Key Takeaways

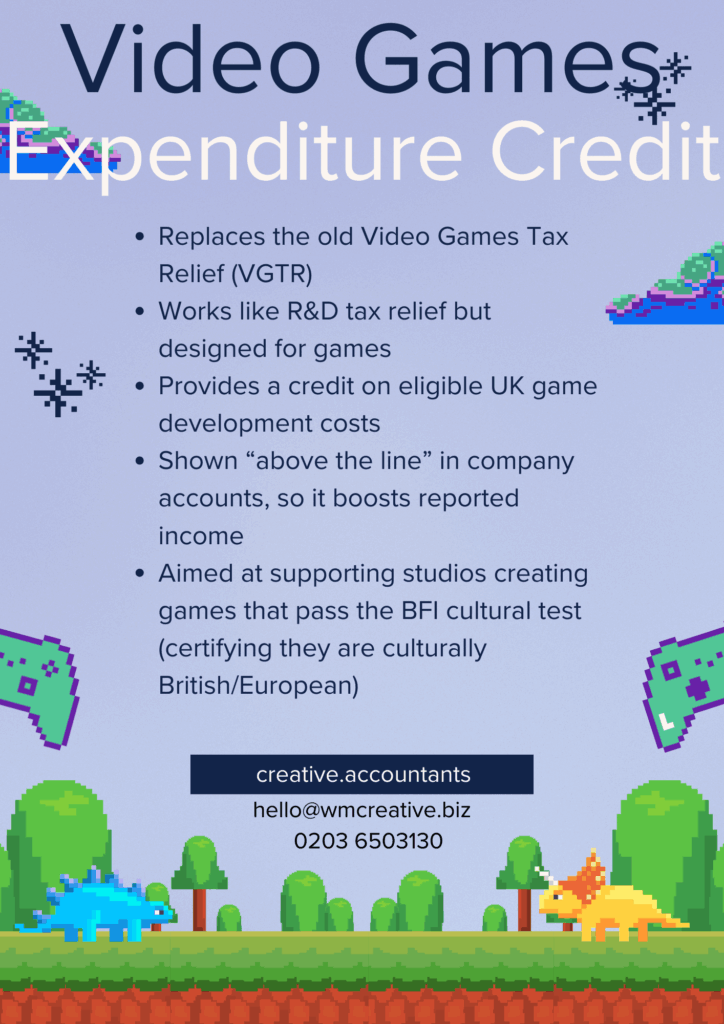

- The Video Games Expenditure Credit (VGEC) is a new tax incentive introduced by the UK government. It is intended for companies developing video games.

- VGEC replaces VGTR as the new UK game development tax incentive.

- Offers a substantial 34% credit for qualifying UK-based game development expenses.

- Games must pass the BFI cultural test (minimum 16 of 31 points).

- Claim core development costs (design, coding, writing, testing, management).

- Companies have a two-year window after the accounting period ends to claim.

Table of contents

1. Who qualifies for Video Games Expenditure Credit (VGEC)?

In short: if you’re building the game and you’re paying for the work, VGEC could apply to you.

To claim, your company must be directly involved in the development process and be the one paying for the work.

You’ll also need to be within the UK tax system and pay Corporation Tax here. It doesn’t matter where your company is registered, as long as you’re taxed in the UK and doing the development work here too.

The game you’re making must be for public release.

That means something you plan to sell, publish, or make it available to a wider audience. You’ll need to apply for a certificate from the British Film Institute (BFI) to show your game meets the cultural criteria.

If you’re working with other studios, that’s fine.

Each company involved in development can claim based on its own costs. But if you’re just publishing or distributing the game without working on production, you can’t claim.

2. Which games are eligible for VGEC?

If you’re building a game for players to buy or download, there’s a good chance it qualifies for VGEC. The key rule is that your game must be intended for the general public.

That includes:

- console games

- mobile apps

- PC titles

- anything you plan to release commercially.

Games made for advertising, training, or gambling won’t qualify! So, if the project is a promo for a brand, an internal tool, or linked to betting, it’s outside the rules.

It doesn’t matter what genre or platform your game is. Whether it’s a story-based indie release, a multiplayer shooter, or a puzzle app, what counts is that it’s made for public use and meets the cultural and production rules.

Meet the criteria of the BFI test

Your game also needs to meet the UK’s cultural test.

