As a self-employed or a freelancer, you can lower your tax bill by claiming self assessment expenses. These are the costs you pay to run your business.

HMRC lets you subtract these from your income to figure out how much tax you owe.

But there’s a catch: the expense has to be used wholly and exclusively for your work. That means if something is partly personal, like your mobile phone, you can only claim the work portion.

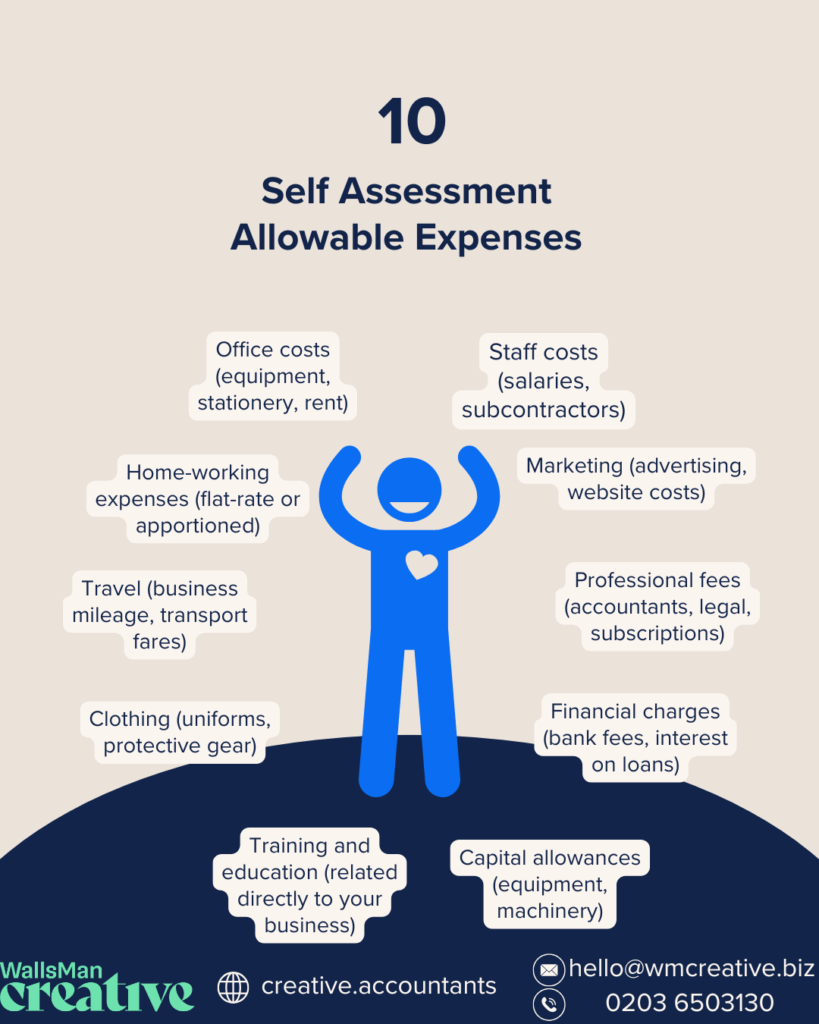

Self assessment allowable expenses are:

- Office costs (equipment, stationery, rent)

- Home-working expenses (flat-rate or apportioned)

- Travel (business mileage, transport fares)

- Clothing (uniforms, protective gear)

- Staff costs (salaries, subcontractors)

- Marketing (advertising, website costs)

- Professional fees (accountants, legal, subscriptions)

- Financial charges (bank fees, interest on loans)

- Training and education (related directly to your business)

- Capital allowances (equipment, machinery)

For example, if you made £40,000 and spent £10,000 on allowable expenses, you’d only pay tax on £30,000. It’s simple maths, and it adds up fast, so you can save thousands in taxes.

Key Takeaways

- Self assessment allowable expenses help you significantly cut your tax bill – make sure all your costs are strictly business-related.

