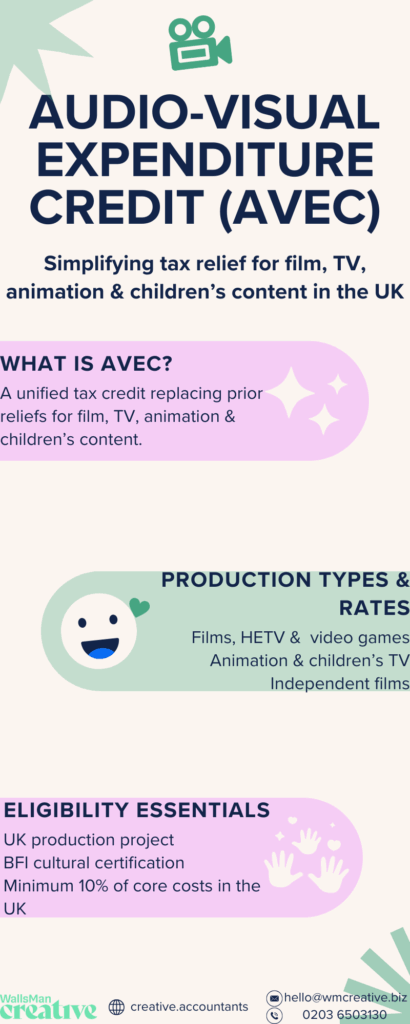

The Audio-Visual Expenditure Credit (AVEC) is a tax credit for UK film, TV, and animation productions.

With Audio-Visual Expenditure Credit, production companies can get money back from HMRC for some of their UK production costs. The amount depends on the type of work they’re doing.

AVEC replaces several older tax reliefs that creative businesses have used for years:

- Film Tax Relief

- High-End Television (HETV) Tax Relief

- Children’s Television Tax Relief

- Animation Tax Relief

These reliefs closed to new productions on 1 April 2025, and will be close for all productions on 1 April 2027. These schemes helped many companies, but the rules could be hard to follow and slower to process. AVEC applies instead to all qualifying productions from that point.

AVEC’s main goal is to keep the UK attractive for production work, to support British-made content and ultimately, to make claiming easier. Apart from replacing previous tax reliefs, some independent films and VFX-heavy projects can claim a higher rate.

Creative Takeaways

- AVEC is a UK tax credit for film, TV, animation, and children’s productions, designed to support creative sector funding.

- You can claim for core UK production costs like filming, editing, VFX, staff wages, and studio hire – but not for marketing or overseas work.

- Depending on the production type, you can get back between 34% and 53% of eligible UK spend through AVEC.

- To claim, apply for BFI certification and submit your records, accountant’s report, and Company Tax Return (CT600) to HMRC.

Table of contents

1. Who can claim AVEC? – Industry breakdown

To claim the Audio-Visual Expenditure Credit, your company must be responsible for the production and must be within UK Corporation Tax. You need to have a UK company set up to manage the project and handle all key stages. This includes contracts and payments.

Below are the types of productions that can qualify and what the rules look like for each.

AVEC for Film

- Your company must be responsible for making the film, not just providing services.

- The film must be intended for cinema release.

- At least 10% of the core costs must be spent in the UK.

- You’ll need a cultural certificate from the BFI (British Film Institute).

- Both live-action and animated films can qualify.

AVEC for High-End Television (HETV)

- The TV programme must be drama, comedy or documentary — not variety or reality.

- The average cost per broadcast hour must be at least £1 million.

- The minimum slot length is 30 minutes.

- At least 10% of the core costs must be spent in the UK.

- The programme must be intended for broadcast on TV or a streaming platform.

- A cultural certificate from the BFI is required.

AVEC for Animation

- The work must be mainly animated — at least 51% of the content.

- It must be intended for broadcast or online viewing.

- At least 10% of the costs must be spent in the UK.

- A BFI certificate is needed to show it meets cultural standards.

- Both children’s and adult animation can qualify.

AVEC for Children’s TV

- The programme must be made for children under 15.

- It must not be a game show, chat show or similar.

- The content must be educational, entertaining or both.

- At least 10% of the production costs must be UK-based.

- A cultural certificate from the BFI is also required here.

| Creative Tip Independent UK films with budgets up to £15 million can claim a higher tax credit rate of 53% through the Independent Film Tax Credit (IFTC). They have to meet specific criteria: having a UK writer or director and obtaining BFI certification. |

2. What costs can you claim under AVEC?

After listing all the industries for which you can claim the audio-visual expenditure credit, it’s time to know more about what costs qualify under AVEC.

AVEC lets you claim back some of the money you spend making your production.