This is managed by the British Film Institute (BFI).

They’ll look at things like the setting, characters, and if the game was made in the UK or by a UK team. You’ll need to apply for this certificate before you can claim the credit.

If you’re not sure, applying for the BFI test is a good starting point. It tells you early on if your game is likely to qualify.

To pass the criteria test, your game needs at least 16 out of 31 points:

- cultural content (up to 16 points)

- cultural contribution (up to 4 points)

- cultural hubs (up to 3 points)

- cultural practitioners (up to 8 points)

You can check out the summary of points for every section on BFI. (You also have to pay attention to BFI when you’re claiming AVEC.)

3. Claim core costs with VGEC

You can claim for the core costs of building your game:

- design

- coding

- writing

- testing

- project management.

You can include staff wages, freelancer or contractor fees, and software tools used directly for production.

If you outsource work to another UK company, that’s allowed too as there’s no longer a cap on subcontracting costs.

You can also claim for indirect costs that support development, like your project lead’s time or tech infrastructure – as long as it’s tied to production!

The Video Games Expenditure Credit covers up to 80% of your core UK expenditure. You’ll get 34% back as credit.

Keep in mind that this credit is taxable, so the real value works out to around 25.5% of what you spend.

If your company doesn’t owe any Corporation Tax, the credit can still be paid out to you

When to claim UK expenditure credit for video games

You can submit, change, or cancel a claim for creative industry tax reliefsup to two years after the end of the accounting period the claim covers.

In some cases, HMRC may accept claims after this deadline, but only where there’s a valid reason for the delay – and you need to put that on paper, of course.

4. How to claim VGEC – step-by-step guide

HMRC made a fantastic video on creative industry tax reliefs: how they work and how you can claim them. Take look, and then see our breakdown of things with a step-by-step guide!

Step-by-step guide:

- Make sure you’re eligible

You must be a company that:- Is liable for UK Corporation Tax

- Is responsible for all stages of development (from design to testing)

- Is creating a game intended for public release

- Get BFI certification

- Apply to the British Film Institute (BFI) for a “British” cultural certificate

- You can apply for:

- Interim certification (during development)

- Final certification (after completion)

- Track core expenditure

- Record UK-based development costs such as design, programming, testing, and staff wage

- Exclude costs like marketing, financing, or early concept work

- Calculate your claim

- You can claim 34% of up to 80% of your core qualifying UK costs

- This is a taxable credit, typically worth around 25.5% net

- Prepare your tax return

- Include the VGEC claim in your Corporation Tax return

- You’ll need to complete an Additional Information Form (AIF) as part of your submission

- Submit to HMRC

- File the claim along with your Corporation Tax return

- If approved, HMRC will apply the credit against your tax liability, or pay it out if you’re in a loss-making position

- Review deadlines

- Claims apply to expenditure incurred from 1 January 2024

- VGTR is closed for new games from 1 April 2025, with final claims by 31 March 2027

5. VGTR and VGEC: key differences

VGEC has replaced the long-standing Video Games Tax Relief (VGTR).

It is different than VGTR, and there are a few important changes in how this tax relief or expenditure credit works for game developers.

Here’s a quick breakdown of how the two schemes compare:

| Feature | VGTR | VGEC |

|---|---|---|

| Applies From | Before 1 Jan 2024 | 1 Jan 2024 onwards |

| Relief Type | Deduction from taxable profits | Taxable credit (similar to RDEC) |

| Credit / Relief Rate | ~25% (effective, non-taxable) | 34% (taxable, net benefit ~25.5%) |

| Payment Timing | Below-the-line relief | Above-the-line credit (shows as income) |

| Eligible Costs Location | UK and EEA | UK only |

| Subcontracting Cap | £1 million cap | No cap |

| Expenditure Cap | 80% of core expenditure | 80% of core expenditure |

| Cultural Certification | Required from BFI | Required from BFI |

| Final Claim Deadline | 31 March 2027 | Ongoing from 2024 |

6. Claim confidently for video game development with WallsMan Creative

The Video Games Expenditure Credit is a game-changer – literally and pun-intended! – for game studios. But claiming it effectively requires precision, planning, and up-to-date knowledge of the tax rules.

WallsMan Creative is here to help. We provide hands-on support while understanding how you operate things in the creative sector.

Contact us now for a free consultation to get started today!