- When working from home, choose between claiming the simplified flat rate or a detailed calculation based on actual household expenses.

- Use the Annual Investment Allowance (AIA) wisely to deduct capital purchases like studio gear and essential business equipment.

- Keep your finances clear and organised by maintaining separate business accounts, tracking expenses diligently, and holding onto your receipts.

Table of contents

- 1. Claim self assessment allowable expenses working from home

- 2. Claim capital allowances: big-ticket items you can write off

- 3. Allowable business expenses for landlords and creative spaces

- 4. Claim business staff expenses

- 5. Most common other expenses: what’s allowed vs what’s not

- 6. Simplified expenses with easy business banking solutions

- 7. VAT claims: what you can and can’t claim

- 8. How to claim business expenses as a sole trader

- 9. Stay organised and let WallsMan Creative handle the rest

1. Claim self assessment allowable expenses working from home

You might be missing out on money you could keep.

If you use your home as your main workspace, you can claim self assessment allowable expenses working from home to cut your tax bill.

There are two ways to do this.

Flat rate method for WFH

If you work from home for 25 hours or more each month, HMRC lets you claim a fixed amount – no receipts needed. It’s simple and suits people with low running costs:

- 25 to 50 hours: £10 per month

- 51 to 100 hours: £18 per month

- 101 hours or more: £26 per month

Apportioned costs method for WFG

This takes a bit more effort, but it often saves you more.

You work out what share of your home expenses (rent, electricity, gas, broadband, mortgage interest, etc.) relates to your work.

So, if you use one room out of five, you might claim 20% of the bills, depending on how often you use it.

Say you’re a filmmaker editing in a spare bedroom. You use that room five days a week for work. That’s a legitimate workspace. You can claim a portion of your household costs against your income.

We have a dedicated blog post on how you can claim expenses if you work from home – go check it out!

2. Claim capital allowances: big-ticket items you can write off

Some expenses are too big to count as day-to-day running costs.

If you buy equipment like cameras, laptops, instruments, or editing kits, these are classed as capital items.

Instead of spreading the cost over several years, you can claim the full amount in one go using what’s called the Annual Investment Allowance (AIA).

The AIA lets you deduct up to £1 million of qualifying purchases from your taxable profit each year.

This applies to most items you buy to keep and use in your business, rather than items you buy to sell.

For example: if you spend £5,000 on a high-end camera for commercial shoots, that cost can be claimed under AIA and knocked off your income for that year.

This kind of claim falls under self assessment other expenses and capital allowances.

If your accounting period is less than 12 months, the Annual Investment Allowance (AIA) limit is reduced proportionally.

Let’s say your accounting period is 6 months long. Your AIA limit would then be:

£1,000,000 × 6/12 = £500,000

That means you could claim up to £500,000 in qualifying capital purchases for that shorter period.

Make sure you keep detailed records of what you bought, when, and how you use it. Only equipment used for business counts, not personal gear!

3. Allowable business expenses for landlords and creative spaces

If you own property or rent space for your business, you can claim back some of those costs as self assessment allowable property expenses.

The rules depend on how you use the space and what type of costs you’re claiming.

Deductible expenses for landlords

For landlords, the most common deductible expenses include property repairs, letting agent fees, insurance, and utility bills paid by you, not the tenant.

It’s important to distinguish between repairs and replacement, and revenue and capital expenses:

- Replacement of domestic items – those that already exist on the property – are allowed (new microwave, fridge, or a bed that’s the same as the old one).

However…

- Only replacement of existing items is an allowable expense. A first-time purchase isn’t deductible.

So, replacement of domestic items is a revenue expense.

But what about repairs of capital items?

- A replacement of a roof or windows are not deductible expenses as capital expenditure is not allowed in rental income calculations.

As such, improvements or significant repairs of capital items are a capital expense.

Capital Expenditure is allowed when you’re selling the property, and you’re calculating capital gains, resulting in less capital gains tax liability. This creates a huge potential to save in taxes.