These are called “core costs.”

To count, the costs must be part of the actual making of the film or show. This includes things like planning, filming, and editing.

You can only claim for costs spent in the UK. You must spend at least 10% of your total production costs here to qualify.

Confused yet? No worries!

Let’s take a look at what you can claim here:

- Staff wages during filming and editing

- Equipment hire

- Studio hire

- Set building and design

- Post-production work like sound, editing, and visual effects

- Insurance for the shoot

- Location costs in the UK

That’s a lot, right?! But there are some expenses you can’t claim for:

- Development work before the project is approved

- Costs for marketing or distribution

- Legal or finance work that’s not part of production

- Work done outside the UK

What happens if part of a cost is UK-based and another part is not? You can only claim the UK part.

That’s why it’s important to keep clear records of everything you spend, so it’s easy to show what counts. You’ll need to have all of these details in your claim to HMRC.

3. How much can you claim with AVEC in the creative sector?

It’s easy to understand what you can claim with AVEC, but it’s a bit more complex answering the question of: how much can you claim through the audio-visual expenditure credit in the creative sector?

The amount you can claim depends on the type of production and some specific criteria. Let’s take a look!

Standard AVEC rates

- Film and High-End TV: You can claim 34% of your UK-based production costs. After accounting for corporation tax, this equates to a net benefit of 25.5%

- Animation and Children’s TV: These productions are eligible for a higher rate of 39%, resulting in a net benefit of 29.25% after tax

Independent Film Tax Credit (IFTC)

Already mentioned in our Creative Tip section, independent films with budgets up to £15 million, a higher credit rate of 53% is available.

This higher credit rate results in an approximate of 39.75% net benefit after tax. But to qualify, there’s more you have to do as the film must pass specific criteria. You can learn more about IFTC by reading the HMT-HMRC policy note.

Visual Effects (VFX) Bonus

From 1 January 2025, productions with a lot of UK visual effects work can claim 39% back on those costs. The usual 80% spending limit doesn’t apply to VFX done in the UK.

These rates are all made to support the different categories of the creative industry.

4. How to claim AVEC: step-by-step guide

Just as in other cases for EIS or SEIS, we also put together a step-by-step guide on how to claim AVEC this time.

Check if you qualify

- Your company must be in the UK and pay Corporation Tax

- Your project must fit into one of the four AVEC types

- At least 10% of your main costs must be spent in the UK

Get your BFI certificate

- Apply to the British Film Institute for a cultural certificate

- You can get a temporary one during production or a final one when finished

- This shows your project meets UK cultural requirements

Get your paperwork ready

- Keep good records of all money spent in the UK – something that we as accountants for the creative industry always advocate for

- Have an accountant prepare and sign a report

- Make sure UK and non-UK costs are clearly separated

Send everything to HMRC

- Submit your claim through your Company Tax Return (CT600)

- Include your BFI certificate and accountant’s report

- Make a final claim when your project is done

- You can also make an early claim if needed

5. Key differences between AVEC and previous creative tax reliefs

Older creative tax relief systems are different than Audio-Visual Expenditure Credit. It’s a change that sole-traders and small businesses need to get used to, but we can hope that all it does is help the creative sector.

Since the older creative industry taxes are still present and will be in effect until 2027, it’s good to have a comparison between them and AVEC.

| Feature | Previous Tax Reliefs | Audio-Visual Expenditure Credit (AVEC) |

|---|---|---|

| Structure | Multiple separate schemes (Film, HETV, Animation, Children’s TV) | Single unified system covering all categories |

| Calculation Method | Based on enhancing qualifying expenditure | Direct credit against qualifying UK expenditure |

| Rates | Varied across different relief types | Standardized rates (34% for Film/HETV, 39% for Animation/Children’s TV) |

| Special Provisions | Limited additional benefits | New Independent Film Tax Credit (53%) and VFX Bonus (39%) |

| Claiming Process | Different processes for each relief | Streamlined single application system |

| Accessibility | Complex rules that smaller companies found difficult | Designed to be more straightforward for all company sizes |

| Expiration | Closing to new productions on 1 April 2025 | Currently active with no set end date |

AVEC consolidates everything into a streamlined approach. Just as AVEC pays attention to different sectors, you as a company director or sole-trader also have to focus on many things.

The thing is, you don’t have to understand these changes alone.

At WallsMan Creative, we specialise in helping creative companies maximise their tax benefits and we ensure full compliance with HMRC requirement. (We don’t want to brag, but just check the reviews on our Google Business Profile 😉 )

Ready to optimise your AVEC claim? Book your free one-hour consultation with our creative industry specialists today.