EIS stands for Enterprise Investment Scheme. SEIS stands for Seed Enterprise Investment Scheme. Both are tax relief schemes from the UK government and both help small businesses raise money from private investors.

But, what’s the difference between EIS and SEIS?

SEIS is for very new businesses. EIS is for slightly bigger startups, but still early in their growth.

These schemes reduce the risk for investors: in return for putting money into a company, investors can get some of their income tax back. If the company fails, they can still claim back part of their loss.

Creative Takeaways

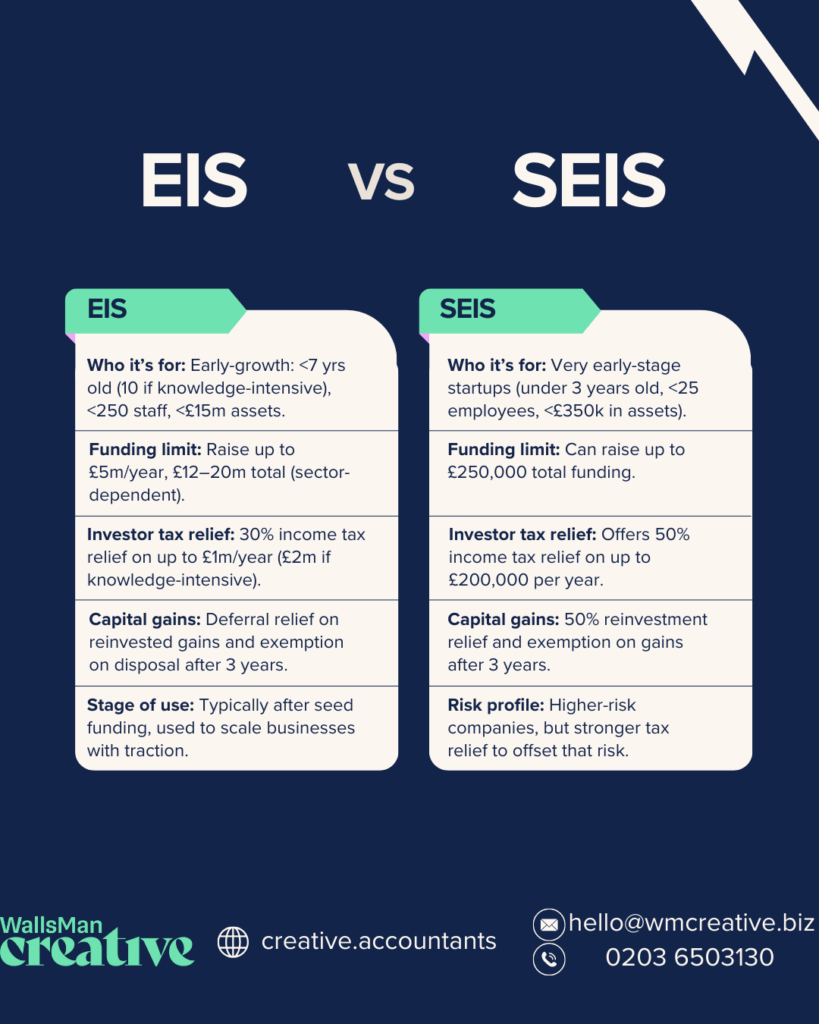

- SEIS is for very early-stage startups (under 3 years old, <25 employees, <£350,000 assets) and allows raising up to £250,000 with 50% investor income tax relief.

- EIS is for early-growth companies (under 7–10 years old, <250 employees, <£15 million assets) and allows raising up to £5 million per year (£12m total) with 30% investor income tax relief.

- SEIS investors can invest up to £100,000 per year, while EIS investors can invest up to £1 million (£2 million for knowledge-intensive companies).

- Both schemes offer capital gains tax exemptions after 3 years and loss relief if the company fails, but only EIS provides capital gains deferral relief.

- Many startups combine SEIS and EIS sequentially: starting with SEIS for pre-seed/seed rounds, then moving to EIS for scaling.

Table of contents

1. Seed Enterprise Investment Scheme (SEIS) explained

SEIS is a tax relief scheme that helps very early-stage UK companies raise money. Why is it useful for investors?

Because it gives them strong tax breaks to make backing new businesses less risky.

A company can raise up to £250,000 through SEIS.

To qualify, your company must be less than three years old, have fewer than 25 employees, and hold less than £350,000 in total assets. Your company must also carry out a qualifying trade, so some sectors (e.g. finance and property development) are excluded.

What about investors?

SEIS offers up to 50% income tax relief on investments of up to £100,000 per year. If the shares are held for at least three years, any gains made on the sale are free from capital gains tax. If the company fails, investors may claim loss relief.

Most of the time, SEIS is used at the pre-seed or seed stage, when a business is just getting started. The founders then secure their first outside investment, and early supporters get a financial reason to get involved.

We’ve written a separate blog post that goes into SEIS in more detail. Read more about it if you’re interested.

2. Enterprise Investment Scheme (EIS) explained

EIS is a tax relief scheme for early-stage businesses that are slightly more developed than those using SEIS.

It helps these companies raise larger amounts of funding from private investors by offering tax relief.

Through EIS, a company can raise up to £5 million per year, and up to £12 million in total.

To qualify, your business must be less than seven years old (or ten if it’s in a “knowledge-intensive” sector), have fewer than 250 employees, and less than £15 million in gross assets. Like SEIS, the company must carry out a qualifying trade.