Deductible expenses for creative studios

If you’re a creative renting a studio or desk in a co-working space, those rent payments count too. Shared workspace fees, light and heat, and business insurance are all valid if you’re using them for work.

Mortgage interest can sometimes be claimed, but not the full mortgage payment. Only the interest part may qualify, and only if you’re renting out the space or using it for your business.

Instead of mortgage interest being an expense, a domestic property relief is given by HMRC to landlords paying mortgage and renting out. It is 20% on the total amount of mortgage interest paid for the year you are calculating your taxable income. This isn’t an expense, but a reduction in calculated tax liability.

Let’s say that after all income and expenses, you calculate that you owe £1000 in taxes. Your mortgage interest for the year is £3k x 20% = £600 deduction from your tax bill. Thus, the tax left to pay is -£400.

If the property is your home, you’ll need to apportion the costs carefully based on use – as mentioned earlier!

4. Claim business staff expenses

If you’re a sole trader and employ others (because that’s a thing, too!) to help run your business, many of those costs can be claimed as self assessment allowable expenses.

Just make sure the costs are strictly business-related.

You can claim for:

- Employee and staff salaries

- Bonuses and performance-based pay

- Employer pension contributions

- Benefits provided to staff (e.g. health cover)

- Fees paid to recruitment agencies or temps

- Payments to subcontractors

- Employer’s National Insurance contributions

- Training courses that help staff do their current job

These are all part of your running costs and are considered allowable by HMRC.

The key test is whether these costs support your business or your personal life. So, you cannot claim for carers or domestic help (nanny or a cleaner), or for any payments that aren’t directly linked to business activity.

As always, it is recommended to keep records for everything, so your claims are clear and easy to justify.

5. Most common other expenses: what’s allowed vs what’s not

Some business expenses feel obvious.

Others sit in a grey area. HMRC expects you to only claim costs that are clearly tied to your business, so you must not mix personal and work use.

Let’s check the most common categories people ask about when figuring out their self assessment allowable expenses.

Subsistence vs entertainment

Food costs are tricky. The difference is whether the meal is part of your job or part of your social life.

| ✅ Allowable | ❌ Not Allowable |

|---|---|

| Meals while working away from home (if the primary purpose is business) | Meals with clients as a gesture of good will |

| Food during overnight business trips | Drinks at networking events or social gatherings |

Rent vs mortgage repayments

If you work from home or rent a separate space, you may be able to claim a portion of the cost.

| ✅ Allowable | ❌ Not Allowable |

|---|---|

| Rent for a studio or co-working space | Mortgage capital repayments |

| Share of rent or mortgage interest for a home workspace | Entire household rent if the space isn’t used exclusively for business |

Subscriptions: what counts

Only subscriptions used directly for your work count.

| ✅ Allowable | ❌ Not Allowable |

|---|---|

| Adobe Creative Cloud | Netflix |

| Shutterstock | Spotify |

| Trade publications or professional memberships | News apps or general reading materials |

Travel and mileage

Travel must be for business only, not your usual commute.

| ✅ Allowable | ❌ Not Allowable |

|---|---|

| Trips to a client meeting | Travel between your home and your regular studio or office |

| Mileage to a temporary work location | Fuel for personal errands, even if done on a work day |

6. Simplified expenses with easy business banking solutions

A lot of our clients start out using their personal bank account for everything.

It feels easier… at first.

But it usually causes problems down the line. Mixing business and personal spending makes it harder to track expenses, justify claims, and stay organised for tax season. It can also raise red flags if HMRC ever asks to review your records.

If you’re just getting started, it’s worth opening a separate business account straight away.

You don’t need to go through a high street bank. Many of the best options are fully online and quick to set up.

Think of your bookkeeping as a creative project, something you can personalise like your portfolio. You might create a profile picture for each client folder, establish your naming conventions, choose colors that match your style, or design simple icons for your documents.

These banks offer features that help you stay on top of your self assessment: automated expense categories, receipt uploads, and real-time spending notifications.

