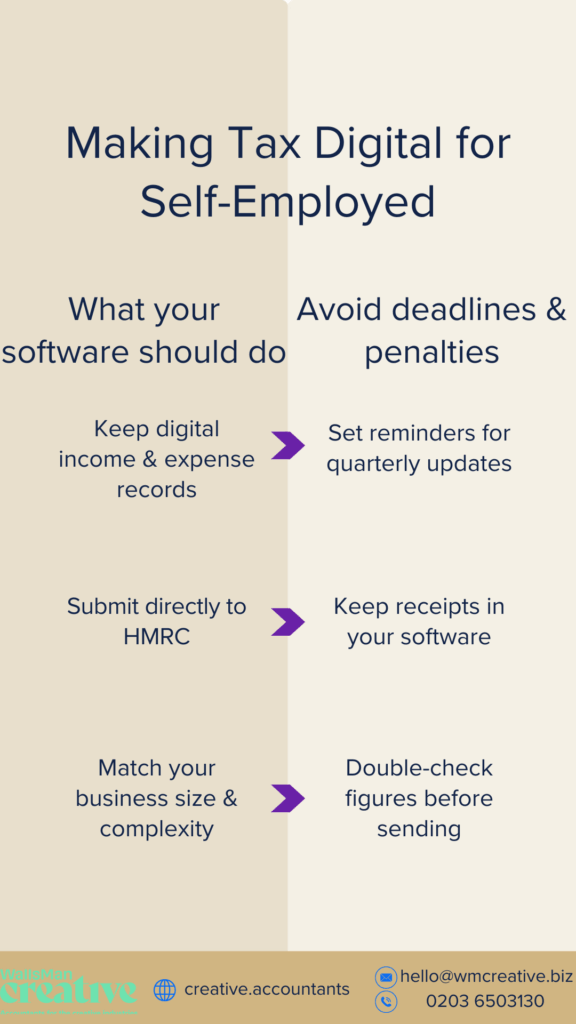

Choosing good software is a key part of Making Tax Digital for self-employed. Your software should be compatible with HMRC. It must let you keep digital records and send updates directly to HMRC.

Look for software that matches the size and type of your business. Many self-employed people want simple tools for tracking income and expenses, creating invoices, and storing receipts.

Some tools offer mobile apps, some only have desktop versions. If you’re more on-the-go, opt in for one with a good app,

Some of the most popular options include Xero (our recommendation), QuickBooks and FreeAgent.

All of these choices are popular, easy to set up, and support automatic updates to HMRC. Make sure you look for clear pricing and check if the software has a free trial, if you want to try it before committing.

If you only have a few transactions, you can pick a low-cost or basic solution. If your finances are more complex, choose a program with extra features: bank feeds and advanced reporting come in handy in these cases.

Make sure your chosen software is on HMRC’s list of recognized products. If you already use accounting software, check if you can add MTD features, or if you’ll need to switch.

| Creative Tip Test your software before your first quarterly update. Use the help sections and guides your provider offers. |

4. Sign up for Making Tax Digital (MTD) with WallsMan Creative

Our advice: start using digital records as soon as you can.

This gives you time to get used to your software before you have to submit your first update. Enter your income and expenses as they happen to prevent mistakes and make quarterly updates easier.

Set reminders for your quarterly deadlines. Missing a submission can lead to penalty points, so put dates in your phone or calendar. (Some software will send reminders too.)

Keep copies of your receipts and key documents in your software, not just in a box or drawer. Digital records are easier to find and safer from loss.

Check your figures before you send any updates to HMRC. Fixing small mistakes early is much better than dealing with problems at the end of the tax year.

If you’re unsure about the rules, find help early!

If your business is growing or your finances are complicated, it can help to speak to an accountant who understands MTD.

Ready for Making Tax Digital?

Reach out to WallsMan Creative, and let us explain all the changes you have to make for MTD!