Investors can claim up to 30% income tax relief on investments of up to £1 million per year, or £2 million if they invest in knowledge-intensive companies. If shares are held for three years, any gains are free from capital gains tax.

Investors may also defer capital gains from other assets if they invest those gains through EIS.

EIS is generally used after a company has already raised a seed round and is looking to grow.ó

We also covered EIS in more detail in a separate blog post.

3. Key differences between SEIS and EIS

By now, you probably understood that EIS and SEIS are similar in purpose: they both help early-stage businesses raise funding and offer tax relief to investors.

But there are some key difference between the two schemes:

- who they are for

- how much can be raised

- the type of investor they attract

- the benefits they offer.

The biggest difference is the stage of the business.

SEIS is for very early-stage startups, usually raising their first external funds. These companies are pre-revenue most of the time, with small teams and limited assets.

EIS is for businesses that are a bit more established. Perhaps they already have a working product, some revenue, or early traction.

Another key difference is the amount of money a company can raise.

SEIS allows up to £250,000 in total, while EIS allows up to £5 million per year and £12 million overall.

The tax relief is also different. SEIS offers 50% income tax relief, while EIS offers 30%. SEIS investors can only invest up to £100,000 per year and still get full relief. EIS investors can invest up to £1 million per year, or £2 million in certain cases.

Loss relief works in both schemes, but because SEIS is for riskier businesses, the higher relief rate helps offset that risk. EIS provides capital gains deferral relief, which SEIS does not.

EIS companies can be older – up to seven or ten years old. SEIS is only available to companies less than three years old. The number of employees and asset limits are also lower for SEIS.

This is a lot, right? We’ve complied everything into a comparison table:

| Feature | SEIS | EIS |

|---|---|---|

| Company age limit | Less than 3 years | Less than 7 years (10 for knowledge-intensive companies) |

| Maximum amount raised | £250,000 total | £5 million per year (£12 million total; £20 million for knowledge-intensive companies) |

| Maximum investor relief per year | £200,000 | £1 million (£2 million for knowledge-intensive companies) |

| Income tax relief | 50% | 30% |

| Capital gains tax relief | 50% reinvestment relief; exemption on disposal after 3 years | Deferral relief on reinvested gains; exemption on disposal after 3 years |

| Loss relief | Yes | Yes |

| Minimum holding period | 3 years | 3 years |

| Employee limit | Fewer than 25 | Fewer than 250 (500 for knowledge-intensive companies) |

| Gross asset limit | £350,000 | £15 million |

| Stage of business | Very early-stage / pre-seed | Early growth / seed to Series A |

4. Which scheme to choose: SEIS vs EIS

Choosing between EIS and SEIS depends on where your company is right now and how much funding you need.

To help you decide, here are a few example scenarios that show how each scheme fits different stages of growth – based on our experience with clients.

Starting out, building product – eligible for SEIS

You’ve recently set up your company. It’s just you and a co-founder, and maybe a few freelancers. You’re working on your first version of the product. You don’t have revenue yet, but you need £100,000 to get things off the ground.

SEIS is the best option here. You’re well within the age, size, and funding limits. Investors will like the 50% income tax relief, which makes it easier for you to raise money at this early and risky stage.

Launched and ready to grow – EIS fund available

Your product is live. You’ve signed your first few customers. You’re generating some revenue, and you’re ready to hire a small team.

You want to raise £500,000 to expand.

EIS fits this situation better. You’ve outgrown SEIS, and you’re looking to scale. EIS allows you to raise much more, and investors still get 30% tax relief. Plus, other benefits like capital gains deferral.

Apply for SEIS and EIS?

You raised £150,000 under SEIS last year. You hit your early targets and now need £750,000 to take your business further.

It’s possible that you have first applied for SEIS, but now you can raise under EIS. Many startups follow this route.

The two schemes can work together, not against each other!

5. Get started with Advance Assurance

Although the process of applying for SEIS and EIS is straightforward, it’s not that simple as it seems.

Before raising money under SEIS or EIS, most investors will ask if you have Advance Assurance from HMRC.

What is advanced assurance?

This is a letter that says your company is likely to qualify for the scheme. It’s not a guarantee, but it gives investors confidence that they’ll get the tax relief.

To get advance assurance, you’ll need to provide some information about your business:

- plans for the investment

- company structure.

HMRC reviews this, and usually responds within a few weeks.

Getting advance assurance early can speed up fundraising. It shows you’re prepared and makes your offer more attractive to investors.

If you don’t have it, many investors simply won’t consider your pitch. That’s why it’s one of the first steps founders take when preparing to raise under SEIS or EIS.

We have a dedicated page that explains the advance assurance process in more detail. And if you hesitate, feel free to reach out!

6. How WallsMan Creative helps with EIS and SEIS

At WallsMan Creative, we’ve now spent over a decade working with creatives and businesses across the creative industries – film, design, fashion, music, digital media etc. We understand the unique challenges you face when raising investment and deciding between SEIS and EIS.

To us, it doesn’t really matter if you’re a solo founder preparing your first raise or a creative agency looking to scale, we can help you.

We’ve supported clients in securing advance assurance, came up with investor-ready materials, and we definitely understand how each scheme fits into broader funding strategies.

We don’t just know the rules. We know how they apply to creative businesses in the real world.

If you’re looking for straightforward, experienced support with EIS or SEIS, we’re here to help you make the right decision.