If you set them up early, they will save you time and stress!

7. VAT claims: what you can and can’t claim

VAT can be confusing when you’re new to self-employment. Some of our clients see VAT registration as a chance to get money back on business costs.

But the truth is: that’s only part of the picture.

You must register for VAT if your turnover goes over £90,000 in any 12-month period.

You can also register voluntarily if you’re under the threshold and want to reclaim VAT on your expenses. But once you’re registered, you have to charge VAT on your sales and file VAT returns.

Being VAT-registered means you can reclaim VAT on many things you buy for your business—but not everything qualifies.

| ✅ You can claim VAT on: | ❌ You can’t claim VAT on: |

|---|---|

| Software (e.g. Adobe, editing tools, CRM systems) | Client entertainment (meals, drinks, gifts) |

| Business subscriptions | Non-business or mixed-use purchases |

| Equipment and materials used directly in your work | Purchases without a valid VAT receipt |

Some see VAT registration as a quick win, but it brings extra admin and rules.

If you’re unsure, speak to an accountant before signing up – you can’t undo it easily once you’re in.

8. How to claim business expenses as a sole trader

After all of this meaningless chatter, let’s put the theoretic into practice.

Sam is a freelance cinematographer working as a sole trader in the UK film industry.

Over the year, Sam worked on several short films, corporate videos, and one indie feature. His income before tax came to £55,000. Like many in the creative sector, Sam has a mix of fixed and variable costs. Some of these costs qualify as self assessment allowable expenses.

Here’s how Sam can reduce his tax bill:

- Equipment: Sam bought a new camera, lenses, and lighting kit costing £8,000. Since these are used only for his business, they qualify as capital allowances.

- Home office: He edits from a spare room in his flat. He claims a proportion of his rent, internet, electricity, and phone costs—about £1,200 for the year.

- Travel: Sam drives to shoots across the country. He logs mileage for business trips and claims back over £2,000 using HMRC’s approved rates.

- Professional services: He pays an accountant £600 per year, which is fully deductible.

His expenses total around £11,800. If he claims these expenses correctly, Sam reduces his taxable income from £55,000 to £43,200.

Time to double-check two different scenarios: one where Sam doesn’t account for the expenses, and one where he accounts for the expenses.

Not claiming expenses as a sole-trader

Total income: £55,000

Personal allowance: (£12,570)

Taxable income: £42,430

Income Tax

- Basic Rate (20%) on £37,700 = £7,540

- Higher Rate (40%) on £4,730 = £1,892

National Insurance (Class 4 – applies to sole traders)

- 6% on income up to £37,700 = £2,262

- 2% on income above £37,700 = £95

✅ Total tax due: £11,789

Claiming business expenses as a sole-trader

Let’s say Sam has £11,800 in allowable business expenses.

Adjusted taxable income: £43,200

Personal allowance: (£12,570)

Remaining taxable amount: £30,630

Income Tax

- Basic Rate (20%) on £30,630 = £6,126

National Insurance (Class 4)

- 6% on £30,630 = £1,838

✅ Total tax due: £7,964

Just to put into perspective, the difference is 425 months of Amazon Prime, 9 PS5s, an all-inclusive vacation to Turkey for 2 people for 7 days, or a brand-new Apple Vision Pro!

9. Stay organised and let WallsMan Creative handle the rest

You’ve now got a clear picture of what you can write off, and how those self assessment expenses can make a real difference to what you owe HMRC.

The key now is to stay on top of your records. Keep your receipts, track your spending, and separate your business and personal finances. Most of the stress comes from messy bookkeeping, not the tax rules themselves.

And…

That’s where we come in!

WallsMan Creative has spent over 10 years helping creatives – freelancers, artists, designers, filmmakers, and more – to stay organised, stay compliant, and save money on tax. We know the industry, we speak your language, and we keep things simple.

Let us handle the numbers so you can focus on what you do best.

Your work is creative. Your finances don’t have to be chaotic.